CERB Confusion: Gross or Net Income?

Beth Graddon & Evelyn Jacks

The Grinch just keeps showing up at the doorway of Canada’s ailing small business community. Due to a lack of clarity on the definition of qualifying income levels for the receipt of the Canada Emergency Response Benefit (CERB), many now face the prospect of repaying as much as $14,000 along with some unwelcome tax complexity. Help from a local tax specialist could help.

According to reports, recent letters received by thousands of Canadians from the CRA indicate that self-employed recipients don’t qualify for the program due to 2019 net income that’s below the $5,000 threshold. Yet, even now, the eligibility criteria on the CRA website for the Canada Recovery Benefit (CERB’s replacement) doesn’t clarify this: there is no specific reference to net or gross income from a business.

In fact, the only reference we could find to “net income” refers to the clawback of the benefit; but the definition of net income in this context differs from net income from a business.

The problem is perpetuated in one government example scenario which refers to earnings rather than income:

“Scenario for the Canada Recovery Benefit: Self-employed worker whose business is affected by the COVID-19 pandemic

- Ibrahim is a self-employed bookkeeper in Toronto, ON

- He earned $34,000 in 2019 but his business has slowed due to COVID-19

- Ibrahim applied for and received the Canada Emergency Response Benefit (CERB) but his benefits will run out in September

- While his business has begun to rebound, it is still not business as usual and he is only back to working at 40% capacity

What could Ibrahim qualify for:

- With the Canada Recovery Benefit, he could receive $400 per week for up to 26 weeks. If his annual net income for 2020 is above $38,000 (excluding the Canada Recovery Benefit payments), he would need to repay some or all of the benefit when he files his annual income tax return for 2020.”

It is reasonable to draw the conclusion that this lack of clarity has contributed to many small business owners mistakenly believing that they qualify for the CERB. Now they’re being asked to pay it back on a tight deadline. Although there are no interest or penalties currently being applied to CERB repayment requirements, sending the money back before year-end will ensure that it doesn’t appear on the T4A slip. Those who don’t repay this year will have to report the CERB as taxable income on the 2020 tax return.

Any repayment made after year-end won’t be deducted until the 2021 return is filed; which means taxpayers must wait over a year to get overpaid taxes on any repayments back. This foreshadows a tax reporting nightmare in April of both 2021 and 2022 for some recipients.

The CRA has justified the confusion around this, stating that net income was “implied”, since income used for taxation purposes is always net (gross revenues minus expenses) for the self-employed. However, one could argue that this implied definition of the terms “earnings” and “income” used on the CRA site does not entirely live up to Right #6 of the Taxpayer’s Bill of Rights:

“6. You have the right to complete, accurate, clear, and timely information. You can expect us to provide you with complete, accurate, and timely information in plain language explaining the laws and policies that apply to your situation.”

The site goes on to say that “We use plain language and revise our publications to make sure that they are accurate and complete.”

The CERB income eligibility rules could certainly have been clearer, more complete, accurate and used plain language to eliminate any potential misunderstanding resulting from an implied definition. Further, the issue that needs clarification had not been updated, even after the letters were received by taxpayers.

It is difficult to self-assess and comply with rules that are implied. As the CRA is not intending on changing its mind on the matter, small business owners already in a challenging financial position and struggling to remain afloat, have yet another debt burden hanging over their heads. And this, right in the midst of the pandemic’s second wave.

Bottom Line: Financial advisors can help taxpayers in this situation before year-end in a number of ways: with an estimation of 2020/21 tax consequences and the effects of these transactions on any quarterly tax remittances. In addition, they can provide guidance on what investments should be tapped first to ensure the repayment of CERB doesn’t increase taxes payable. Finally, by completing a review of omissions on prior filed returns, it is possible to unearth important missed deductions. These include child care, moving expenses, medical and disability credits.

Any resulting refunds could help taxpayers move beyond this unexpected financial hurdle and close the door to the unwelcome Grinch.

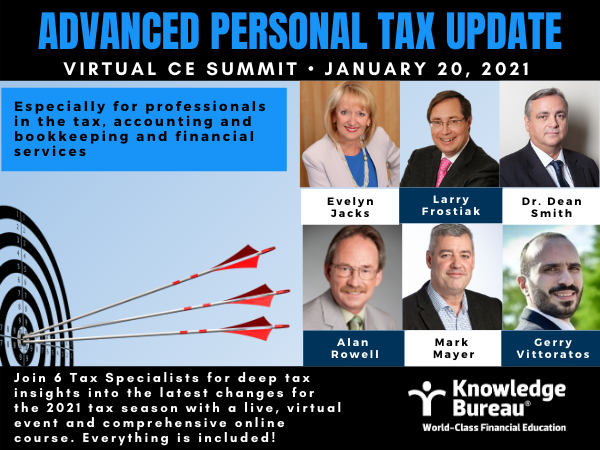

Additional educational resources: Train your team now to provide this essential service during what is sure to be a complex tax season this spring: join us at the January 20 Virtual CE Summit for an Advanced Personal Tax Update and earn 10 CE/CPD credits, too.