Last updated: January 29 2025

Is the Canada Carbon Rebate for Small Business Taxable?

Evelyn Jacks

Many small businesses are currently receiving the long-awaited Canada Carbon Rebate, and for some it’s a sizable sum. Is it taxable? It shouldn’t be, according to an announcement made by the Finance Minister last November after the CFIB raised the issue. In fact, its written statement on the matter on its website also casts this as a tax-free payment. But did you know, the law says something different?

The Tax Free Announcement. Specifically, here’s what the Department of Finance Canada said on their website, modified November 15, 2024:

“The Canada Carbon Rebate for Small Businesses is a tax-free payment that will return $2.5 billion in proceeds from the price on pollution, for fuel charge years 2019-20 to 2023-24, to small- and medium-sized businesses through an automated process. To enable the Canada Revenue Agency to deliver these payments by the end of 2024, pursuant to subsection 127.421(2) of the Income Tax Act, the date specified by the Minister of Finance is October 1, 2024.”

The Law. Consider Clause 35 of Bill C‑69, which added new section 127.421 to the ITA to create with the passage of Bill C-69 which was passed into law on June 20, 2024:

“Assistance received ITA 127.421(6). New subsection 127.421(6) provides that the amount of tax that a taxpayer is deemed to have paid under subsection 127.421(2) or (3) is considered to be assistance received by the taxpayer from a government in the taxation year in which the assistance is received.”

How is the CCR for Small Business Calculated? New section 127.421(2) provides a method for calculating the amount of the carbon rebate for the 2019 to 2023 calendar years. A “fuel return” is set by the Minister of Finance for a designated province for the calendar year. This rate is then multiplied by the total number of persons employed by an eligible corporation in the calendar year.

Finance Canada has announced that “to enable the Canada Revenue Agency to deliver these payments by the end of 2024, pursuant to subsection 127.421(2) of the Income Tax Act, the date specified by the Minister of Finance is October 1, 2024.”

In the same website communication, Finance Canada states: “The Canada Carbon Rebate for Small Businesses is a tax-free payment that will return $2.5 billion in proceeds from the price on pollution, for fuel charge years 2019-20 to 2023-24, to small- and medium-sized businesses through an automated process.”

The Dilemma. This is contrary to communications made by the Finance Department. Will a new amendment to this clause be required to ensure that the Minister’s statement on the tax free status of the payment is indeed validated and followed by the CRA? We posed this question of Finance Canada, but unfortunately have had no response.

The Dilemma. This is contrary to communications made by the Finance Department. Will a new amendment to this clause be required to ensure that the Minister’s statement on the tax free status of the payment is indeed validated and followed by the CRA? We posed this question of Finance Canada, but unfortunately have had no response.

Who is receiving the CCRs? Eligible corporations are Canadian‑controlled private corporations that employ fewer than 500 employees at any time in the calendar in the designated province.

The eligible corporation must also file a tax return on or before 15 July 2024 for a taxation year ending in 2023 to get the current rebate being distributed.

New section 127.421(3) provides that the same method will be used in the future for calculating the amount of the carbon rebate for tax years after 2023.

New section 127.421(4) authorizes the Minister of Finance to specify the fuel return and if he or she does not do so, the rate for that calendar year for that province is deemed to be zero.

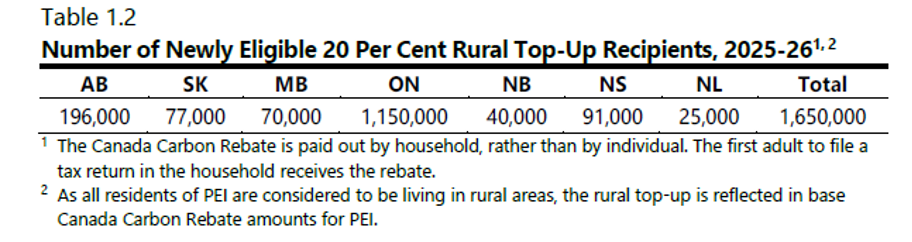

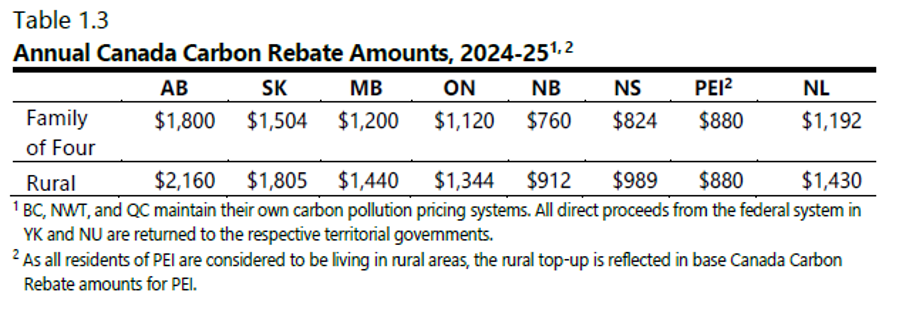

April 1, 2025 Canada Carbon Rebate Will Increase for Small Business. Small businesses with between 1 and 20 employees will qualify for a payment amount that is equivalent to that given to companies with 20 employees, which effectively creates a base payment. However, larger businesses may receive less than under the original design. Payments will be zero once the firm has 500 employees. In addition, the rebate will now be available to cooperative corporations and credit unions starting in the 2024-2025 fuel charge year. The government projects the following payments:

Bottom Line. Knowledge Bureau Report will keep you posted on any further news on whether the tax law will be amended to accommodate a tax free rather than a taxable Canada Carbon Rebate. In the meantime, accountants will have to discuss how the CCR will reported on the books – for now.