Last updated: September 10 2013

Do You Have Enough Retirement Savings?

This is the burning question for many baby boomers contemplating retirement. After many years of saving for retirement is it safe to retire?

The Fixed vs Variable Income Calculator can help you figure this out. Given your current savings, the calculator will determine how much you can withdraw annually over a given period of time or how long you can withdraw a given amount annually without running out. The answers, of course, depend on your expected rate of return, what type of account you have the money invested in, and the rate of tax you’ll pay in taxable income. For those who are still building their savings, the calculator can help determine the saving needed to fund the desired income level in retirement.

Example

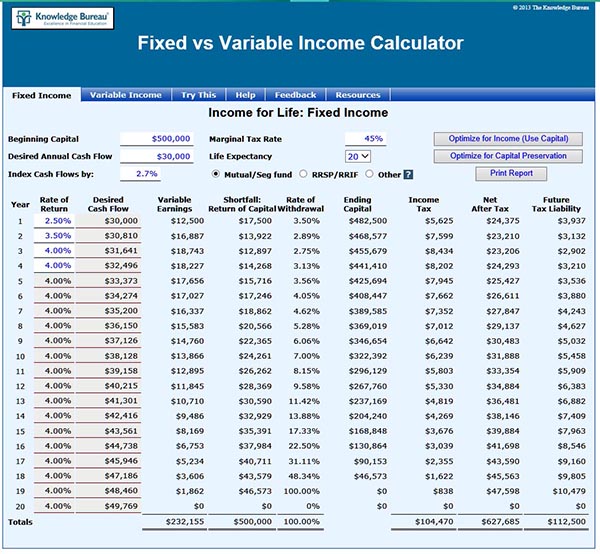

Keith has accumulated $500,000 in non-registered mutual funds which allow him to withdraw capital as well as earnings. His expected marginal tax rate in retirement will be 45%. He’d like to withdraw $30,000 annually, indexing by 2.7% to cope with cost of living increases. Will the $500,000 be sufficient for this plan assuming earnings of 2.5% in the first year, 3.5 in the next and 4% thereafter?

The Fixed Income tab of the calculator show us:

The earnings certainly aren’t enough to meet the $30,000 indexed income goal. Even with capital withdrawals to top up earnings, Keith will run out of capital in year 19. In addition, he will have accrued a tax liability of $112,500 on the capital withdrawals and he’ll be taxed annually on the earnings, so he'll have only $24,375 after tax in the first year.

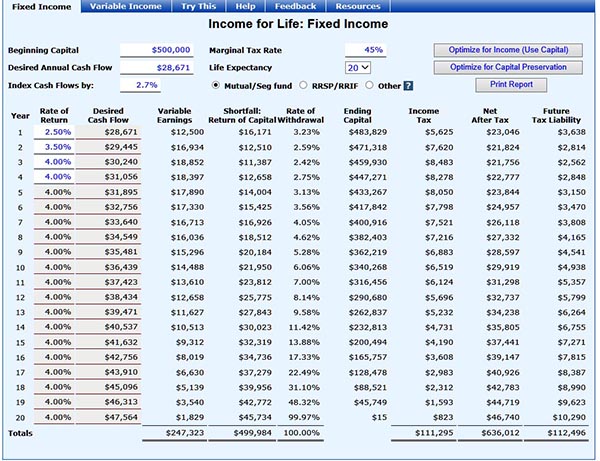

So how much can Keith withdraw without running out of money? Clicking on the “Optimize for income” button shows:

The maximum withdrawal is $28,671 (indexed) so that the capital is used up in year 20. After tax, that starts with $23,046 in the first year.

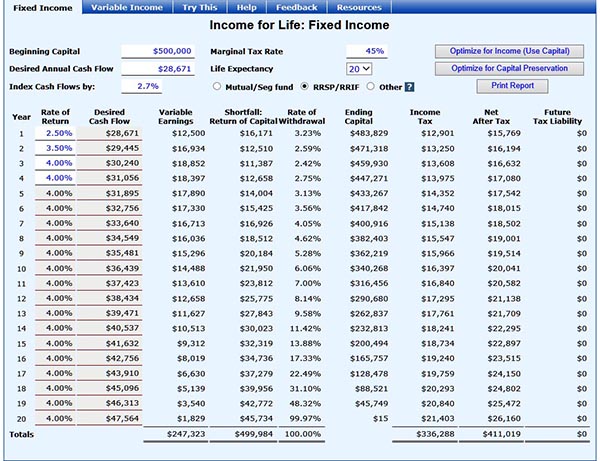

Results vary if the savings were in an RRSP (where withdrawals are fully taxable) or in a bond or other type of investment where return of capital is not taxed. For example, if Keith’s $500,000 retirement savings were in an RRSP, the maximum amount he could withdraw annually would still be $28,671, but since the entire amount is taxable, Keith would only have $15,769 after tax in the first year.

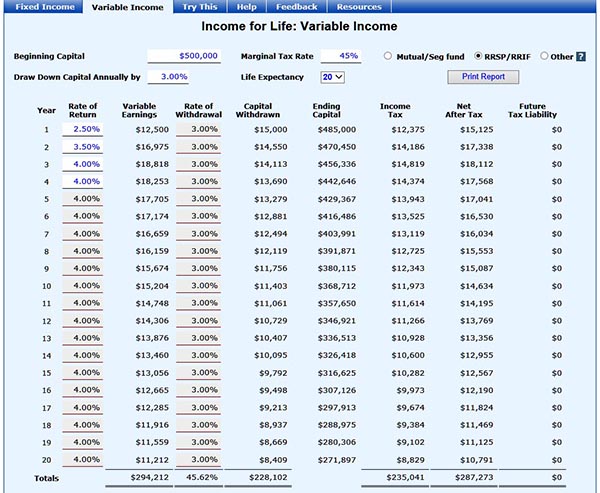

The Variable Income tab determines the income that could be generated by withdrawing the earnings plus a percentage of the capital rather than withdrawing a fixed amount annually. For example, if Keith withdrew the earnings plus 3% of the capital from his $500,000 RRSP, over a 20-year retirement period, he’d withdraw $12,500 earnings plus $15,000 capital in the first year, but only net $15,125 after taxes. As capital is being depleted and all earnings withdrawn, the income increases for the next couple of years as earnings increase, but falls annually after that.

How do your retirement savings stack up? Give the calculator a test drive by signing up for the free trial.

The Fixed vs Variable Income Calculator is one of fourteen calculators available in the Knowledge Bureau Toolkit.