Tax Planning: How To Push Back on Economic Malais

Taxpayers need to quickly sharpen financial skills for the challenging times ahead, and a good way to start is to find the right advisor for their future, says Knowledge Bureau Founder and President Evelyn Jacks, best-selling tax financial author and award-winning educator. It’s also critically important for both parties to invest anew in their financial education, especially tax education, to push back on the economic malaise predicted for 2023.

The good news? There’s plenty of new tax relief available.

“We are weathering through the most significant economic shock in a decade; with levels of uncertainty that are unprecedented,” says Mrs. Jacks. “Tax and financial decisions for significant life and financial events must align with grim economic triggers – high inflation, high interest rates, significant labor market changes and higher taxes. Those challenges are new; that means tax and financial plans must be different, too.”

Finding the right professionals, with up-to-date credentials is challenging for most people, says Jacks, but it’s a foundational investment for 2023. “Look for an Advisor for Your Future - someone with deep and broad knowledge who can help assemble a team of specialists – a tax, financial and legal assistance. These advisors must aligned with you in setting critical short and long term financial goals.” she says. “They should also challenge you to do three things: stick to your plans, look for tax advantages and maximize tax efficient investment solutions.”

What are some of those critical financial decisions to make for 2023? Jacks says many of them involve awareness of new tax provisions and tax efficient investment opportunities. Finding new money in 2023 is all about understanding your tax advantages as a household economic unit. She provides three critical questions as a primer in starting new conversations with tax and financial advisors:

- How can We Increase Cash Flow? Begin by asking what tax benefits you can tax advantage of. For example, high transportation costs can be offset with new Climate Action Incentive Payments in seven provinces in 2023; the next one happens January 13 in four of them – Alberta, Saskatchewan, Manitoba and Ontario[1]. Also coming soon: the Canada Child Benefit (CCB) payment on the 20 of both January and February, and OAS, CPP and GIS (Guaranteed Income Supplement) benefits on the 27th of both January and February. Canada Veterans’ Disability Benefits on January 30 and February 27. Be sure to catch up on missed tax returns as soon as possible to qualify and maximize your RRSP deduction, if you are eligible, to avoid clawbacks.

- How can we Decrease Income Taxes? Discuss income splitting within the family for the best after-tax results. It’s a great way to increase cash flow – every two weeks –to pay family expenses, make investments and stay out of debt. To do that, learn more about tax. For example, the “tax free zone” is now $15,000 - no federal taxes are payable when income falls below this. And, due to high inflation rates, personal amounts and tax brackets have been indexed by 6.3%[2]. Individual income levels can reach $53,359 and still be within the lowest federal tax bracket of 15%. The next bracket attracts a 20.5% rate up to $106,717[3]. For a couple that evenly splits income, that’s $213,434 for the household.

- What About Tax Changes in Real Estate? Residential real estate transactions are subject to a number of new tax measures in 2023 including the new Tax-Free First Home Savings Account (FHSA), the refundable Multi-Generation Home Renovation Tax Credit and doubling of the non-refundable New Home Buyer and Home Accessibility Tax Credits. But there are tax traps: residential home flipping within 365 days of purchase will not only cancel the Principal Residence Exemption but require a 100% income inclusion for the profits, except in limited instances.

These measures are complex and require planning. They can affect other investment opportunities – such as TFSA and RRSP contributions, or decisions about what accounts should be used to buy, sell or improve real estate. That requires help from tax, legal and financial advisors who can work together.

But where to find such an advisory team? “It’s a question I have often been asked,” says Jacks. “Professionals often work in silos. If so, you may not always receive the holistic and customized financial services you need,” says Jacks.

