A New Debt Instrument: Limited Recourse Capital Notes

Marco Iampieri B.A., JD, M.B.A.

In today’s hot but volatile financial markets, investors are looking for new places to invest for safety, while taking advantage of change. A new type of debt instrument, Limited Recourse Capital Notes, may fit the bill for some fixed income investors, and tax and financial advisors will want to come up to speed to better understand the structure.

Limited recourse capital notes (“LCRN”) are a type of hybrid securities that have been reported to overtake preferred shares as an investment solution. LCRNs offer fixed income investors an alternative to traditional bonds, “with coupons north of 4% at a time when 5-year Government of Canada bonds yield well below 1%”.

The following items are many of the critical structural elements of an LCRN:

- They can only be purchased by institutional investors.

- They must have a minimum term to maturity at issuance of 60 years, which is required to allow these instruments to fall into the “perpetual” capital bucket.

- The coupon is to be reset at ever five years at the then-prevailing 5-year Government of Canada yield plus the original credit spread.

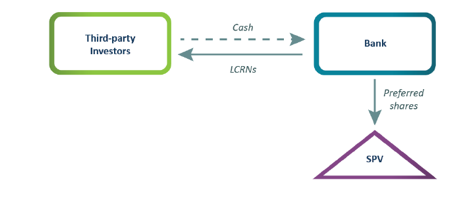

- At issuance two underlying instruments are created (a) LCRN and (b) preferred shares. The (a) LCRN are sold to investors and (b) preferred shares are issued and held in a special purpose vehicle (SPV). In certain situations, the preferred shares will be delivered to the LRCN investors, for example in the case of liquidation, insolvency, windup and bankruptcy. The recourse instrument, in this case preferred shares, are issued at the onset to avoid any problems which may arise if they were created in a stress environment.

- The SPV is essentially a trust that holds the preferred shares on behalf of the bondholders and will deliver those preferred shares in exchange for the bonds under certain predetermined stress scenarios.

Structural Overview

(Source: OFSI, “Capital Ruling.” (July 2020)) https://www.osfi-bsif.gc.ca/Eng/fi-if/app/default/Pages/lrcn.aspx

- These preferred shares have the same distribution rate (although a dividend, not a coupon) and other details except maturity date, as the LCRN.

- The LCRN effectively ranks pari passu (on an equal footing) with preferred shares because there are no situations under which the rank matters where investors will still be holding the LCRN bonds.

- LCRNs will be treated “similar to equity by regulators (this helps the bank’s balance sheet)”.

- The structure of the LCRN allows for tax deductibility by the issuer as opposed to dividends on preferred shares which are paid with after-tax dollars.

What is the tax treatment for third party investors? We’ll cover that in the next article on this topic.

Conclusion

LCRNs are an interesting new debt instrument that can improve an issuers balance sheet while offering investors an alternative to the traditional bond market with the potential for greater yields.