Last updated: August 30 2023

CRA: Don’t Mess With Trust

EVelyn Jacks

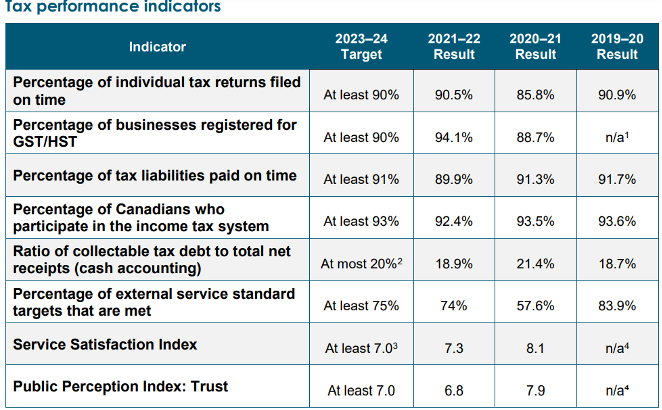

CRA recently paid over $122,000 for a report, Underground Economy In Today’s Post-Pandemic Environment. Curiously, as part of its research, it wanted to find out if accountants would identify small business owners who do not pay their taxes, according to news reports. Upon reviewing the CRA’s 2023-2024 departmental plan in preparation for the September 20 CE Summit on Audit Defence, it begs the question: why would CRA want to erode trust amongst stakeholders, when overall participation in the tax filing requirement is so high? Check it out:

The CRA’s Departmental Plan for 2023-2024, show compliance numbers that are really impressive. Its accountants would identify small business owners who do not pay their taxes would appear that our self-assessment system is working very well:

- 92.4% of tax filers are willing participate in the income tax system

- 90.5% of individuals file their tax returns on time

- 94% of businesses register and comply with the requirement to collect and remit GST/HST

- Almost 90% (89.9% to be exact) pay their tax liabilities on time

- The ratio of tax debt to total net receipts is below target at 18.9% - below target

The tax intermediary community appears to be doing its job well also, considering they are the primary participants in the tax filing process (60% of Canadians use EFILE). Small business owners too, are actively involved in the tax collection process. They collect and remit the GST/HST and Payroll taxes on behalf of their own businesses, their clients, and employees across the nation.

Notable in the tax performance indicators, however, is that CRA has not performed as well in the service or trust department. The public perception of trust has dropped. From 7.9 in 2020-21 to 6.8 in 2021-22. The Service Satisfaction index is also lower: from 8.1 to 7.3.

Make a Difference. It would appear that a small percentage of people are failing to pay their fair share, operating in the underground economy. The CRA estimates over $60 billion in tax leakage, and that continues to be a challenge.

However, what makes the Canadian tax system one of the most exemplary in the world is that the vast majority of Canadians believe filing a tax return and paying their taxes on time is a price worth paying for living in on of the best countries in the world. They are very much above ground in their relationship with their tax department.

It’s a precious outcome of a tax system that has been focused on fairness, equity, simplicity and compliance. Together these ideals have earned trust, a precious outcome that can be quickly eroded.