Coming August 31! Canada’s Income Tax Fundamentals Course™

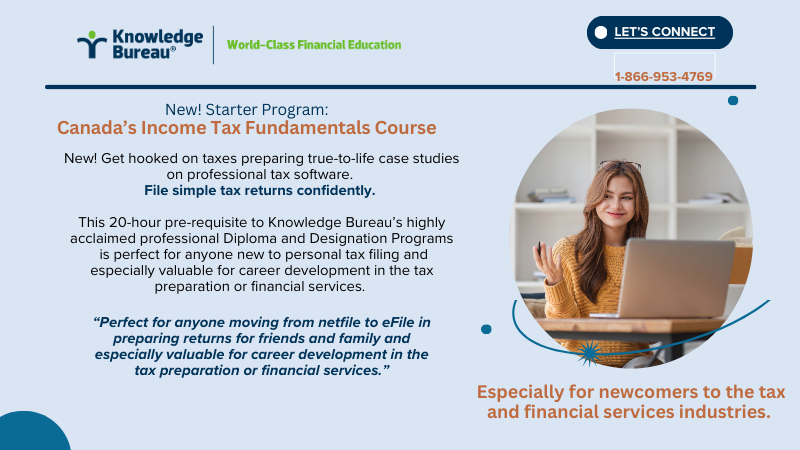

New! Get hooked on taxes preparing true-to-life case studies on professional tax software. File simple tax returns confidently. This 20-hour pre-requisite to Knowledge Bureau’s highly acclaimed professional Diploma and Designation Programs is perfect for anyone new to personal tax filing and especially valuable for career development in the tax preparation or financial services. Pre-register now. Canada’s Income Tax Fundamentals Course™ will be available August 31 and you can take advantage of this pre-sale offer, ending this week!

Pre-Register Now!

Only $395 plus taxes . Introductory Offer Until August 31 Only: Save $50 more*

*Cannot be used with any other offers or rebates. Enquire about large group rates.

Reserve your own course now; or courses for your tax season training program. Everything is included; start online anytime; Qualifies for CRA Tax Credits.

- About Canada's Digital Tax System

- What is Taxable? What's Not?

- Reporting Income from Employment, Pensions

- Claiming Deductions

- Claiming Non-Refundable and Refundable Tax Credits

- Reporting Income from Self Employment

- Reporting Capital Gains from investments and property

- Filing the T1 and Responding to CRA's Communications

This course features lots of true-to-life case studies to bring confidence to the tax filing process and help you prepare simple tax returns for households including individual employees, families and seniors with confidence.