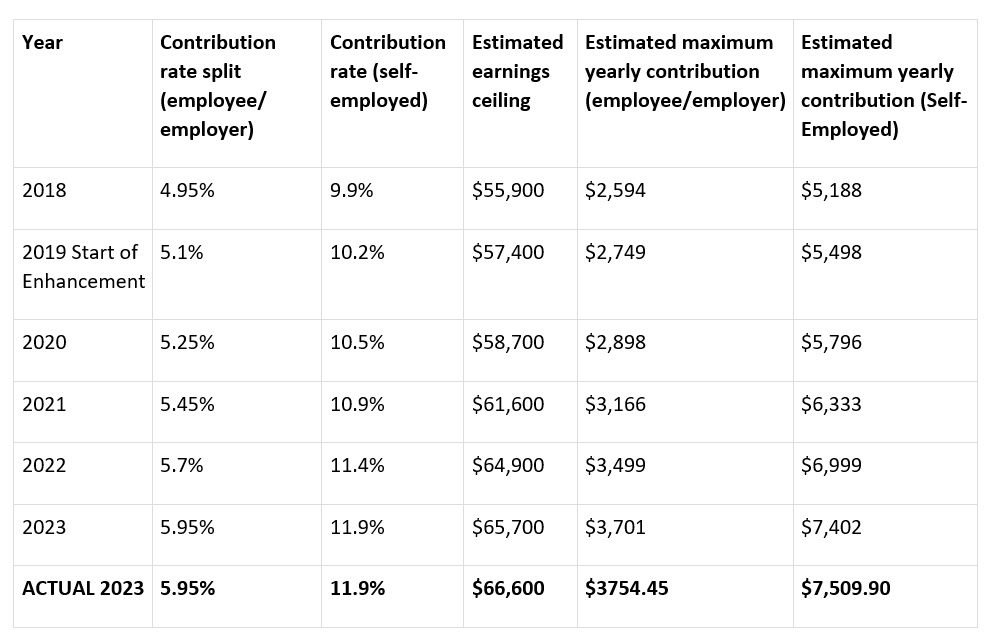

It’s very important for the self employed to start putting some money away now and throughout the year to get ready for their April 2023 and 2024 CPP remittance, which is due when you file those tax returns. Here is what you can expect to pay, based on government estimations[1]:

CPP enhancemen rate

As of 2023, there will be no further rate increase for those who earn less than the earnings ceiling unless earnings rise higher than the earnings ceiling. However, because of indexing of the earnings ceiling, which is based on a formula that measures the growth in average weekly wages and salaries in Canada, the amount of premiums paid by Canadians will go up higher than estimated a year ago as shown above.

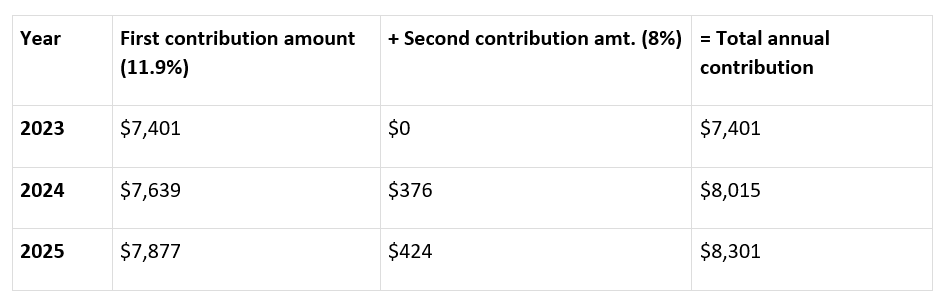

Phase 2: 2024–2025. Things will get even more expensive next year. Starting in 2024, a second, higher contribution limit will be introduced to be known as the Year’s Additional Maximum Pensionable Earnings. Earnings will be subject to two earnings limits and the government will refer to the Year’s Additional Maximum Pensionable Earnings as the second earnings ceiling.

This second earnings ceiling will be based on the value of the first earnings ceiling, which is indexed to the growth in average weekly wages and salaries as explained above. In 2024, the second earnings ceiling will be set at an amount that is 7% higher than the first earnings ceiling. Then it will rise to 14% above the first earnings ceiling in 2025 and future years.

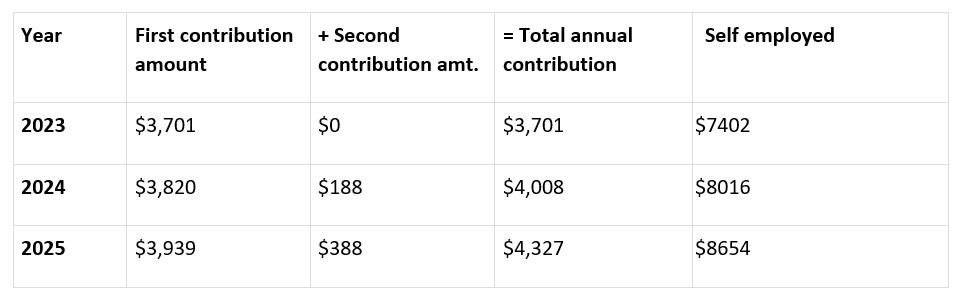

For someone who is self-employed earning $75,000, CPP contributions will increase as follows:

For someone earning $150,000, the numbers appear below; note by 2025 it is estimated you’ll pay $8654 in CPP premiums annually. These increasing premiums required to be paid to the CPP will squeeze out TFSA, RRSP and FHSA contributions for some, and that means the earlier you take advantage of topping up other tax-assisted saving room, the better.

Bottom Line: Canadian business and workers may have to brace for even higher CPP premiums in the future. Savings room for other critical retirement accounts – such as the TFSA and RRSP – will diminish even more. That’s why it's critical to fill those savings room opportunities in 2023. Speak to your tax and financial advisors about this.

Advisors consider taking the 2022 Advanced Retirement & Estate Planning Certificate Course. Earn CE | CPD Credits 20 – and be ready for client’s this season.

Evelyn Jacks is Founder and President of Knowledge Bureau, holds the RWM™, MFA ™, MFA-P™ and DFA-Tax Services Specialist designations and is the best-selling author of 55 books on tax filing, planning and family wealth management. Follow her on twitter @evelynjacks.

©Knowledge Bureau, Inc. All rights Reserved