Expansion to CWB Gets the Green Light

Beth Graddon & Walter Harder

The April 19, 2021 Federal Budget has received Royal Assent, and one important change will bring much needed help to a million more low income Canadians: the expansion to Canada’s Workers Benefit (CWB). The expanded annual benefit, which provides up to $1,400 for single workers without children and $2,400 per family, will now be accessible to 3.2 million people. Here are the details.

The enhancements include:

- Increasing the phase-in rate from 26% to 27%. This effectively increases the additional benefit available for every dollar of earned income over the threshold.

- Increasing the phase-out threshold from $13,194 to $22,944 for singles and from $17,522 to $26,177 for families.This change means that individuals and families can make significantly more income before their CWB is phased out.

- Increasing the phase-out rate from 12% to 15%. This change means that once the phase-out threshold is reached, the benefit decreases more for each additional dollar earned

than it did in 2020.

than it did in 2020.

In addition, the computation of adjusted family income will allow the lower-income spouse in a family to exclude $14,000. This effectively increases the maximum income for a family with two working parents to over $56,000 before they become ineligible for the CWB. This will also result in a larger refund at tax time.

These changes will increase the maximum income ceiling for singles in 2021 from $24,815 to $32,244 and from $37,548 to $42,197 for families. These changes will apply to 2021. Thresholds will be indexed for subsequent years.

The government has indicated that these changes will help bring 100,000 Canadians out of poverty, and that for the first time, most full-time workers earning minimum wage will receive significant support from the CWB.

Bottom line: RRSP planning is important for lower income earners on the cusp of these income thresholds to maximize access to the full $1400/$2400 refundable credit.

Knowledge Bureau Report will keep you posted as further details of the implementation of the provisions from the April 19, 2021 federal budget are available.

Additional educational resources: For a guided update of the federal budget, the Advanced Retirement & Estate Planning course as featured in the May 20 Virtual CE Summit is still available. Enrol today!

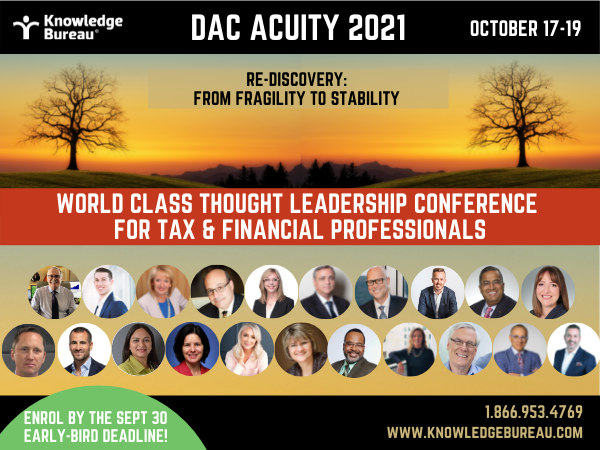

This will also be part of the discussion as the speakers at the 2021 Distinguished Advisor Conference share their world class thought leadership for tax and financial professionals virtually from October 17-19. Enrol by September 30 to take advantage of early-bird pricing.

Share the Knowledge: feel free to send this link to a friend or colleague!