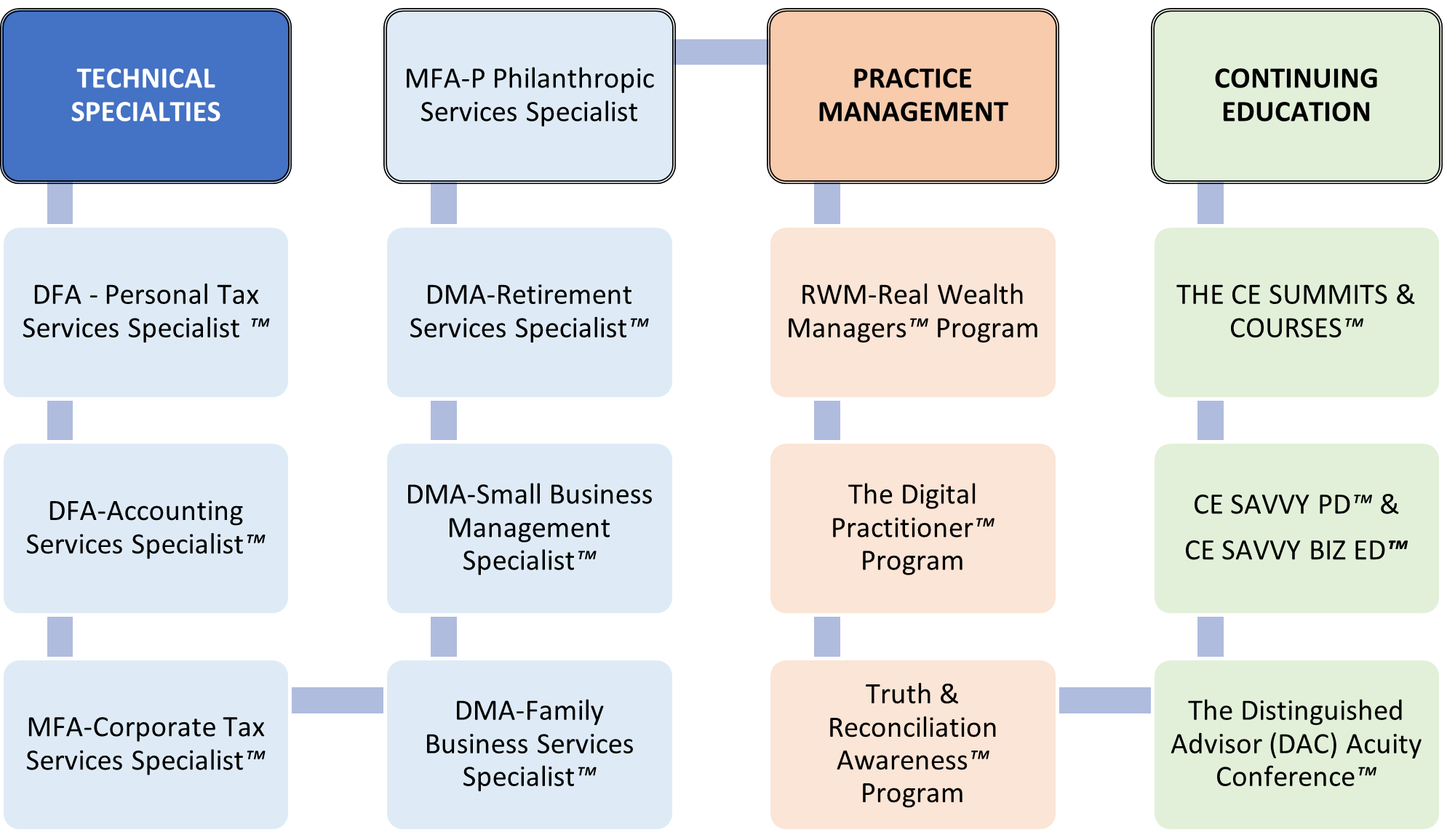

That’s where specialized credentials from the Knowledge Bureau can help. “With the taxpayer in mind, we set out 20 years ago to raise standards in continuing professional development with an academic pathway to new specialized credentials for advisors; ones that clients can readily recognize. Jacks explains: “To find a lead advisor for a family wealth plan, look for a Real Wealth Manager (RWM™). For specialization in personal or corporate tax, retirement, philanthropic or business services, look for Distinguished Master Financial Advisors who are highly trained for the economic challenges ahead.”

To address the new economic headwinds, Knowledge Bureau recently expanded and harmonized its online certificate, diploma and designation programs. The goal, says Jacks, who was also a member of the Federal Task Force on Financial Literacy, is to ensure graduates are trained to be better educators, advocates and stewards of family financial resources.

Also new are CE Savvy Biz Ed™ courses advisors can share with clients who have a “side-hustle”. The focus in this series is to help clients start and run scalable businesses with formal business training in an informal online setting, that prepares them to ask better questions of advisors, too.” Affordability has been addressed with a new educational subscription service.

Knowledge Bureau plans a year of celebrations across the country, culminating in a 20th Anniversary Snow Ball Gala at the Distinguished Advisor Conference at the Banff Springs Hotel, November 11 to 14, 2023. This conference feature thought leaders from across North America. For more information contact: Evelyn Jacks, President, Knowledge Bureau, Evelyn.jacks@knowledgebureau.com.

TAKE A NEW PATHWAY TO SPECIALIZED PROFESSIONAL CREDENTIALS - 24/7- ON YOUR OWN TERMS

Technical Specialties: 30, 90 or 180 hours of study.

Practice Management Programs: 40 hours of study

Continuing Education: 5-1 hour modules, 10 or 15 hour events, or 20 hour CE Courses

Designation Program Courses: DFA-Specialist™, MFA™, DMA™ programs contain 6-30 hour certificate courses. The DMA™ Retirement Services Specialist Program Requires 75 CE Savvy PD™ micro Courses (15 Bundles) plus the Personal Pension Planning & Retirement Income Planning (Software) Courses. The MFA-P™ program consists of three individual courses. The RWM™ has 18 micro-courses.

For Course Details see www.knowledgebureau.com

Practice Management & Continuing Education: The Digital Practitioner Program™ has 14 micro-courses; The Truth & Reconciliation Awareness Program features 10 micro-courses. The CE Summits™ consist of a full day live/virtual event plus 20 hour online course. The CE Savvy PD™ & Biz Ed™ Series can be taken in bundles of 5 micro-courses at a time and the DAC Acuity Conference™ provides 15 hours of strategic education. Some programs are also accredited by third party regulators & associations.

For Course Details see www.learn.knowledgebureau.com

[1] Newfoundland, Nova Scotia and PEI will start receiving payments in 2023 in July and October and January 2024

[2] This compares to 2.4% in 2022 and 1% in 2021.

[3] Note, taxpayers must add provincial taxes and calculate tax credits to compute final taxes payable.

Evelyn Jacks is Founder and President of Knowledge Bureau, holds the RWM™, MFA ™, MFA-P™ and DFA-Tax Services Specialist designations and is the best-selling author of 55 books on tax filing, planning and family wealth management. Follow her on twitter @evelynjacks.

©Knowledge Bureau, Inc. All rights Reserved