What’s New at Knowledge Bureau?

About our weekly course news releases:

We are proud to share new courses offerings as we continuously develop cutting edge and immediately implementable courses for our busy students. That’s what makes a Knowledge Bureau education so relevant and unique. Need something specific that you don’t see here? Please let us know about it.

Call 1-866-953-4769

The Evolution of Bookkeeping Has Come A Long Way

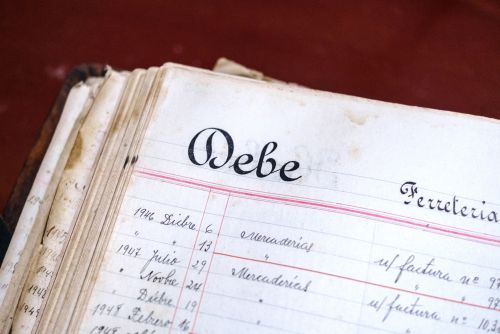

The first ‘record’ of accounting dates back as early as the Mesopotamian civilization, where simple documentation was maintained in the books. Around the 15th century, an Italian monk named Luca Pacioli, considered the father of accounting, developed the double-entry bookkeeping system, which changed the accounting landscape completely. The evolution of bookkeeping has a come a long way from the 15th century when accounting ledgers were completed by hand, compared to today’s digitized process.

Canadians “Guessing” Their Way into Retirement

CIBC’s latest annual Financial Priorities poll holds some disturbing revelations. When survey respondents were asked how they are determining how much money they will need to retire: A shocking 33% indicated they are using their “best guess” and only 14% indicated they are arriving at a number with the help of an advisor.

Should Canada Bring Back Income Averaging Provisions? February Poll Results

With high inflation rates, currently 5.9% on average across the country – all Canadians are feeling the pinch. One could argue that those earning an income that varies significantly year-to-year are being hit even harder.

Looking for CE credits in 2023? Knowledge Bureau has World Class Financial Education for you

Did you know 2023 is an extremely important Milestone Year for CE/CPD Credits in the financial services industry? Knowledge Bureau designates need 15 CE Credits by June 30 to relicense; IIROC Cycle 9 ends on December 31, 2023 and Insurance Council licensing CE credits are due at various times throughout the year. That’s why Knowledge Bureau is offering 5 new and exciting CE options to meet your professional development needs in 2023:

Asset Management and The Price of Lettuce

The price of lettuce in Canada – up over 35% in a year – is still an eyebrow raiser, despite the easing of the inflation rate in January to 5.9%, according to Statistics Canada. What does that have to do with Asset Management? Simply that 2023 is proving to be a tough financial year and advisors need to up their game to manage the concerns of anxious taxpayers and investors who are tapping into portfolios to pay for inflation and recent interest rate hikes, and coming up soon – their tax bills.