The Urgent Need for Tax Reform

Winnipeg, which already has one of the highest residential tax rates in Canada, is the latest city to propose a property tax increase this week. At 5.95%, this is the largest increase in 34 years and is expected to raise $44.4 million dollars. What is behind these tax increases, and why, when taken together with the convergence of other layers of tax, is tax reform so urgent in Canada today?

The Reasons for the Cost Pressures. Raising taxes comes at a bad time for Canadians, who have suffered declines in their standards of living since June 2019. The adjusted per person GDP, which is an indicator of standards of living, has declined for the 6th consecutive quarter as of the third quarter of 2024.

While the economy has grown modestly from July to September 2024, (0.3%), GDP per person fell by 0.4%. How is this possible? Through rapid population growth; an increase of 0.6% or 250,229 persons in this timeframe, according to the Fraser Institute. This population growth has also strained the resources of the cities in which people live.

From 2022-2023, for example, Winnipeg saw its highest population growth since 1992 at 3.9%. Property taxes subsidize the fastest growing costs as a result – transit, housing, emergency services and other important infrastructure costs.

The City Property Tax Increases. The following cities have announced property tax increases for 2025; noted below are a few that are decreasing taxes. The average homeowner in Winnipeg can expect to pay about $121 more.

|

City |

Increase Proposed |

Current Tax Rate |

Average Home Price |

Current Taxes $500K Home |

Current Taxes $750K Home |

Current Taxes $1Million Home |

|

Victoria |

+12.17% |

.47416% |

$1,150K |

$2371 |

$3556 |

$4742 |

|

Toronto |

+9.5% |

.71519 |

$1,135K |

$3576 |

$5365 |

$7153 |

|

Winnipeg |

+9.5% |

.91000 |

$380K |

$4550 |

$6825 |

$9100 |

|

Halifax |

+6.3% |

1.1100 |

$578K |

$5550 |

$8325 |

$11,100 |

|

Edmonton |

+6.1% |

1.01738 |

$440K |

$5087 |

$7630 |

$10,174 |

|

Vancouver |

+3.9% |

.29681 |

$1,250K |

$1484 |

$2226 |

$2968 |

|

Calgary |

+3.6% |

.648611 |

$621K |

$3243 |

$4865 |

$6486 |

|

Montreal |

-6.18% |

.49770 |

$630K |

$2489 |

$3733 |

$4977 |

|

Regina |

-3.71% |

1.36434 |

$324K |

$6822 |

$10233 |

$13643 |

Property Taxes are Levied at the Provincial Level too. In addition to the city property taxes, Manitobans also pay provincial taxes on their properties. In fact, there are four distinct taxes on property in Manitoba:

- The municipal tax rates (varies by municipality)

- The School Division Rate (varies by municipality)

- The provincial education rate (same for all municipalities)

- Additional taxes for local services

When all of these taxes on residential property are added up, Winnipeg is amongst the highest taxed cities in the country.

How are Property Tax Credits Changing in Manitoba? In 2025, there are further changes to affect homeowners, based on the provincial government’s tax credit system. The Education

Property Tax Credit will be replaced with a new $1,500 Homeowners Affordability Tax Credit. It will mean that some homeowners won’t pay any property taxes. But for residential properties with $2,500 of provincial property taxes, $1000 will be payable – about $100 more.

Property Tax Credit will be replaced with a new $1,500 Homeowners Affordability Tax Credit. It will mean that some homeowners won’t pay any property taxes. But for residential properties with $2,500 of provincial property taxes, $1000 will be payable – about $100 more.

Home ownership costs are rising due to carbon taxes as well. The federal government plans to increase the carbon tax charges by $15 per tonne a year, until it reaches $170 per tonne in 2030, just five years from now. This is equal to an increase from 15.25 cents per cubic metre in 2024 to 32.40 cents per cubic metre by year eight.

Remember that GST is charged on top of the carbon tax.

In real dollar terms, if natural gas consumption in 2024 is $338, the cost for the same consumption will be $719 by 2030. This is an increase of $1.13%.

