Bill C-78 and the Finer Details: The GST/HST Holiday

Geoff Currier and Evelyn Jacks

Bill C-78 introduced on November 27 to suspend the GST/HST on a wide variety of goods from December 14 to February 15, 2025 appears to be moving ahead in the House of Commons on a fast track. The provisions deserve a deeper dive, however, as this comes with a multitude of significant future costs including unwelcome new tax audit risk for retailers. Here’s what tax advisors and their clients need to know and plan for before the end of the year:

The Behavioral Affects. The temporary GST/HST holiday will have the effect of putting off some pre-Christmas spending until December 14; delaying revenues for Canadian businesses in this important retail season. This could come with staffing adjustments - shorter hours or layoffs for some temporary Christmas workers. This also comes at a time when there is a postal strike, which has the impact of supply chain disruptions and delayed buying decisions. Business owners and their advisors will need to plan for these variations in revenue flows.

The Audit Risk. Business owners are unpaid tax collectors for government. They now face the costs of change to their accounting departments and the audit risk that comes with new GST/HST remittance complexity. The GST/HST holiday does not apply across the board in any category. At a high level, the list of items on which Canadians will not pay the GST includes:

- Most prepared meals at restaurants, takeout spots, lunch counters, food trucks, coffee shops or concession stands as well as most groceries and prepared meals and food from catering services.

- Toys for children 14 and under, including video game consoles

- Christmas trees (real and artificial).

- Newspapers and books, including audiobooks

- Diapers, children’s clothing, car seats and booster seats.

- Children’s and baby clothing, including footwear.

But in checking out the fine print, there are disappointing exclusions for shoppers. Retailers may have some explaining to do; consider the following from the government’s November 21 news release:

Children’s Items: Exemptions and Exclusions. The definition of children’s clothing, as an example does not include “garments of a class that are used exclusively in sports or recreational activities, costumes, or children’s footwear”. That will be important news to parents. What’s exempt from tax in the category of children’s clothes are:

- Garments designed for babies, including baby bibs, bunting blankets and receiving blankets;

- Children’s garments up to girls size 16 or boys size 20, if a national sizing standard applies; if not, girls or boys sizes extra small, small, medium, or large (but not extra-large) or,

- Hosiery or stretchy socks, hats, ties, scarves, belts, suspenders, or mittens and gloves in sizes and styles designed for children or babies – these was no age specified.

Children’s footwear: this will not include “stockings, socks or similar footwear or footwear of a class that is used exclusively in sports or recreational activities. It will include footwear that is designed for babies or children and has an insole length of 24.25 centimetres or less.” Shoppers will have to check the descriptive tabs carefully; retailers will need to get the computer programming in cash registers right.

Children’s diapers: these are products designed for babies or children including a diaper, a diaper insert or liner, a training pant, or a rubber pant designed for use in conjunction with any of those items.

Children’s car seats: the definition here is a restraint system or booster seat that conforms to the Canada Motor Vehicle Safety Standard 213, 213.1, 213.2 or 213.5 under the Motor Vehicle Restraint Systems and Booster Seats Safety Regulations.

Children’s toys: This is not for every child, so be aware. Specifically exempted from the GST/HST will be products designed for use by children under 14 years of age in learning or play. This will include the following detail which is :

- a board game or card game (e.g., a strategy board game, playing cards, or a matching/memory card game);

- a toy that imitates another item (e.g., a doll house, a toy car or truck, a toy farm set, or an action figure);

- a doll, plush toy or soft toy (e.g., a teddy bear); or,

- a construction toy (e.g., building blocks, such as Lego, STEM assembly kits, or plasticine).

- Jigsaw puzzles, however, in this case, it is puzzles for all ages. The same appears to be true of video-game consoles, controllers or physical game media (e.g., a video-game cartridge or disc).

