Last updated: April 25 2024

Financial Literacy: Why the Federal Budget Does it a Disservice

The April 16 federal budget proposed capital gains taxes that penalize those who have used their knowledge, skills and resources to make responsible financial decisions and has widely promoted tax and financial concepts that are not quite on the mark. That introduces the potential for three unfortunate outcomes: uncertainty that stifles investment and initiative, increased financial illiteracy and worse, potential injustices when tax changes are politicized to pit one generation against another. Fortunately, tax and financial advisors can help to restore shaken confidence in their important roles as educators and intermediaries. Here are the issues to consider:

Capital Gains: A One Time Event for Most. The key measure of concern is the increase in the capital gains inclusion rate from 50% to 66 2/3 for dispositions of taxable assets occurring on or after June 25, 2024. This is sold as a tax on the very few “rich” who should pay more. But in reality, this is tax on grandma, our highly educated graduates, and the entrepreneurs who have worked to serve people in their local economies through investment, ingenuity and hard work.

Here’s the reality: most people who report a large capital gain often have low or middle incomes before and after the event. Consider the sale of a rental property, or the disposition of a cottage, a business or a non-registered financial portfolio, perhaps as a result of a deemed disposition on death. In the absence of income averaging provisions, this new tax is unfair, particularly when proceeds or cost bases are not adjusted for accrued inflation in the holding period.

A Divisive Narrative. Unfortunately, the budget is also being sold, divisively, as “economic justice” for younger generations. One might event think that’s borderline “agist,” and that does not sit right. Here’s why:

There is already significant financial abuse in Canada; a recent study in BC noted 8% of seniors each suffered financial abuse in the range of $20,000. Justice Canada estimates 4.5% of seniors are abused and a whopping 10% are victims of crime. In the US, it is estimated that financial abuse of the elderly is estimated to be in the vicinity of $36 Billion. This type of rhetoric could scare up more if it.

All generations, equally, have the opportunity to invest wisely to accrue their own capital gains. Tax and financial advisors can help young people take advantage of tax-assisted opportunities to build wealth over time and responsibly steward and regenerate wealth accumulated by elders.

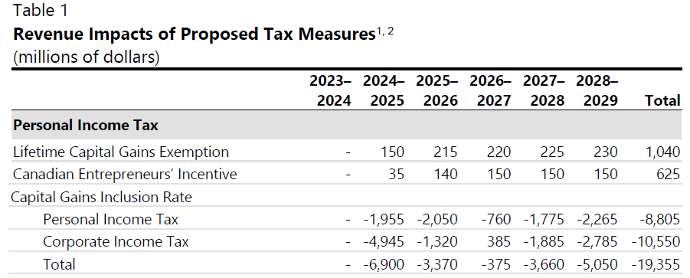

A Tax on Initiative and Education. The budget indicates that Canada’s entrepreneurs including medical professionals will pay $10.5 Billion more in taxes by 2028-29, on the disposition of their corporate assets, as described in the chart below. Many of those people will be selling businesses built to secure their retirement. Increasing capital gains inclusion rates taxes the investment in their education and initiative.

For individuals, the increased inclusion rate is only on capital gains over $250,000. Still, revenue expected from this measure increases by almost the same amount as that paid by corporations, by the time we get to 2027. Young investors are taking note; they are mobile and their skills highly prized in lower taxed jurisdictions. Financial advisors are needed to help them do the math.

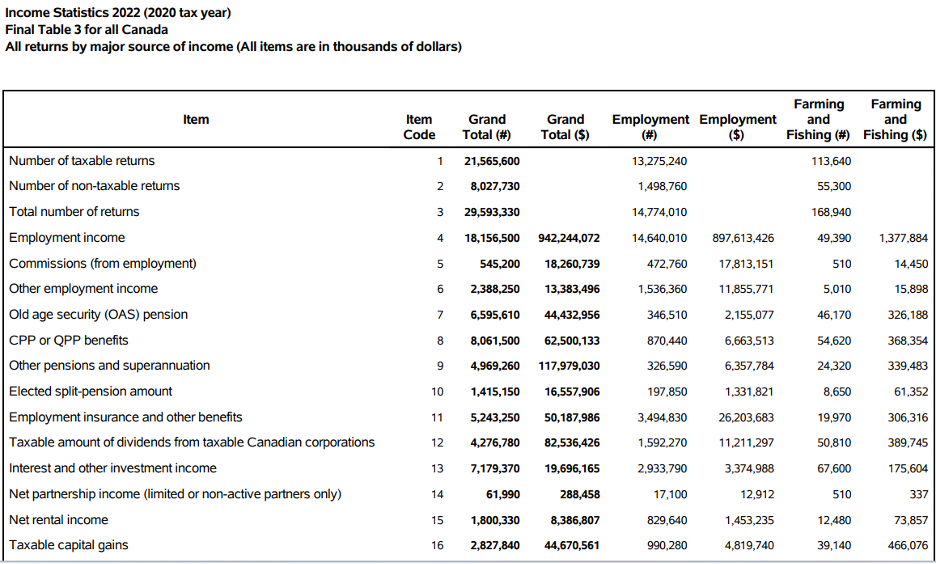

Taking Risk into Account. The budget says less than .01% of the population will be affected by these changes. But this is misleading. Taking a look at the most recent tax filing statistics for the 2022 tax year (below), of the close to 30 million tax returns filed, 2.8 million taxpayers reported taxable capital gains for a grand total of $44.7 billion. That’s 9.5% of our population, many of whom also have employment and pension income sources. The accrued gains in their investments continue to grow – maybe. Many of these folks also took a losses: over half a million of them.

Unlike employment income, investing in business or property does not come with a guarantee. The taxation of pension income, which grew with the benefit of a tax deduction on contribution,  also requires a different approach. Comparing either to investments leading to an eventual capital gain thwarts the goals of sound financial literacy: the financial decision-making required in each case is as different as the potential outcomes.

also requires a different approach. Comparing either to investments leading to an eventual capital gain thwarts the goals of sound financial literacy: the financial decision-making required in each case is as different as the potential outcomes.

The Financial Literacy Goal. As a member of the Federal Task Force on Financial Literacy, my colleagues and I travelled across the country to hear the myriad of financial issues that perplex Canadians to develop a simple definition of financial literacy: to have the knowledge, skills and confidence to make responsible financial decisions.

The Financial Consumer Association of Canada’s (FCAC) home page states: “Financial literacy is critical to the prosperity and financial well-being of Canadians. . . Canadians need to be able to navigate a complicated and ever-changing financial marketplace in which they buy investments including financial assets for their retirement and homes for their families. They need to be able to:

- “Evaluate the financial information and advice they get, whether from friends, the media or professionals”.

- “Plan ahead about how to use their hard-earned dollars for life goals, such as buying a home or preparing for retirement;

- Deal with local, provincial and national government programs and systems that are often complicated and confusing, even to experts;”

The Bottom Line. The April 16 Federal Budget may have made it more difficult for people to plan ahead for life goals, understand tax systems and evaluate financial information for investment purposes, due to the complexity and uncertainty it has introduced. Pitting entrepreneurs against employees and young people against elders, will not encourage sound intergenerational planning to secure financial futures in society. This is damaging and needs to stop. Tax and financial professionals can help on the ground with their clients and contact their Members of Parliament if they are concerned.

Join us for a national discussion on a multi-disciplinary approach to intergenerational wealth management at the May 22 Virtual CE Summit. Your opinion matters, as we discuss the issues emerging out of the April 16 Federal Budget.