Paycheques will be shrinking due to increasing payroll taxes. Workers will be experiencing shrinking paycheques as the amount they pay into the Canada Pension Plan and Employment Insurance will increase in this time frame. Regarding the CPP alone, two layers of increases began in 2019. CPP1 will have increased premiums by 55.5% since 2018

|

Year |

Regular CPP Rate |

Max. Pens. Earn. |

Max. Reg. Premiums |

Add. Pens. Earn. |

Max. Pens. Earn. |

Add. Rate |

Add. Prem. |

Total Prem. |

Max. SE Prem. |

|

2018 |

4.95% |

$55,900 |

$2,593.80 |

|

$55,900 |

0% |

|

$2,593.80 |

$5,187.60 |

|

2019 |

5.10% |

$57,400 |

$2,748.90 |

|

$57,400 |

0% |

|

$2,748.90 |

$5,497.80 |

|

2020 |

5.25% |

$58,700 |

$2,898.00 |

|

$58,700 |

0% |

|

$2,898.00 |

$5,796.00 |

|

2021 |

5.45% |

$61,600 |

$3,166.45 |

|

$61,600 |

0% |

|

$3,166.45 |

$6,332.90 |

|

2022 |

5.70% |

$64,900 |

$3,499.80 |

|

$64,900 |

0% |

|

$3,499.80 |

$6,999.60 |

|

2023 |

5.95% |

$66,600 |

$3,754.45 |

|

$66,600 |

0% |

|

$3,754.45 |

$7,508.90 |

|

2024 |

5.95% |

$68,500 |

$3,867.50 |

$4,700 |

$73,200 |

4.00% |

$188 |

$4,055.50 |

$8,111.80 |

|

2025 |

5.95% |

$71,300 |

$4,034.10 |

$9,900 |

$81,200 |

4.00% |

$396 |

$4,430.10 |

$8,860.20 |

CPP 2 adds 4% or a maximum of $396 more when incomes are higher. This is a significant burden on workers and businesses alike.

How to raise living standards? Living standards improve when economic growth occurs. So do tax collections. Economic growth creates new jobs, new opportunities for investments and innovation. Unfortunately, according to the OECD’s 2021 report, Canada is expected to have the lowest growth rates in per-person GDP of any industrialized country, up to the year 2060. This was well before the Trump tariff threats were taken into account.

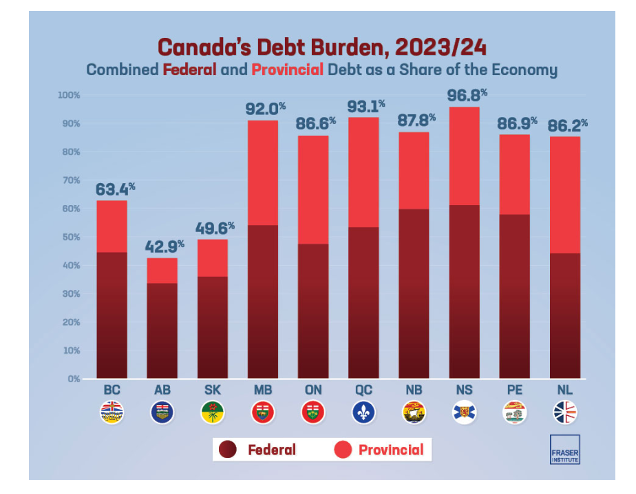

Governments will also continue to struggle with affordability of services we need against the headwinds of unprecedented debt servicing costs. Since 2007/08, combined federal and provincial net debt (inflation-adjusted) has nearly doubled from $1.18 trillion to a projected $2.18 trillion in 2023/24. This is a particularly serious problem for Manitobans.

Why Tax Reform is So Urgently Needed. One of the best ways to increase living standards is to reduce taxes on workers and businesses. And that is why tax reforms are urgently required in Canada today. The tax mix – the ways in which all government raise taxes – is currently disjointed, complex and onerous and far too expensive.

The system of taxation we live with in Canada requires optimization in order for Canadians to have real opportunities to make responsible fiscal decisions to secure their future lifestyles. The time for this is now.

Fraser Institute Study: The Growing Debt Burden for Canadians: 2024 Edition