Printed Reading Products. The government is also very specific in what qualifies and what doesn’t. From a CRA perspective at least, the government usually pushes digitization; for the GST/HST holiday, however, electronic or digital publications are excluded. On the good news side, though, the Digital Subscription Tax Credit, claimed on Line 31350 of the T1 return is available but only up to the end of 2024. Included in the GST/HST holiday are:

Print newspapers but not magazines: The government is exempting print newspapers containing news, editorials, feature stories, or other information of interest to the general public – but these must be published at regular intervals. Aside from the digital subscriptions noted above the following are not included in the holiday: most fliers, inserts, magazines, periodicals, or shoppers.

Printed books: Again, the devil is in the details. The GST/HST holiday will be extended to a printed book or an update of such a book, an audio recording where 90 per cent or more of it is a spoken reading of a printed book, or a bound or unbound printed version of scripture of any religion.

Here’s what’s not on the GST/HST holiday list, and this list includes some items typically purchased for children:

- a magazine or periodical purchased individually, not through a subscription;

- a magazine or periodical in which the printed space devoted to advertising is more than 5 per cent of the total printed space;

- a colouring book or a book designed primarily for drawing on or for affixing or inserting items such as clippings, pictures, coins, stamps, or stickers;

- a cut-out book or a press-out book;

- a brochure or pamphlet;

- a sales catalogue, a price list or advertising material;

- a warranty booklet or an owner’s manual;

- a book designed primarily for writing on;

- a program relating to an event or performance;

- an agenda, calendar, syllabus or timetable;

- a directory, an assemblage of charts or an assemblage of street or road maps (other than a guidebook or an atlas that consists in whole or in part of maps other than street or road maps);

- a rate book; or,

- an assemblage of blueprints, patterns, or stencils.

One can see where the explaining comes in - consumers are sure to check their bills for the GST/HST exemptions on children’s items and printed purchases, and some will wonder why coloring books and sporting equipment still carry the sales tax burdens.

In the Food and Beverage List. Here too there are details; included in the GST/HST holiday are some alcoholic beverages and lots of junk food; food conscious adults may want to choose the nuts or seeds! Catering services will be happy with the exclusions as well. Check out the full list here.

The GST/HST Savings Will Differ for Some Provinces. The impact of this tax holiday will depend on where you live. Ontario, Newfoundland and Labrador, Nova Scotia, New Brunswick and Prince Edward Island charge the higher HST. Residents of those provinces will not pay the HST on the items listed above so will get a larger break than other jurisdictions.

What Could Have Been Done. Given that the GST/HST is charged on top of the carbon tax, the government could do Canadians of all income levels a bigger favour by removing the GST/HST on heating bills until February 15.

Addressing the Tax Burden to Come. This pre-Christmas largesse on the part of the government disguises some more expensive times to come, in particular if the $250 Working Canadian Rebate comes to fruition in the spring. This second part of the November 21 announcement ran into roadblocks and was therefore delinked from the GST/HST holiday at the til.

Unfortunately, the impending carbon tax increase in April of 2025 was not mentioned. It’s important to know the cost of the anticipated charges for 2025 to 2030.

