Last updated: April 04 2024

Federal Budget 2024: Is There Potential for Wealth Building?

Evelyn Jacks

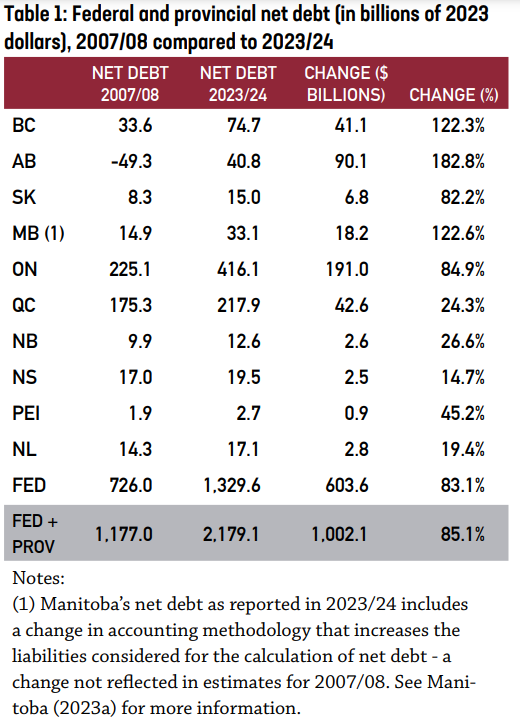

As Canadians scramble to meet their April 30 tax filing obligations, the federal government plans to release its next budget on April 16. Expect more red ink as debt services costs skyrocket. According to a new study by the Fraser Institute, the government debt burden for families across Canada has been growing significantly, it’s making us poorer. The numbers tell the story, below, and underscore the need for a fiscal focus on our future prosperity.

In fact, over the past 16 years, the federal government has accumulated nearly double the amount of debt that it repaid in the mid-1990s to late-2000s. The provinces are heavily indebted, too.

Writing in the National Post, Dr. Jack Mintz, a popular speaker at last year’s DAC Acuity Conference, puts the problem this way: “Canada is falling behind economically and it’s getting worse. Eighth among OECD countries in per capita GDP in 1974, we are 14th today. From 2015, when the Liberals were elected, to 2022 our GDP per capita fell from 78.6 percent of U.S. levels to 72.8 per cent.

Relative to the G7 average (the favourite comparison for a finance minister), it fell from 92 per cent in 2015 to 88 per cent in 2022.”

And he notes, in an interview with Knowledge Bureau Report, that Canada needs to get back to encouraging investment and entrepreneurship: “We need more animal spirits in the private  sector -- investment, entrepreneurship and risk taking -- growth won't come from government spending.”

sector -- investment, entrepreneurship and risk taking -- growth won't come from government spending.”

The Fraser Institute study points out that there have been various studies to underscore that there is a negative relationship between government debt and economic growth. In particular, the following outcomes occur when there is significant government debt:

- Effect on Profitability: Long-term interest rates can rise, and this increases the cost of borrowing in the private sector, and hurts bottom lines.

- Effect on Investments: Higher borrowing costs can reduce the incentive for private capital investment.

- Effect on Productivity: Declining investment levels then pose great challenges to the country’s ability to enhance productivity and can reduce future economic performance.

- Effect on Taxation Levels: Growing debt can also cause governments to raise taxes to pay back debt or finance their interest payments, which in turn impedes economic growth.

- Effect on Social Services: Like households, governments are required to pay interest on their debt. Revenues directed towards interest payments leave less money available for government programs such as health care, education, social services, or tax relief.

In short, rising government debt has the potential to bring significant negative consequences for Canadians – from the erosion of business profits to pay interest costs, reduce incentives to invest or hire, thereby stifling economic growth.

And, because governments, too must direct more money to make interest payments, resources for programs that meet increasing societal needs dwindle.

That leaves few choices aside from raising taxes of every kind or cutting costs, benefits and programs.

For the Federal Budget April 16, it is therefore important to show that long-term plans address government debt and bring economic health and competitiveness back in focus as we forecast the potential for prosperity and wealth building to the end of this decade.

Reinhart and Rogoff, 2010; Woo and Kumar, 2014; Chudik et al., 2015; Eberhardt and Presbitero, 2015; Swamy, 2015; Egert, 2015; Congressional Budget Office, 2019