FHSA: New Lines & Forms on the T1 This Year

If you opened a First Home Savings Account in 2023, you’ll be addressing potentially 3 new lines on the 2023 tax return, several new auxiliary tax forms and a brand-new Schedule 15. Here is what you need to know:

First-time homebuyers can save annual tax-deductible contributions of up to $8,000 up to a lifetime limit of $40,000. The plan can stay open for 15 years. To create the unused contribution room, a First Home Savings Account must be opened. Unused contribution room can be carried forward to future years but only after the opening of a FHSA. Income earned within the account does not attract tax, and qualifying withdrawals are also tax-free. You’ll keep track of all the FHSA activities on new Schedule 15 FHSA Contributions, Transfers and Activities.

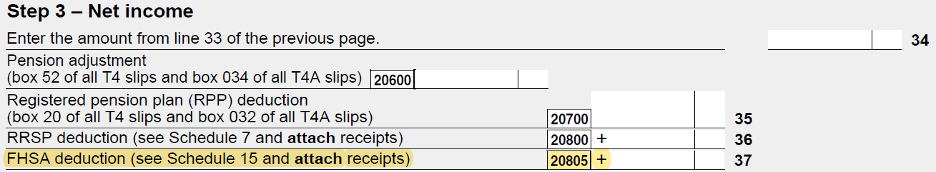

Taking the FHSA Deduction: The FHSA contribution qualifies for a tax deduction on new line 20805. As noted on the T1, receipts for the contribution must be available.

The restriction on using both the FHSA and the Home Buyer’s Plan within the RRSP was removed in Bill C-32, thereby allowing new individual home buyers to use up to $75,000 of tax-sheltered savings ($40,000 from the FHSA plus $35,000 from the RRSP Home Buyer Plan. Keep track of the RRSP HBP activities on Schedule 7 RRSP Unused Contributions, Transfers,  And HBP Or LLP Activities.

And HBP Or LLP Activities.

It is also possible to transfer funds from an RRSP to a FHSA. There are a series of new forms to take note of for these purposes:

- RC720 Direct Transfer from RRSP to FHSA

- RC721 Transfer from FHSA to FHSA, RRSP, RRIF

- RC722 Transfer from FHSA to FHSA, RRSP, RRIF after death of FHSA Holder

- RC723 Transfer to FHSA to another FHSA, RRSP, RRIF on marriage breakdown

- RC725 Request to make Qualifying FHSA Withdrawal

- RC727 Designate an Excess FHSA Amount as a Withdrawal from a FHSA or as Transfer to RRSP or RRIF

The FHSA has an expiry date and a bonus opportunity: FHSA plans may be transferred to an RRSP or RRIF if the funds are not used to purchase a home within 15 years; that’s over and above normal RRSP contribution room. The plans also are restricted to those age 18 to 71 and resident in Canada.

But, with these opportunities comes complexity. Subsection 146.6(5) of the Income Tax Act provides that an individual may deduct an amount not exceeding the lesser of these two amounts.

- the individual's total undeducted "annual FHSA limit" for the year and all preceding taxation years.

- The lifetime limit of $40,000 (reduced by amounts transferred from an RRSP to an FHSA).

Subparagraph 146.6(5)(b)(ii) has been amended to refer to the taxpayer's "net RRSP-to-FHSA transfer amount" as at the end of the taxation year. This is important In cases where an individual has carried forward FHSA deductions and later has an excess FHSA amount caused by a transfer from an RRSP.

This amendment ensures that designated amounts returned to an RRSP will allow the individual to deduct previously undeducted contributions.

Excerpted from the Advanced T1 Tax Update. You can register in this certificate course now and take it online for CE Credit – completion date is May 6. This course provides one full course credit in the DMA-Tax Services Specialist Program. Recorded instructor presentations are included. Graduates of the CE Summit version of this program need only 5 more certificate courses to earn their DMA™ designation.