Breaking News: Capital Gains Changes Will Need to be Reported

Evelyn Jacks, MFA™, MFA-P™, DMA™, RWM™, FDFS™

Will proposed tax hikes for certain capital gains incurred after June 24, 2024 survive now that Parliament has been prorogued? Maybe not, but at this time, the proposals have not officially died for tax filing purposes and in fact, CRA has confirmed on January 7 that it will administer the provisions as if passed for the 2024 tax filing year.

The Backdrop. In a January 7 news release, CRA provided background information on the matter. Specifically, it outlined the process that gives it temporary authority to implement the taxes:

- On September 23, 2024, the Finance Minister tabled a Notice of Ways and Means Motion (NWMM) to introduce a bill entitled An Act to amend the Income Tax Act and the Income Tax Regulations. This was actually a modification of a NWMM tabled on June 10, 2024.

- While the proposed changes are subject to parliamentary approval, the release notes that “consistent with standard practice, the CRA is administering the changes to the capital gains inclusion rate effective June 25, 2024, based on the proposals included in the NWMM tabled September 23, 2024.”

Forms will be available on January 31, 2025. CRA will make the various impacted forms available at the end of January. The forms will be specific to individuals, trusts and corporations which generated capital gains income in 2024. For these reasons, Knowledge Bureau has scheduled a series of Mini CE Summits to be held in February to teach the forms and their procedures to tax and financial advisors.

Register here!

CRA position on penalties and interest. The new inclusion rate of 66 2/3% will apply to capital gains realized on or after June 25, 2024 if they exceed $250,000 in the case of individuals. Corporations and trusts will be subject to different rules: the new inclusion rate applies from the first dollar of capital gains earned. CRA has announced that arrears interest and penalty relief, if applicable, will be provided for those corporations and trusts that have a filing due date on or before March 3, 2025. The interest relief will expire on March 3, 2025.

Bottom line: It's important to manage tax audit risk in relation to these provisions. Clients should discuss your capital gains questions with your tax specialist. Despite the fact that future legislation could kill these provisions, the prudent approach is to calculate taxes on capital gains accordingly to this stated position by the CRA and then request a refund later, if these provisions are officially scrapped.

These have been very difficult times for taxpayers; in particular investors and business owners. Not only are the proposed capital gains tax changes mind-numbingly complex, but uncertainty in complying with them has been amplified by a lack of timely guidance and forms, tax law retroactivity, and the threat of future tax reassessments that could result in penalties and interest if taxpayers and their advisors ultimately get it wrong. For some there are significant sums at stake.

Our tax system relies on self-assessment, while at the same time placing the burden of proof on the taxpayer. This doesn’t seem fair. What's your take? Let us know.

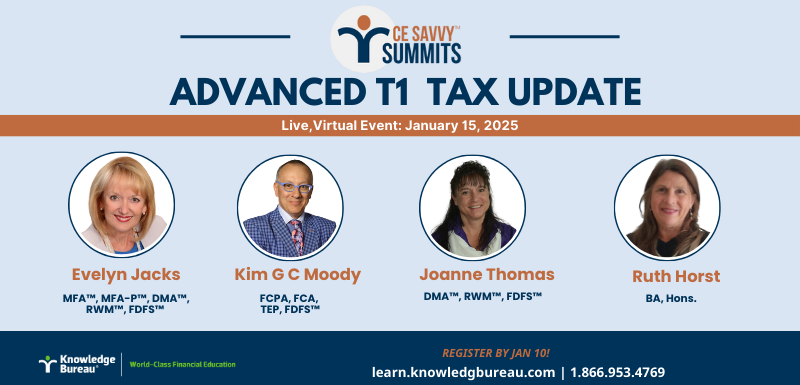

We begin our 2025 Tax School for Professionals on January 15 when we’ll be discussing all the new rules including changes on the 2024 tax return at the Virtual Live Advanced T1 Tax Update. Join me with my special guest Faculty Members Kim Moody, Joanne Thomas and Ruth Horst. Register now!