Last updated: September 03 2014

Dealing With Excess Wealth – Without Waste

Many boomers are now in the fortunate position of dealing with the complexities of excess.

Excess furniture and cutlery as they downsize or move to the cottage, excess obsolescent technology as they fear throwing away quality and STILL working devices and, of course, excess newsfeeds, e-flyers and subscriptions lest they miss out on the latest piece of information.

Excess, excess, excess!

Frequently discussed in the press, the boomers also have an excess (and record) amount of debt going into retirement1. A problem to be sure, but for the sake of this article we will shift our focus to the subset of boomers on the opposite side of the spectrum: those with wealth beyond their retirement needs. Not to be confused with the Warren Buffetts, Bill Gates and Thomsons of this world, this subset can’t afford to buy entire companies (or countries) or build complex foundations but do have enough assets to provide for their own retirement and leave an estate.

Empirically2, the planning for the security of this accumulated wealth is often overlooked, and sadly left to the last minute. For a kaleidoscopic set of reasons, the preservation of wealth of this colorful generation is allowed to be gnawed at by its ever present enemies: inflation, taxation and under-diversification.

Rather than delving into the mystery of why this erosion of wealth is tolerated or discussing why we humans are seemingly irrational with our financial decisions, let us review a simple strategy that can be easily added to our toolkit to address the major flaws in our estate/succession planning for those wanting to leave an inheritance for their children and potentially grandchildren.

The typical pitfalls of a successful inheritance plan are the lack of control of assets by owner, the taxation of investment income while alive and the subsequent taxation (and fees) payable by the estate. For example a non-registered portfolio will earn income that is taxable while it grows, will directly increase estate valuation (increasing probate in some provinces) and will create a taxable capital gain at death or upon disposition. A direct gift of this non-registered asset to the intended beneficiary to avoid the tax at disposition causes control over the asset to be lost.

A possible solution:

Assuming insurability, a permanent life insurance policy can be purchased with your adult child as the life insured and the designated contingent owner. The beneficiary of the policy is your grandchild (the child of the life insured). By funding the policy with the non-registered asset, the tax burden in future years to you will be reduced. Funds invested in a life insurance policy allow for accumulation of cash value inside the policy (subject to legislative limits), with non-taxable growth. At your death, because of certain income tax provisions3 applying to life insurance policies, you may transfer ownership of the life insurance policy to your adult child (who is the only life insured on the policy) without your estate paying any tax on the cash value growth. The transfer is also free of probate, executor and legal fees. Upon the transfer of ownership of the policy to your adult child, he or she will have access to the cash value in the policy while he or she is living. Alternatively, and ideally, your adult child can maintain the policy to be passed on at their death to your grandchild as a death benefit, again without taxes, probate or legal fees. The cash value in the policy remains completely accessible and in your control while you’re alive in the event that you do require additional income.

Conclusion

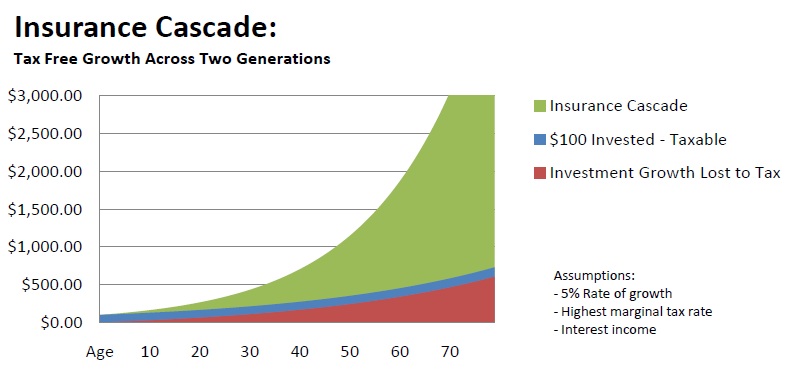

By utilizing this strategy all the pitfalls of wealth erosion concerning inheritance planning are eliminated and the problem of excess is passed on, at times exponentially (as per graph below) to your heirs. Although not suitable for all people, the use of this cascading strategy is worth investigating with a qualified professional and if suitable, will certainly provide the next generation with plenty of gadgets, furniture and subscriptions to enjoy. After all, isn’t passing on problems to the next generation what we do best? I suppose that discussion is for another article as well.

Written by KBR guest columnist, Joseph Bakish, CFA, CLU, CHS.

1 Scotiabank: The Retirement Landscape -- A Focus on the Baby Boomer; 2014

2 RBC and CIBC polls in 2012

3 Section 148 of the ITA which states that the transfer of a cash value life insurance policy from a grandparent or parent to a child or grandchild is not subject to income tax.