Last updated: September 17 2013

Canada Pension Plan – Sooner or Later?

Gone are the days when you had to quit work to start receiving your Canada Pension Plan retirement pension. These days you can start receiving you CPP retirement pension at any age from 60 to 70. There is a catch however.

If you start receiving your pension in 2013 before you turn 65, your pension will be reduced by 0.54% for each month between your start date and you 65th birthday. If you start when you turn 60, your reduction will be 60 x 0.54% = 32.4%. The penalty rate will change each year until 2016. Plus, if you keep working you’ll have to keep contributing to CPP even though you’re receiving a retirement benefit. These premiums will earn you a post-retirement benefit which will increase your pension in future years. In addition, if you’re already receiving a CPP survivor pension, you may lose some or all of it when you start receiving your retirement pension.

On the other hand, if you wait, your pension will be increased by 0.7% for each month between your 65th birthday and the date you begin (maximum 60 months). So, if you wait until you turn 70, your pension will be 42% higher than if you started at age 65.

So, what’s best—get a smaller pension for a longer period of time or a larger pension for a shorter period of time? For those who need the money to live on as soon as possible, the answer is easy. For those who have other sources of income, it depends on what you’ll do with the money and how long you’re going to be around.

Because it’s a very complicated question, Knowledge Bureau has created the CPP Income Calculator. The calculator allows you to enter all the relevant factors and determine at what age you’ll break even—before that age, your total receipts from CPP will be more if you start receiving CPP early and after that age, your total receipts will be less.

Example

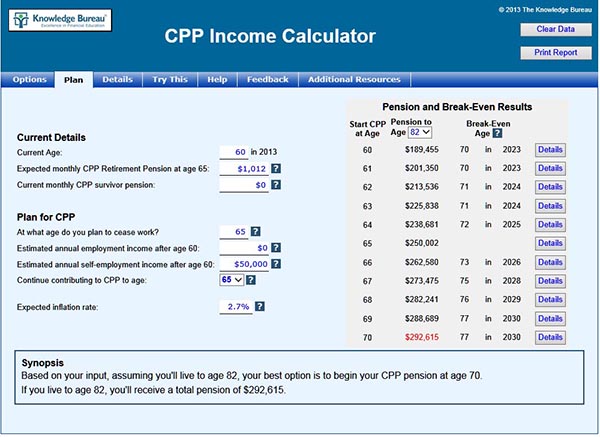

Daniel turns 60 in 2013. His expected monthly CPP retirement pension at age 65 (per his CPP Statement of Contributions from Service Canada) is $1,012. He has no survivor pension. He is leaving his current employment but plans to operate his own business until age 65, earning about $50,000 per year. He fully expects to live to age 82. At what age should he apply for his CPP retirement pension?

The CPP Income Calculator shows the following:

If Daniel begins to receive his CPP in 2013 (age 60), he’ll receive an estimated $189,455 during his lifetime (to age 82). If he waits longer, he’ll receive more over his lifetime. The calculator shows that if he waits to age 70, his estimated income from CPP will be $292,615. Although he’ll only receive CPP for 12 years, rather than 22 years, he’ll receive over $100,000 more from the plan.

If he starts at age 60, his break-even age is 70, meaning that he’ll receive more from the plan by starting at age 60 rather than 65 only if he dies before age 71. If he waits until age 70 to start, his break-even age is 77, so he’ll receive more from the plan if he lives to at least age 77.

The CPP Income Calculator is one of fourteen calculators available in the Knowledge Bureau Toolkit.