Featured Tool: Registered vs. Non-Registered Savings Calculator

Get a quick answer to how much tax saving are available by making an RRSP contribution and determine the costs of a proposed RRSP loan and compare the loan costs to the earnings within the RRSP during the loan repayment period. Read more to see the calcualtor in use.

Ashley is 20 years old and meeting with her financial advisor looking at long-term financial plans for retirement. One of the options to be considered is depositing $5,000 per year (indexed) into a TFSA for the next 40 years If the TFSA deposits earn 6% return annually for the 40-year accumulation period, how much will have accumulated by the time Ashley turns 60? Will that amount be sufficient to fund Ashley’s retirement if she lives to age 85?

The Knowledge Bureau’s Registered vs Non-Registered Savings Calculator can provide the answers.

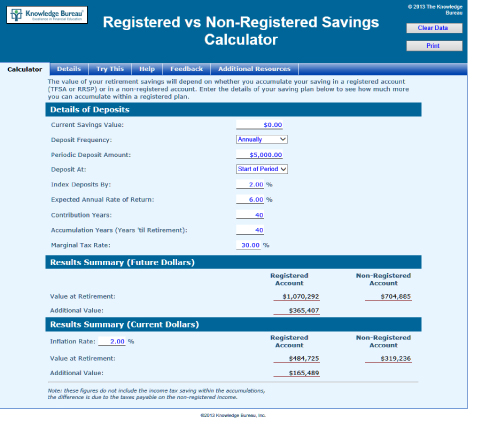

Filling in the details above and assuming an inflation rate of 2%, the calculator shows the following:

The deposits into a non-registered account such as a TFSA (no taxes to pay) will accumulate (with earnings) to $1,070,292. If the same deposits were made to a non-registered account the balance would be $704,885 (because taxes of $365,407 would be paid (assuming a 30% tax rate)). Because of inflation, the value of the $1,070,292 balance would be equivalent to $485,725 in today’s dollars. Over a 25-year retirement, this would yield a current-dollar equivalent of about $29,500 (indexed) per year if the balance continues to earn income at 6% annually. Although the calculator is not designed to deal with withdrawals, it can be used for this calculation as well by entering the current balance and negative deposits.

Is the equivalent of $29,500 of tax-free money enough to fund retirement? It depends on factors such as other income sources and the individual’s lifestyle wants and needs.

Another option is to make annual RRSP deposits. What are the pros and cons of the using an RRSP vs using a TFSA? How much would Ashley have to deposit to get the same $29,500 after-tax income (that’s about $42,000 if the tax rate is 30%)?

The Registered vs Non-Registered Savings Calculator is one of fourteen calculators in the Knowledge Bureau Toolkit. Our calculators are now available to you on a subscription basis starting at only $19.95 per month for a single calculator or $99.95 per month for the complete toolkit.

“When I first used the Knowledge Bureau Calculators, I was so impressed. They did a much better job than my long form plus it was very clear and cut the time to calculate incomes and taxes to almost nothing. These calculators are great. I give them an A+!”

- Marc O., ON