Last updated: December 15 2020

Employee Life and Health Trusts

Since 2009, the government has worked to create a new Employee Life and Health Trust to replace Health and Welfare Trusts. Last month, new rules were proposed to allow for the transition of Health and Welfare Trusts and permit for the rollover of assets, so that one set of rules can be applied to both. In addition, new “designated employee benefits” and relaxed restrictions for “Key Employees” were introduced. An overview follows:

First, the old set of rules applied to Health and Welfare Trusts, slated to end on December 31, 2020, will continue to be administered until the end of 2021.

Rules established for Employee Life and Health Trusts will also be extended to trusts created prior to 2010. Conversions of old trusts into the new Employee Lie and Health Trusts will be possible without tax consequences and without having to create a new trust. Under certain conditions, transitional rules will permit Health and Welfare Trusts to make an election to be deemed Employee Life and Health Trusts until December 31, 2022.

Where a new trust is created, or where there is a transfer of assets, a tax-free rollover of property will be allowed. A prescribed form may be filed to notify the CRA of the conversion to an Employee Life and Health Trust at that time. Otherwise CRA must be notified of the conversion no later than the first filing due date after 2021.

If a Health and Welfare Trust does not transition into the new Employee Life and Health Trust structure or wind up by the end of 2021, it will become an inter vivos trust with all the applicable  tax rules.

tax rules.

There have also been changes to improve the rules for Employee Life and Health Trusts:

- The list of designated employee benefits will now include certain counselling services

- Death benefits of up to $10,000 will be included

- Employers will be permitted to offer benefits such as bereavement leave and leave for jury duty, provided that all or substantially all (90% or more) of the total costs of the benefits are for designated employee benefits and the employer contributions would otherwise be deductible if the employer had directly paid for those benefits.

- The “automatic deductibility” rule will apply to contributions made under a collective bargaining agreement or a participation agreement that is substantially similar, or to legally binding employer contributions with at least 50 beneficiaries who operate at arm’s length to the employer.

- A new tax will apply to prohibited property (investments or loans).The good news is that the acquisition of this property would not cause the trust to fall offside.

- Certain non-resident trusts will be allowed to qualify

- The carry forward period for non-capital losses will be expanded from 3 to 7 years

Finally, rules will be relaxed to allow the participation of “key employees”; that is, specified shareholders and highly-paid executives, in the trust as long as they are dealing with their employers at arm’s length and the benefits are negotiated under a collective bargaining agreement. Second, total costs of the private health services plan benefits paid to each employee and their family members do not exceed $2500 a year. These amounts are prorated if employees worked only a part of the year.

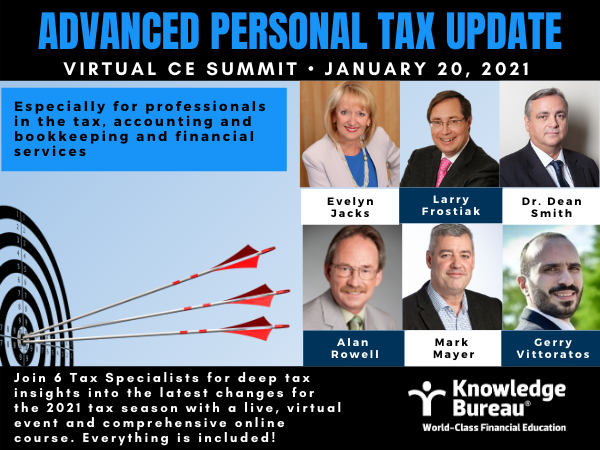

Additional Educational Resource: An in-depth Advanced Personal Tax overview of changes will be presented at the January 20 CE Summit and the included online course. Enrol today: if you sign up by December 31, not only will you get some extra treats included, yo