Last updated: April 07 2021

Purchase a Zero-Emission Vehicle in 2020?

Walter Harder

Do you have clients that purchased zero-emission vehicles (such as electric cars)? There are some newer rules to get up to speed on as the government has continued to offer a $5,000 rebate for light-duty, zero-emission vehicle purchases along with the 100% write-off for zero-emission autos purchased by those who can write off the purchase of a vehicle. Here’s what you need to know.

The time of purchase dictates the Capital Cost Allowance (CCA) rates and other rules that apply. For cars purchased on or after March 19, 2019, and before 2028, a new depreciation rate allowed for a zero-emission car with a maximum cost of $55,000 plus taxes, unless a federal purchase rebate for electric battery or hydrogen fuel cell vehicles under $45,000 is received.

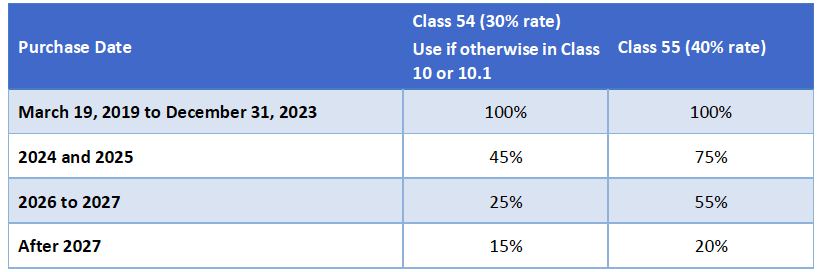

A 100% CCA rate will apply for purchases up to December 31, 2023, and 75% for purchases in 2024 and 2025, then 55% for purchases in 2026 and 2027. For purchases after 2027, the normal CCA rates will apply, as shown below.

For new zero-emission vehicles purchased after March 18, 2019, use class 54 with a first-year rate of

100% if the vehicle would otherwise be in class 10 or 10.1. For vehicles used as taxis or short-term rentals (or other vehicles that would otherwise be in class 16), use class 55 with a first-year rate of 100%. Rates for classes 54 and 55 vary as follows:

- Class 54 is for a zero-emission vehicle that would otherwise be a class 10 or 10.1. The maximum expenditure available for CCA is limited to $55,000 plus taxes. The normal CCA rate for class 54 will be 30%.

- Class 55 is for zero-emission vehicles that would otherwise be in class 16 (taxis, vehicles acquired for rental or short-term leases, and heavy trucks and tractors). The normal CCA rate for class 55 will be 40%.

- Vehicles for which the federal purchase incentive ($5,000 for electric battery or hydrogen fuel cell vehicles with an MSRP of less than $45,000) is paid will not qualify for accelerated CCA in classes 54 or 55.

The normal short business year rules will apply to these new classes. In the year of disposition, recapture will apply, but the proceeds of disposition for class 54 assets will be prorated by the ratio of the CCA limit ($55,000) to the actual cost of the vehicle. Taxpayers who wish to place their zero-emission vehicles in the appropriate class (10, 10.1 or 16) may elect to do so. The interest limit for the purchase of passenger vehicles will also apply to interest on the purchase of a class 54 vehicle.

CCA Maximum Deduction Restrictions. Note that for a zero-emission vehicle, that ceiling is up to $55,000 plus taxes.

Excerpted from the 2021 Advanced Personal Tax Update Course, featured as part of the January CE Summit. Join us at our next live, virtual event on May 20 where we’ll deliver an April 19, 2021 budget analysis and its impact on 2021/22 retirement and estate planning options. Check out the comprehensive online agenda for this Virtual CE Summit.