Last updated: March 26 2025

Bracket Creep Re-Emerges in Manitoba Budget 2025-26

Geoff Currier and Evelyn Jacks

Manitoba’s budget, delivered on March 20th by Finance Minister Adrien Sala, features a lot of red ink and the re-emergence of a stealth, hidden tax: bracket creep is back! Check out the details on this budget below and don’t forget look for the Knowledge Bureau Special Summary Report on the other provinces who have brought down budgets this quarter including: Quebec, Saskatchewan, Yukon and New Brunswick.

Manitoba: The Finance Minister, in his second budget for the NDP government had little to share in the way of tax relief in fact, he raised taxes by de-indexing personal amounts and brackets, described more fully below. He projects a significant deficit for 2025-26 of $794 million. However, Sala was clear that if tariffs with the United States remain in place for the long term, the deficit could well grow to $1.9 billion. Yet, the emphasis on this budget is still on spending and improving services.

Spending and Debt: There’s significant spending in this budget for both health care and education, including the building of eleven new schools in the province over the next three years. There’s also $1.2 billion new health care spending, bringing that portion of the budget up to $9.4 billion. As is the case with other provinces, Manitoba is pledging to hire more health care workers in the coming year.

The province’s overall debt is now $36.6 billion, which is up by $1.4 billion from last year. There is also a possibility of a half a billion-dollar contingency fund to deal with the fallout of a lengthy tariff war with the USA.

So how will this be paid? Partially by taxpayers of all income levels, as explained below.

Bracket Creep. Bracket creep is a hidden tax. As incomes rise due to inflation, taxpayers are pushed into higher tax brackets because those brackets have not been indexed to inflation. In other words, while employers have done their part to help offset the inflation with a higher wage, bracket creep diminishes the value of your inflation adjusted wage. In fact, there is no real gain to help you pay for the rising prices of goods and services.

This is further exacerbated by rising payroll taxes – the Canada Pension Plan premiums in particular. There too you see the effects of bracket creep, as the minimum earnings before you are subject to premiums has been frozen at $3500 since 1996. According to the Bank of Canada’s inflation calculator, adjusted for inflation, this amount should be $6475. ($100 in 1996 is now worth $185).

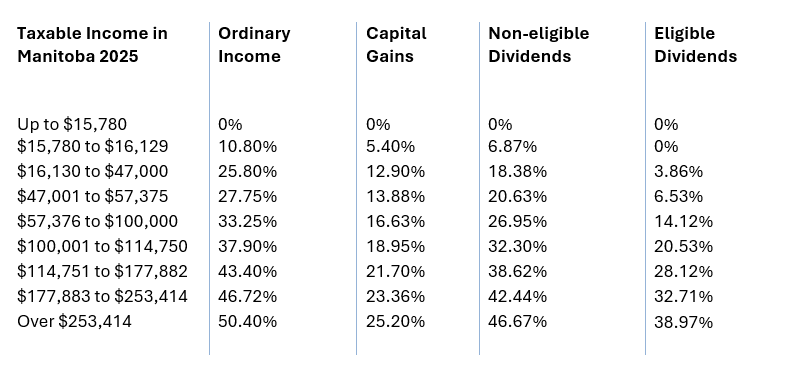

The Frozen Tax Brackets: The Basic Personal Amount and Tax Bracket Threshold Indexation are frozen. The BPA remains at $15,780. As for the Tax Bracket Threshold Indexation, the budget document reads “The maximum impact of the pause on an individual with more than $100,000 in taxable income, would be $87.25 in the 2025 tax year. For the majority of taxpayers, the impact would be $32 or less.” This represents the return of bracket creep in Manitoba. It is a reversal of a promise from a year ago and will mean a tax increase on all wage earners. Consider the marginal tax rates below on various sources of income:

Competitiveness: This tax hike is particularly concerning as Manitoba has struggled to remain competitive with the provinces when it comes to taxation. The freezing of the Tax Bracket Threshold Indexation and the Basic Personal Exemption render Manitoba less competitive with its next-door neighbour, Saskatchewan, where the Basic Personal Exemption is more than $3,600 higher than in Manitoba.

Smaller Measures: The Volunteer Firefighter and Search And Rescue amount will be doubled from $3,000 to $6,000 for the 2025 tax year to harmonize with the federal tax measures. You’ll see this on next year’s return even though the feds increased the amount in 2024. The change raises the maximum annual value of the credit to $648 in Manitoba.

In addition, the following provisions will affect individuals and businesses in Manitoba:

Homeowners. There is a $100 increase in the $1500 Homeowners Affordability Tax Credit, which will reduce property taxes for some. According to the budget, homeowners with gross school tax bills of more than $1,500 in 2026 will see an additional $100 off their school taxes. Renters will also be slightly better off thanks to an increase in the Renters Affordability Tax Credit to $575. Finally, hydro rates will be frozen for one year.

Car Owners. The EV Rebate program will continue to the tune of $14.8 million. However, after a 12 month holiday on the provincial gas tax, that tax is back and revenues from that sector will help the province’s bottom line.

Child Care. The $10 a day childcare program will be expanded to non-school days.

The Young Farmer Rebate threshold is being increased from $300,000 to $400,000 (when). Farmers under the age of 39 receive a 2% rebate on their borrowings for the first 5 years of the loan. The lifetime maximum rebate was previously $30,000; now it’s $40,000. (2% × $400,000 × 5 = $40,000). Thanks to Ag reporter Harry Siemens, Doan Grant Thornton and KAP, who confirmed these numbers for us.

- Large Business’ Payroll Tax Threshold Changes. The Payroll tax will be reduced. Manitoba is a rarity in Canada in that it retains a payroll tax on large businesses. However, there is some relief coming in this area. Sala says this will save Manitoba businesses about $8.5 million dollars and should help in job creation.

-

Small Business’ Cost of Digitization Rises. Beginning next year a new tax will be introduced which is expected to bring in about $4 million as Manitoba begins charging retail sales tax on “cloud computing services, such as subscriptions to software, data storage, and remote computer processing.” This is an anti-business measure at a time when these services are costing more and more, especially because most must be acquired from U.S. providers in U.S. funds.

Meanwhile, the printing industry will get a break in the form of a 35% refundable credit on salary and wages paid to Manitoba employees. This was introduced in 2024 and is now permanent.

However, the government has not introduced any new measures to incentivize digital publishing and innovation to incentivize new businesses to provide the subscription business, data storage and remote computer processing businesses in Canada need. That’s a big miss.

The Tariff Uncertainty: As is the case with every Canadian province, a trade war with the U.S. will impact this year’s budget, to what extent it’s impossible to predict. However, Manitoba is heavily reliant on trade with the States with almost half of the people involved in manufacturing potentially impacted, the province’s GDP will take a significant hit if the tariffs remain in place beyond this summer.

The Bottom Line: What does this mean to your clients? Individual Manitobans could see their income decline by an average of more than $1,400, according to the Province’s projections. Shoring up savings, particularly in a TFSA will help to prepare for emergencies.