CAIP Error to be Corrected September 15

Evelyn Jacks

The Climate Action Incentive Payment (CAIP) is now being paid in Alberta, Saskatchewan, Manitoba and Ontario, and starting in July 2023, in Newfoundland and Labrador, Nova Scotia, and Prince Edward Island. Administering these quarterly payments is a big job – CRA asked for a $1.9 Billion of increase in it’s March departmental budget. At least some of that money will go towards correcting an error made in July: taxfilers living in smaller centres will receive a reconciliation payment on September 15. Here are the details.

The CAIP Error. Taxfilers may wonder about extra money from the CRA in September. Is it theirs to keep? Indeed yes, if they qualified for a “reconciliation payment” for an error made in July 2023. The Climate Action Incentive rural supplement was miscalculated for the communities listed below:

- Alberta: Red Deer

- Saskatchewan: Craven

- Manitoba: Niverville

- Ontario: Beckwith, Carleton Place, Mississippi Mills, Arnprior, McNab/Braeside, Leamington, Kingsville, Essex, and St.-Charles

- Newfoundland: Holy Rood

- Nova Scotia: East Hants, Indian Brook 14

Taxfilers Make Errors, too. Usually they are errors of omission though. Who qualifies for the CAIP? A relationship with CRA starts early in life, and this is one of the important reasons: even Generation Z may qualify for the CAIP. But to receive it, a tax return must be filed. In addition, on the first day of the month to which the payment applies, the taxfiler must:

- Be at least 19 years of age, married or living common law, or the parent of a child

- Live in an eligible province

That means all 18 years olds should file returns to receive the CAIP. Parents should be aware that if a qualified dependant becomes age 19 during the year, their portion of the CAIP will no longer be included in the parent’s CAIP but will be paid separately to them, so long has they have filed a tax return for the previous year, when they were 18. They should also be filing to receive their own GST/HST credit.

Gen Z (those born between 1997 and 2012), in other words, should add annual tax filing to their “starting out” financial milestones.

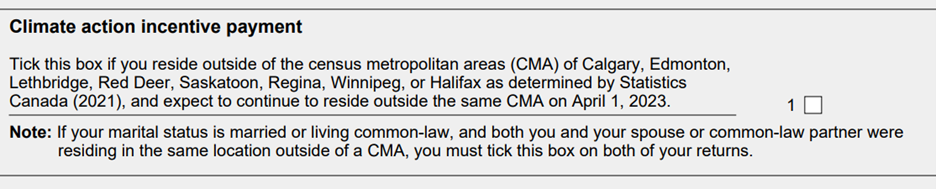

The rural supplement is becoming increasingly important because of the cost of housing in Canada. Many young people are buying their starter homes in smaller communities. The tax forms are tricky though, especially for those rural taxpayers, who are defined as people who live outside of a census metropolitan area. They will receive 10% more than others for their CAIP - but to receive it, they must complete a tickbox on page 2 of the T1. It’s easy to miss:

For everyone else, there are no other requirements – just file the T1 return.

Moving to buy in a rural area? Tell the CRA. Taxpayers who change provinces during the year should inform CRA immediately so that their eligibility can be determined for the next CAIP. They may even qualify for the 10% increment if they move out of a census metropolitan area. Further, if the move was at least 40 Kilometers closer to a new work or self-employment location, don’t forget to keep receipts to claim moving expenses when filing the next tax return.

Two Residences? Where a taxpayer has more than one residence, the credit will only apply to their principal residence. That is, the 10% supplement will not apply if they live in a metropolitan area and have a cottage that is outside a metropolitan area.

Who doesn’t qualify? The following taxpayers are not eligible for the credit:

- Taxpayers who died before April of the following tax year

- Prisoners who are incarcerated for 90 days or more in the tax year.

- Immigrants and emigrants (non-resident at any time during the tax year).

- Officers or servants of a foreign country (at any time in the tax year).

- Children for whom an allowance is received under the Children’s Special Allowances Act

What can you receive? As of July 1, 2023, the Climate Action Incentive will be paid to residents of Newfoundland and Labrador, Nova Scotia, and Prince Edward Island. Here are the CAIP benefit rates:

CAIP Rates for 2023 (based on filing a 2022 tax return):

|

Province

|

Taxpayer

|

Spouse/Eligible Dep.

|

Qualified Dep.

|

|

SK

|

$680

|

$340

|

$170

|

|

MB

|

$528

|

$264

|

$132

|

|

ON

|

$488

|

$244

|

$122

|

|

AB

|

$772

|

$386

|

$193

|

|

NL1

|

$492

|

$246

|

$126

|

|

NS1

|

$372

|

$186

|

$93

|

|

PE1,2

|

$360

|

$180

|

$90

|

1 NL, NS, PE payments start July 1, 2023 so only 3 payments for 2023-2024

2 PE amounts include the 10% rural supplement as there are no CMA in PEI

For those who missed filing a prior tax return, be sure to catch up the 2021 year, where CAIP rates were as follows:

CAIP Rates for 2022 (based on filing a 2021 tax return):

|

Province

|

Taxpayer

|

Spouse/Eligible Dep.

|

Qualified Dep.

|

|

SK

|

$550

|

$275

|

$138

|

|

MB

|

$416

|

$208

|

$104

|

|

ON

|

$373

|

$186

|

$93

|

|

AB

|

$539

|

$270

|

$175

|

Audit Defence: If the taxpayer has a balance due with CRA at the time of the scheduled payment, the payment will first be applied to reduce the balance due and payment will only be made for any amount that exceeds the balance due. Taxfilers should check with tax specialists to see if the tax return was properly completed/assessed to be sure CRA has the right information, especially if they are filing for the rural supplement. If CRA has not assessed properly, the CAIP is recoverable.

It's important to be on top of audit defence strategies. For a comprehensive certificate course that all tax, accounting and financial advisors should take in order to be on top of their clients’ after tax results, take a new course from Knowledge Bureau, available September 20 at the CE Summit: Issues in Tax Audit Defence Strategies. This hybrid course features an instructor-led peer-to-peer full day workshop, accompanied by a comprehensive online course to consolidate knowledge and provide a professional library addition.

To Register (Early bird specials end September 15):

Or for personal, friendly assistance call us 1-866-953-4769