Carbon Tax Rebate Debacle Averted

Evelyn Jacks

Dan Kelly, President of the Canadian Federation of Independent Businesses (CFIB) gave an impassioned speech on the efforts to get the federal government to release the $2.5 Billion Carbon Tax Rebate promised to small business owners back in 2019, only to learn that the government planned to tax the rebate as “government assistance” when it finally arrives. Taxing a refund of tax makes no sense, and the finance department reversed course quickly - the rebate won’t be added to income. But this is another one of many recent instances in which tax policy appears off base, exasperating the ability to comply with our self assessment system of taxation with certainty. Other important points from Dan’s speech on Beating Public Policy Barriers to Small Business:

- About 1 in 3 small businesses are financially robust, 37% are in a stable condition, and 33% face challenging financial conditions.

- Businesses that took on more debt to pay back CEBA loans or missed the deadline are often in poor financial health, showing they are in a risky financial situation.

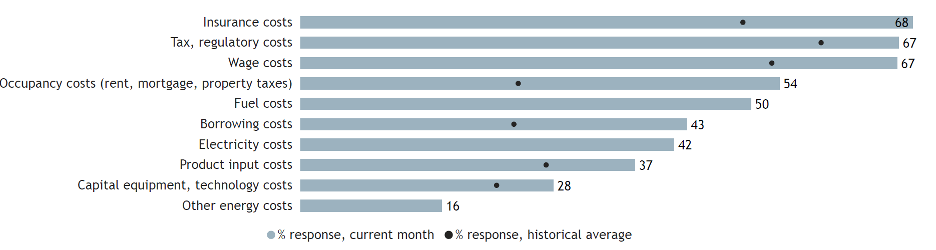

What are the top costs small businesses are grappling with? This chart from CFIB’s research department tells the story – after insurance costs, tax compliance costs are #2:

Source: CFIB, Monthly Business Barometer®, September 2024, final results. Note: Starting January 2024, the option ‘‘Fuel, energy costs’’ was divided into separate options: ‘‘Fuel costs’’, ‘‘Electricity costs’’, ‘‘Other energy costs.’’

Canadian businesses are also wary of their relationship with the CRA, and this is particularly true for their professional advisors. Businesses in the professional services (32%) and hospitality (27%) displayed the highest ratings of “poor” or “unacceptable services. But there was some good news for CRA as well. There is a small increase of those who rated the service as “excellent” (from 2% in 2017 to 3% in 2023) and as “good” (from 24% in 2017 to 27% in 2023). Overall the percentage of those who rated the service as “poor” (from 15% in 2017 to 19% in 2023) or “unacceptable” (from 4% in 2017 to 6% in 2023) has also slightly increased.

But to the carbon tax issues, the CFIB notes that since 2019, the federal government has collected more than $2.5 billion in carbon tax revenues that is owed to SMEs in the 8 provinces in which it applies. Budget 2024 committed to returning these funds to approx. 600,000 SMEs with 499 or fewer employees through a new refundable tax credit administered by CRA, that is based on the number of employees. Of note to business owners:

- In order to receive a portion of these funds, you had to file 2023 corporate income taxes by July 15, 2024.But there is a New Extension until Dec. 31, 2024.

Bottom Line. Advisors and their small business clients would benefit from year end tax planning discussions to take into account the myriad of tax changes for the 2024 tax year. Contact us at Knowledge Bureau to receive your free copy of the Special Report on Year End Tax Planning