RSVP by May 15: Improve Your Retired Client’s Financial Lives

Last year was quite possibly the worst year in decades to retire and start drawing retirement income and so far in 2023, the foreseeable future is fraught with uncertainty. For these reasons we asked CE Summit keynote speaker and best-selling author Doug Nelson, B.Comm., CFP, CLU, CIM, RWM™ to share his inspiration in preparing his sessions for the upcoming May 24 CE Summits Workshop and expand upon the kind of retirement planning advice that’s right for today’s difficult environment. He was passionate in his response and provides a sneak peek at what you will learn.

“I am so looking forward to the May 24th Continuing Education Summit,” Doug began when we asked him some tough questions about the plight of today’s new retiree. “The ultimate goal of the Real Wealth Management™ approach is to see both income and capital maintain purchasing power over time, especially in retirement. But how on earth can this happen when the client is also making regular withdrawals from their RRIF account?”

Doug’s musings went further as he developed the theme. “At what rate of return will the minimum RRIF withdrawal amount keep up with inflation and is this return easily attainable? To what extent will the capital also keep up with inflation? Can you have it both ways or does something need to give?”

As he explored these questions, he reflected on his experience with economic cycles so far.

“I have built some interesting models and have learned some new and interesting factors to consider as part of the retirement income planning process. These models also helped to uncover some important integration strategies between the RRIF and the TFSA, and how they can both be used in tandem to achieve some very exciting outcomes.”

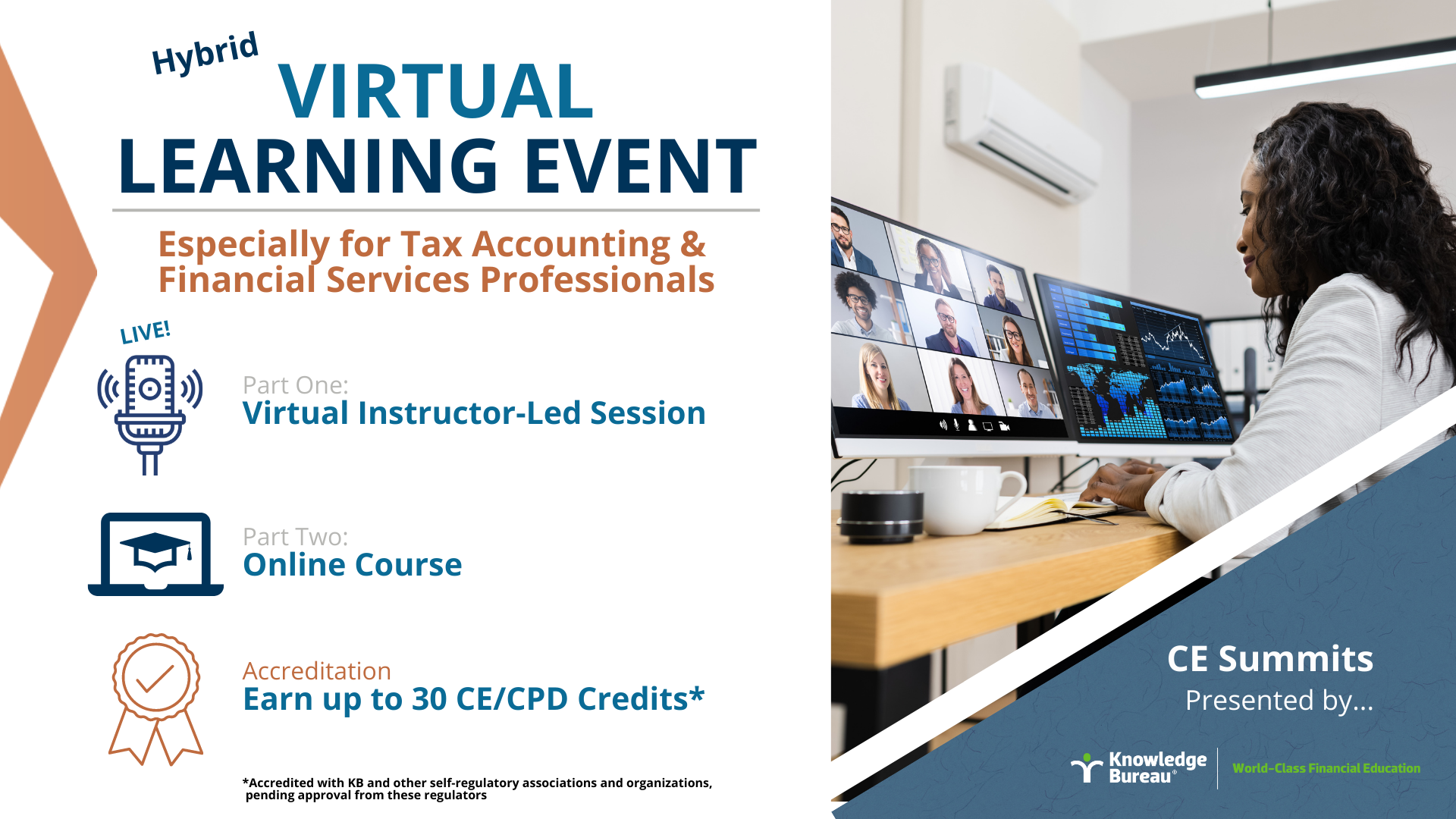

Please join Doug on May 24th as we explore in more detail powerful strategies to protect the purchasing power of both income and capital throughout the retirement years.