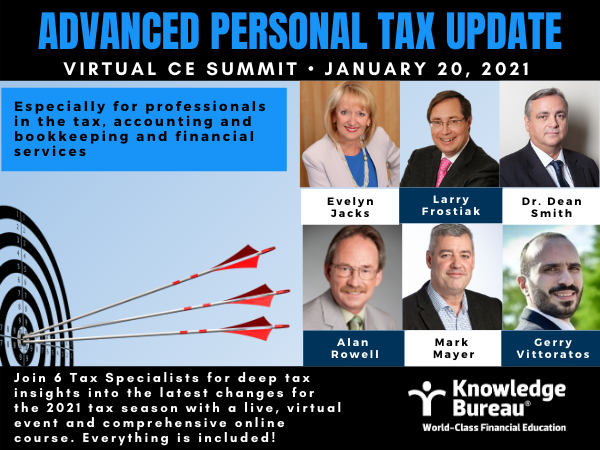

Esteemed Tax Specialists Prepare Pros for Tax Season 2021

Are you training new and returning staff working in independent tax filing firms? Are you a CPA in public practice, a financial advisor, public trustee, legal or financial assistant, municipal officer, payroll or software company serving individuals and business owners with tax compliance? Knowledge Bureau’s acclaimed Advanced T1 Tax Update 2021 for 2020 T1 Returns has gone to a live, virtual format to provide a detailed refresher for a national audience. Join us for the live event on January 20, 2021, then complete the comprehensive Line-by-Line Advanced T1 Tax Update Course online. Early registration ends January 15.

This is an essential professional training program for new and returning staff and this year features four of Canada’s most esteemed tax instructors plus informative information sessions from CRA and Thomson Reuters.

KEY DATES:

- January 7, 2021 - Release of the Hardcopy Virtual CE Summit Course, Desktop Reference and Program Guide

- January 15, 2021 – last day for early registration savings

- January 19, 2021 – Release of Virtual CE Summit Online Course Soft Copy

- January 19, 2021 8:30 AM CT - Zoom Rehearsal

- January 20, 2021 – 8:30 AM CT Live CE Summit Virtual Event

WHO SHOULD ATTEND? This online course and live CE Summit is ideal for training new and returning staff working in independent tax filing firms, CPAs in public practice, financial services firms, public trustees, legal assistants, municipal officers, payroll and software companies who employ staff involved with any CRA remittances. Professionals may earn 10- CE/CPD credits and participate in important networking to build their businesses with relationships across the financial services.

WHY ATTEND? Position your office for maximum efficiency for the expected rush of new clients filing due to the pandemic. You’ll be well equipped with the most recent advanced tax updates from CRA, Finance Canada, Statistics Canada as expertly explained by our noted speakers, writers and Master Instructors from Knowledge Bureau. The Live Virtual session will also put advisors in touch with a national network of like-minded professionals.

WHAT’S INCLUDED? Everything is included for the low tax-deductible tuition fees. Our incredible line up of Canadian tax specialists will provide deep insight into the newest tax changes  for the 2020 tax filing year and the common scenarios that trip up even the most experienced tax advisors to give you a competitive edge in your community at the January 20 Virtual CE Summit. Each delegate will have the opportunity to ask their most pressing tax questions of the experienced tax instructors at the event.

for the 2020 tax filing year and the common scenarios that trip up even the most experienced tax advisors to give you a competitive edge in your community at the January 20 Virtual CE Summit. Each delegate will have the opportunity to ask their most pressing tax questions of the experienced tax instructors at the event.

Students will also be treated to a hard copy of Knowledge Bureau’s Line-by-Line Journal, affectionately known as “The Tax Bible” which has morphed into a 10-chapter online course with true-to-life case studies to deepen your knowledge and study groups at the office. Ensure your registration by January 15 to save on tuition fees and receive your copy in time for the Live Virtual CE Summit on January 20.

IS IT ACCREDITED? Yes, this professional certificate course is accredited for CE/CPD with Knowledge Bureau, Insurance Councils and IIROC for the 2021 CE requirements.

WHY IS THIS ESPECIALLY TIMELY? Every year there are significant changes on the personal tax return and new rules behind the lines that must be understood by professional who file returns or participate in the provision of tax filing information for their clients. But especially this year, as a result of COVID benefits there are more tax changes and more first-time filers than ever before.

Therefore, if you are working as a professional in the tax, bookkeeping or financial services, or are hiring people to do so for you, or are working as an executor or trustee for a deceased or vulnerable person, it is critical to know the personal tax changes for the current tax filing year. Be better informed to answer questions about required documentation, tax compliance, tax planning for individuals and families.

ENROLMENTS ACCEPTED NOW. Don’t miss all the new rules and T1 forms and schedules for the upcoming filing season in detail, including how to maximize relationships with CRA and file audit-proof returns. Please see the detailed agenda below. Taxpayer profiles covered include families, singles, employees, retirees, investors, real estate owners (including personal residence reporting), and small business owners (current, capital and restricted expenses are covered in depth including the new rules accelerated CCA claims) PLUS the details behind filing for various COVID-19 relief provisions with special focus on tax reporting and benefits repayments.

OUR ATTENDEES LOVE THE NEW VIRTUAL PLUS ONLINE COURSE FORMAT:

“What a great summit! It has really shown me where my knowledge gaps lie and furthered my thirst to keep shrinking them with Knowledge Bureau. I really look forward to the next one!” – Dustin Burke

“This was a great, very informative summit! Answered a lot of my questions and gave me points to touch on with my clients.” – Cathy Losing

“Another great day for knowledge and fantastic speakers and topic.” – Tammie Gilbert

“Awesome first-time experience Evelyn and team. Thank you.” – Tania D-Souza

“Thanks again Evelyn. There is always something new to learn or add to our knowledge base at every one of these sessions.” – John Adams

View the detailed online agenda here to learn more.