Last updated: October 15 2020

Cash Crunch? Help Clients Find New Money

By Walter Harder, DFA-Tax Services Specialist

The pandemic has changed the financial picture for a lot of Canadians. The good news? Changes in income levels can produce tax savings few people have thought about. Reduced income, for example, may change the taxpayer’s requirement to make their December 15 instalment payment. Or they may qualify now to collect tax benefits they would otherwise not be entitled to. Check out this true-to-life example:

Let’s look at an example of how the income changes could affect the tax landscape of a sample family.

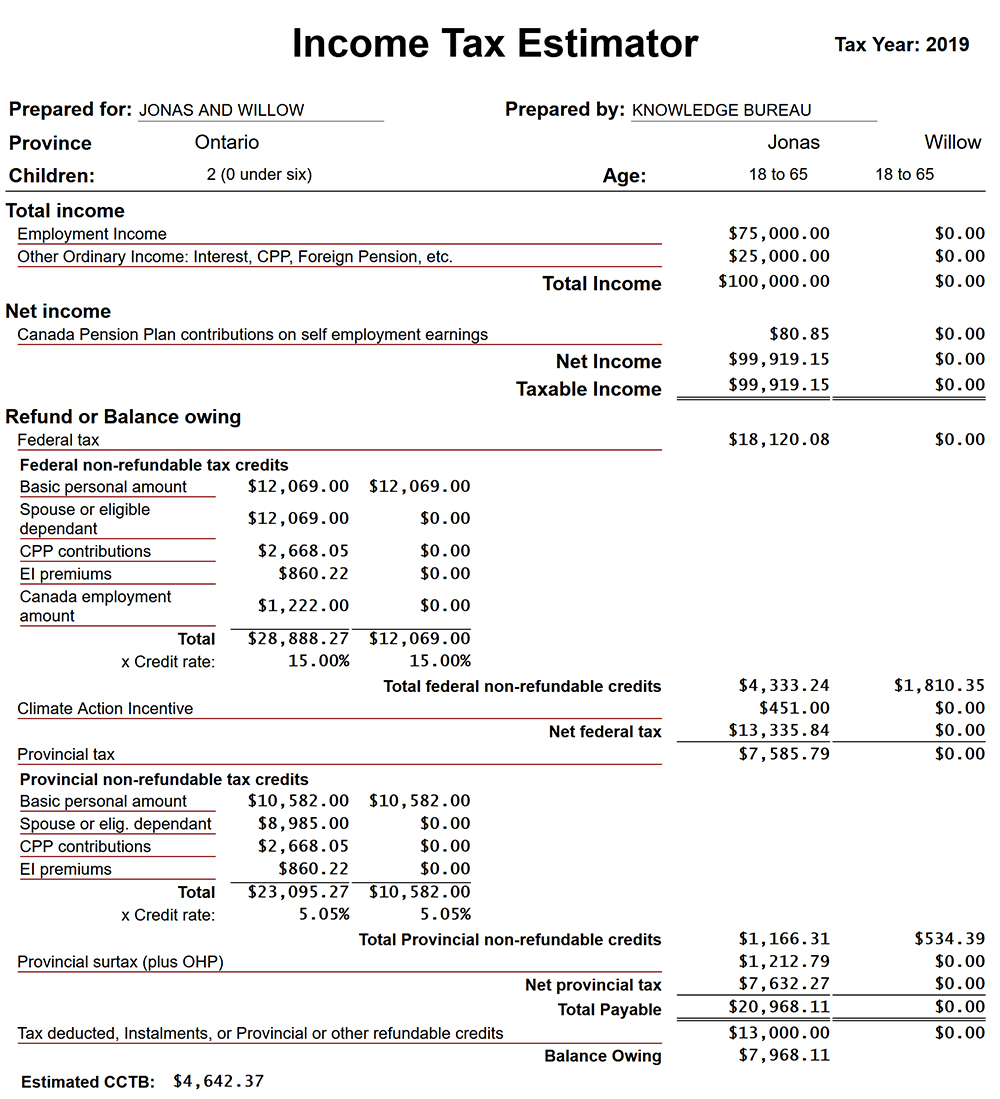

Jonas and Willow have two children, ages 10 and 12. Jonas works and has significant investment income. Willow does volunteer work and takes care of the house and children. In 2019, Jonas made $75,000 from employment and $25,000 from his investments. Although his employer withheld $13,000 in income taxes, Jonas still owed $8,000 in taxes when he filed his return. This means he was required to make instalment of $2,000 each quarter. Willow’s CCB (Canada Child Benefit) was just under $400 a month.

Here are the details of their 2019 returns as created by the Income Tax Estimator.

