Find Solution to Managing Debt Load

Assist your clients with making a plan to get out of debt with the Debt Reduction Solutions Calculator. Become a certified Debt and Cash Flow Management advisor – it only takes 30 hours online.

The calculator starts by determining the current debt load and the funds available to service that debt. Then three strategies are presented: a Maximum Payment Mortgage option, a Fixed Term Mortgage option, and an All-In-One option.

Example

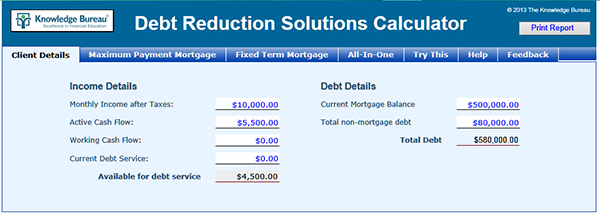

Bryan and Anna both work but are feeling overwhelmed by their debt. Together, they earn $10,000 a month. After discussions on reducing spending, they have determined that their monthly expenses can be reduced to $5,500 per month excluding debt service. Their current mortgage is for $500,000, they have car loans totalling $12,000, a line of credit with a current balance of $50,000, and credit card debt of $18,000. What are their options?

Keying in Bryan and Anna’s details into the first tab shows that the couple has $4,500 available per month to service a total debt load of $580,000.

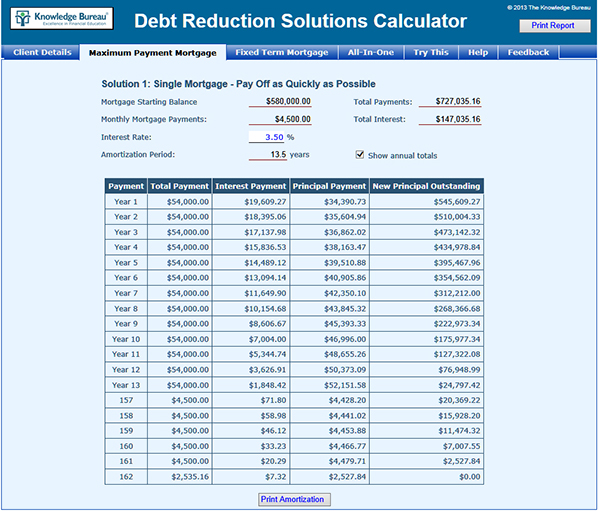

Option 1: Maximum Payment Mortgage

The best rate the couple can get for a fixed rate mortgage is 3.5%. If they choose to pay the full $4,500 per month on such a mortgage, they will be able to pay off the debt in 13.5 years:

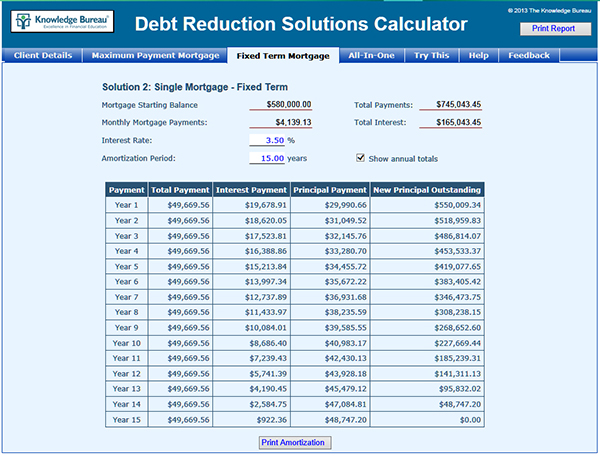

Option 2: Fixed Term Mortgage

Again using a fixed rate mortgage at 3.5%, Bryan and Anna could choose a 15-year amortization for their mortgage, giving them a slightly lower mortgage payment, offering a buffer for unexpected expenses. The mortgage would be for 1.5 years longer, but the payment would be reduced to $4,139.13 per month giving a cushion of $360 per month for unforeseen expenses.

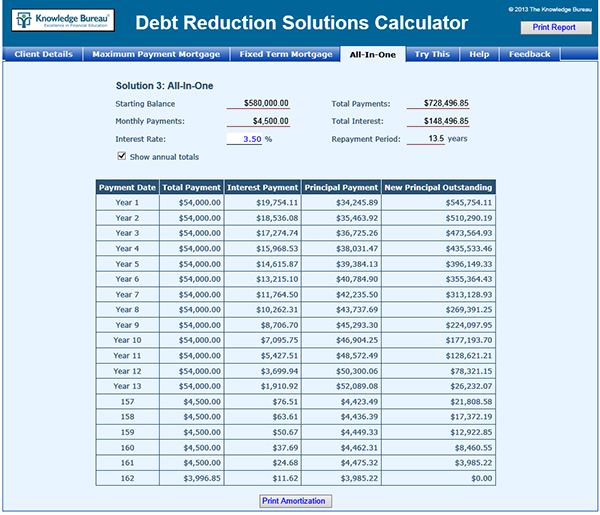

Option 3: All-In-One

The third option available from some lenders is the all-in-one account. With this option, a mortgage account would be set up, Bryan and Anna’s pay would be deposited into one account and all expenses, including mortgage interest, would be paid from that account. If an all-in-one account is available at a rate of 3.5%, their debt would be retired in approximately 13.5 years if all things remain constant.

Comparing the total interest costs of the three options, we see that the maximum payment option has the lowest cost but the least flexibility. The fixed term mortgage option offers more flexibility because of the lower payments but has a higher cost. The all-in-one option offers still more flexibility because the mortgage is paid down by whatever amount is not spent each month. The cost of the third option, as well as the amortization period depends on the couple’s ability to control spending.

The Debt Reduction Solutions Calculator is one of fourteen calculators available in the Knowledge Bureau Toolkit.