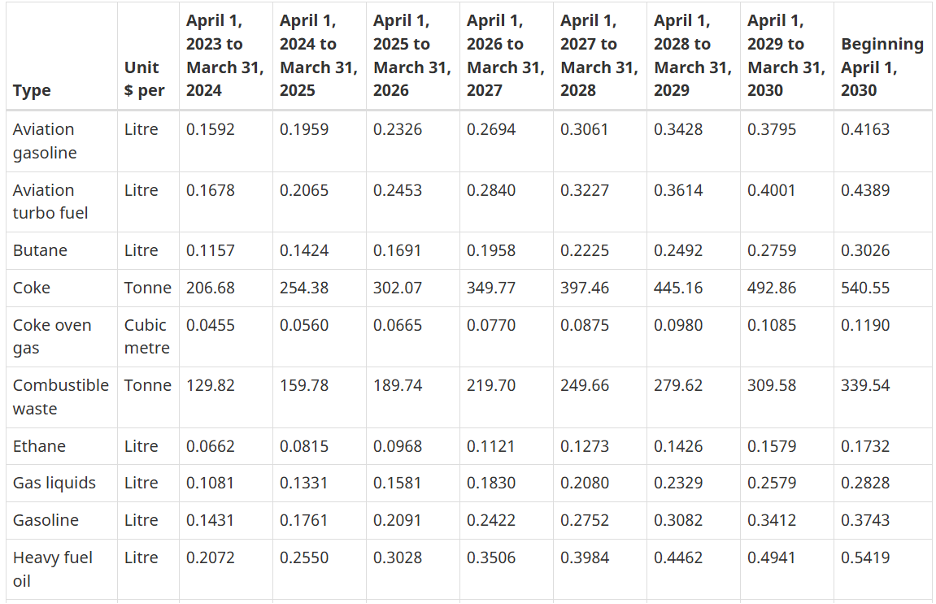

Consumers can expect gasoline costs to rise from .1761 cents per litre to 20.91 on April 1, 2025 and eventually to .3743 cents per litre by April 1, 2030 – 20 cents per litre more. In addition, it would not be unreasonable to expect the cost of travel to increase as a result 161% cost increases. Take a look:

Table 1 – Fuel charge rates for Alberta, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island and Saskatchewan

Note that the rates for aviation gasoline and turbo aviation fuel in Nunavut and Yukon will remain at $0. The CFIB also points out that the carbon tax will rise another $15 per tonne in April, while, “at the same time, government slashes the future rebate to small firms from 9 to 5% of total revenue.”

For the PM to suggest, as he did in announcing the GST/HST exemption, that government doesn’t set prices, would appear to strain credulity.

Debt Management Issues Abound. While there will be some short-term gain for some Canadians, this is not a time to load up the credit card. Consumer debt levels rose to $2.54 trillion in the third quarter of 2024, which is a 4 per cent increase since Q3 2023.

Auto loans and credit cards continued to be the primary driver of rising debt. But, overall credit card debt was up 9.4 per cent from last year. This is attributed to both population growth and an increase in average balance for consumers who are unable to pay their balance in full, according to Equifax Canada.

Recession May Be Around the Corner. Worse, the costs of this measure to the government treasury may come at a bad time with recent tariff threats from the U.S. Should the Canadian economy fall into a recession; job losses could result, further burdening Canadians financially exhausted by inflation and higher taxes. But in addition, this would affect projected government revenues (they could decline) and deficits (they could rise).

The suspension of the GST and HST is expected to deprive the federal government of about $1.6 billion. However, as GST/HST revenues are expected to increase about 25% or $12.6 Billion by 2020 due to the carbon tax increases, there may be some wiggle room.

Fairness and Equity. While this announcement may be a case of good politics, it does trump good tax policy, which relies on self assessment and five ideals: fairness, equity, simplicity, certainty and compliance.

Some Canadians will see cash in their hands and a break at the cash register. These are tangible savings that can be seen and touched, by some but not all Canadians.

However the complexity and confusion imposed on over-burdened business owners at a peak time in their business cycle has the potential of compromising the five ideals and the ability to comply with certainty.

Bottom Line: With an election and potentially a recession on the horizon, the short term stimulus strategy may not have its intended results. Even if politically successful in the short term, this announcement will add even more to the debt and tax burden of future generations, at a difficult time in the global economic environment.

In short, it’s wiser for Canadians to get their tax and fiscal houses in order before year end and shore up savings in tax sheltered accounts like RRSPs, TFSAs and FHSAs. It’s also important to catch up on delinquent tax filings before year end, starting with the 2023 tax return, to be sure to qualify for future government rebates and recover any missed refunds or tax credits sitting in limbo at the CRA.

Market Pulse Consumer Credit Trends and Insights Report, Equifax® Canada.