Details of the New Tax-Free First Home Savings Account (FHSA)

Evelyn Jacks

Tax-Free First Home Savings Account (FHSA) is the newest in a series of tax-advantaged savings accounts critical to the building of wealth, and it’s already a month old! The FHSA is a useful tool, not just for future homeowners but potentially for senior renters, business owners and others with limited RRSP room. Here is a checklist of rules investors will want to discuss with their advisors.

Who can invest in a FHSA? Effective April 1, 2023, Canadian residents who have not lived in an owner-occupied home in the current or preceding four years (2019, 2020, 2021, 2022 or 2023) may contribute to the new FHSA. A social insurance number is necessary to open the account, as well as verification of your date of birth. It’s also important to designate a beneficiary,  discussed in more detail below.

discussed in more detail below.

What are the contribution rules when you have a spouse? Neither you nor your spouse can have owned and lived in a qualifying home in the black-out period – the current year and four immediately preceding years. When your spouse has owned a home in that period, and you didn’t, there are a few considerations.

First, if you lived in a home owned by your spouse, you will be disqualified from opening a FHSA unless that person is no longer your spouse when you do open the account. For those spouses who are separating, it’s possible for the separating spouse who was not the owner of the matrimonial home to open a FHSA after the separation.

Is there an age limitation to making FHSA contributions? Yes. You must be at least age 18 to contribute. Also, you cannot open a FHSA after the year you turn 71. Further, you must use the FHSA to purchase a qualifying home by the end of the year in which you turn 71. If you do not, you can transfer the balance to your RRIF, as further explained below.

What are the rules for non-residents? Non-residents cannot participate in the plan. But, if a Canadian resident becomes a non-resident, it’s not necessary to close the account, and it’s possible to continue to contribute to it under normal rules. The tax trap, however, is that you will lose the ability to make a qualifying withdrawal to buy a qualifying home. The money will be taxable on withdrawal and subject to a 25% withholding tax unless this investment is subject to different rules under a tax treaty. Also, if you emigrate to the U.S., it’s possible that the tax-free treatment will not be recognized.

Next week we’ll feature contribution guidelines for the FHSA.

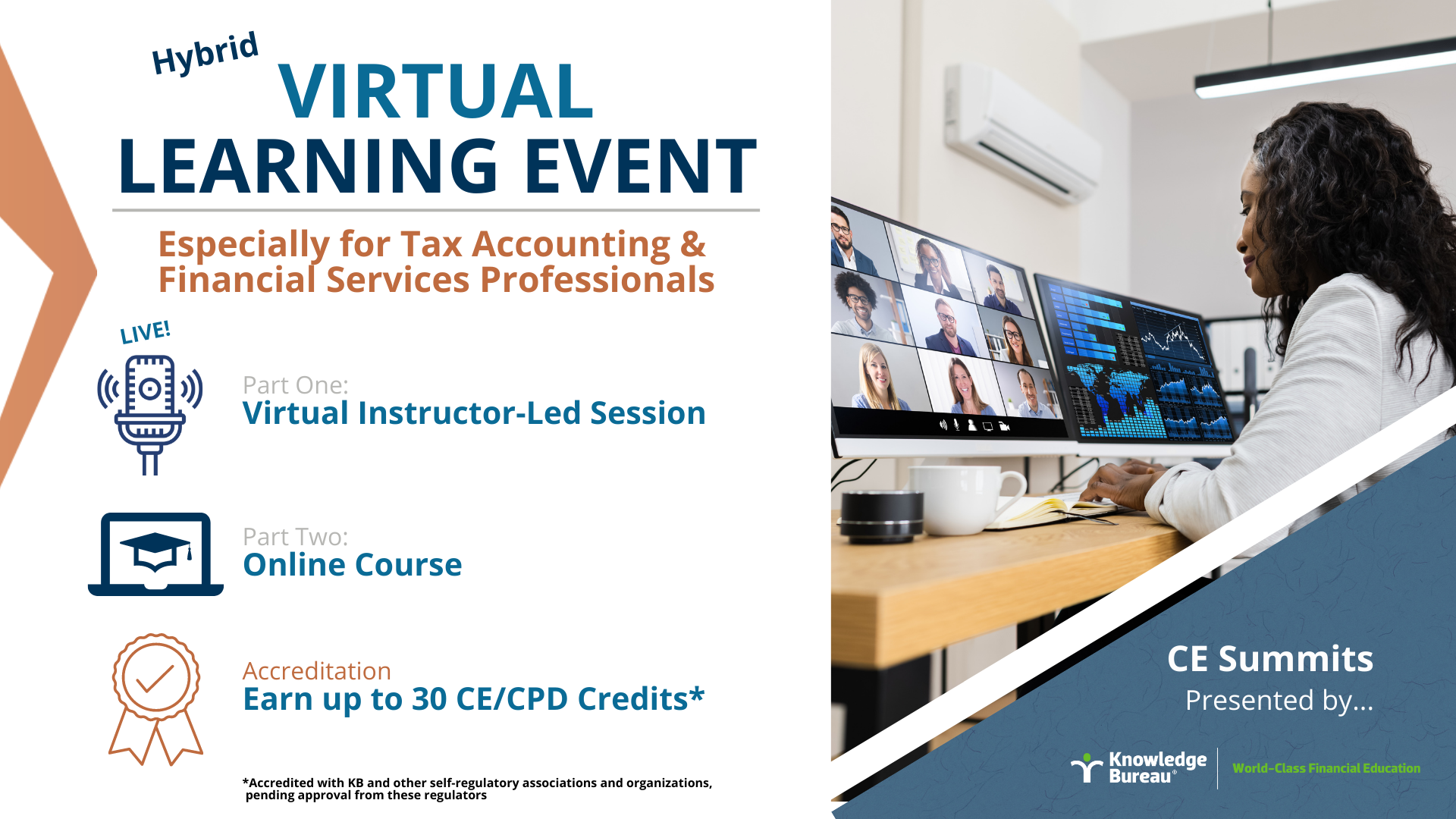

Be sure to join us at the May 24 CE Summit for the details you need to know to help your clients improve their financial lives. Early-bird registration ends May 15!