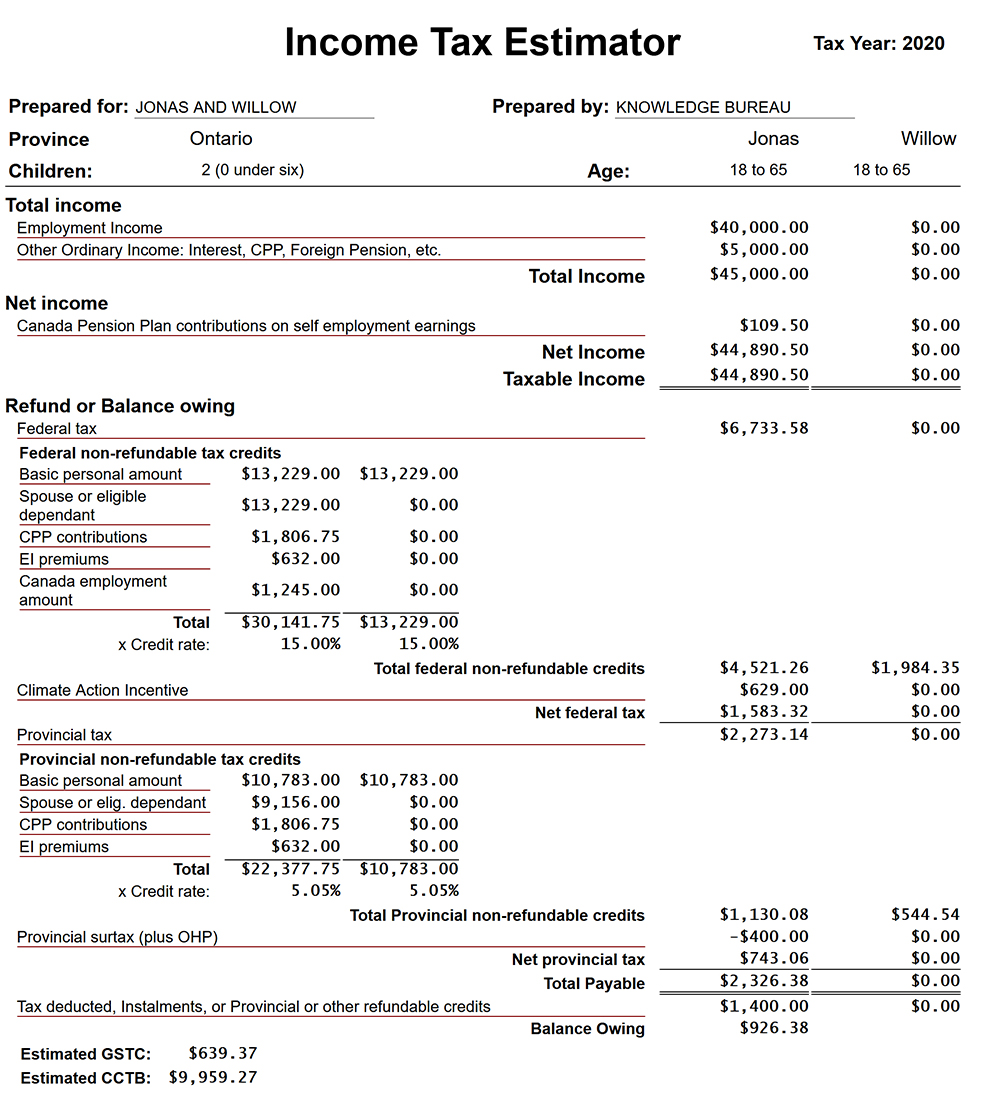

In 2020, Jonas’ employment income was reduced to $40,000 and his investment income to $5,000. His employer withheld $1400 in income tax. Although his hours were cut back, Jonas was never unemployed and did not qualify for CERB. Estimating Jonas’ taxes for 2020 using the Knowledge Bureau Income Tax Estimator shows, before taking into account his instalments, Jonas owes about $900 taxes and Willow’s CCB will increase to over $800 per month, plus the family will not receive a GST Credit of over $600.

Here are the details of their 2020 returns as created by the Income Tax Estimator.

Having already made $6,000 in instalments, Jonas can expect to receive a refund this year of about $5,100. With that in mind, he can skip the December instalment.

Going forward, 2021 will be looking much better, financially speaking. Jonas will not have to make quarterly instalments, saving him almost $700 a month. When he files his return, he’ll get a refund of over $5,000 and, starting in July, Willow’s CCB will increase by about $200 per month and they’ll receive quarterly GSTC payments as well. This family will be able to invest in an RESP now to save for their children’s education!

That’s the kind of good news highly qualified DFA-Tax Services Specialists can provide now to help families manage their income and save for the future. Find out how you can earn your credentials, too. The six courses in the program are all taken online, and you can learn at your own pace; in fact, many of our students will have graduated in time for the 2021 tax filing season.

FIND OUT MORE:

Check out Knowledge Bureau’s Income Tax Estimator, and get your credentials as a DFA-Tax Services Specialist™. We also hope you’ll join us at the Virtual Distinguished Advisor Conference, October 28-30 where 24 thought leaders will speak to topics that will help you better serve your clients who are navigating new financial factors and pressures. The registration deadline is today!