With Almost $2 Trillion of New Wealth Coming – Are You Prepared?

“Global Wealth 2022: Standing Still Is Not an Option” from Boston Consulting Group (BCG) predicts that $80 trillion in new wealth will be created over the next five years, including almost $2 trillion in Canada to a total $9.4 trillion. Are you prepared for this transfer of wealth? Become an advisor for the future: take a bold step and differentiate your practice by earning your RWM™ Designation.

More than ever, given the volatile economic times, clients expect to receive advice that is relevant both for today’s business environment as well as for the long-term wealth accumulation activities the family embarks upon. They are looking for a Real Wealth Manager™ to connect the dots between the various silos of expertise they may be paying for. Above all, they’re looking for someone they trust to provide direction for making important financial decisions about their income and their capital, now and in the future. Does this sound like clients you’d like to meet and service in your practice?

Be sure they can identify you and the new value proposition you offer as an RWM™. Build strong, inter-generational, multi-advisory relationships throughout personal and financial lifecycles, with a new approach: Real Wealth Management.

Click here to enrol now.

Real Wealth Management offers a long-term, multi-generational strategy, designed to keep all stakeholders on the same page under one holistic and unified plan.

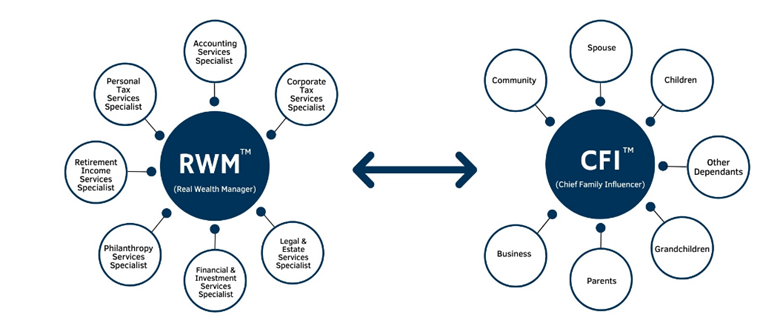

The RWM™- Real Wealth Manager™ - orchestrates the client’s unique plan by leading a team of financial professionals required to accomplish the client’s goals, through direct communication and partnership with the family’s delegated Chief Financial Influencer (CFI). The CFI who acts on behalf of the household unit with the common goal of wealth accumulation, growth, preservation, and transition - with sustainability after taxes, fees and inflation.

Advisors authorized to use RWM™ designation behind their names have a deep and broad understanding of both the behavioral and financial skills required to manage family wealth over several generations. In collaboration with the family, and an inter-advisory team of financial professionals, RWM™ develops a strategy and follows a process to manage intergenerational wealth on an after tax-basis. This sets the standard for decision-making for investment, retirement, business, succession and estate planning. The team educates, advocates and stewards responsible accumulation, growth, preservation and transition of wealth from one generation to the next.

This program will take you beyond the traditional scope of product placement, into an environment where you can integrate the kind of value-added long-term guidance, planning and leadership that will distinguish your practice.

Opportunity

Real Wealth Management has three critical components which integrate traditional planning processes with income, tax and estate planning:

- Real Wealth Management requires an ongoing focus on the elements of accumulation, growth, preservation and transition of wealth in making decisions about income and capital at each stage of life.

- Creation of Purchasing Power, defined as what you have left after tax, after costs and after inflation. It requires a focus on the sustainability of capital in order to fund future lifestyles. What matters is what you keep, rather than what you have. Therefore, advisors must focus on strategies to minimize taxes and costs while anticipating the long-term impact of inflation to effectively manage and minimize risk to savings. Truly wealthy people have peace of mind, attainable through a focus on sustainable wealth over time.

- Real Wealth Managers provide fully integrated, multi-generational advice by developing relationships with a multi-disciplinary team of professionals who can work together under one strategic plan toward client goals using three common analysis tools: The Net Worth Statement, the tax return and the financial plan.

What You Will Learn By Earning your RWM™

You will learn the Elements of Real Wealth Management™, a unique and specialized process for building relationships with your clients will enable joint decision-making that results in the creation of sustainable wealth through the execution of tactical plans for the accumulation, growth, preservation and transition of capital on a net, after-tax basis.

The course entails the completion of 18 online modules and features a case study approach using 15 sophisticated software tools to enable deeper conversations and projections that answer specific financial trigger questions.

“Knowledge Bureau, with their first-class courses, offers a sustainable, long-term educational framework for industry professionals. This is about implementing the Real Wealth Management process from an emotional intelligence, as well as a technical point of view, to guide clients in achieving their goals”

- Stefanie Keller, CFP, RWM™

Your Tuition Includes These All-Inclusive Resources:

• Personal course selection consultation

• Virtual campus orientation

• Lesson and study plans

• Personal instructor email support

• Comprehensive Knowledge Journal

• EverGreen Online Research Library

• Knowledge Bureau calculators

• Testing and certification

• CE/CPD accreditation

• Examination, certification and designation

Bottom Line: Enrol now for the Real Wealth Management approach if you want to differentiate yourself and elevate your practice to a new level. RWM™ designates have consistently strengthened their relationships with clients while also generating new business through referrals.

©Knowledge Bureau, Inc. All rights Reserved