Designate Relicensing Deadline Ahead: 3 Ways to Earn CE by June 30

Designates – it’s almost time to relicense your specialized credentials! Check out verifiable and non-verifiable options at special tuition prices until June 30 to earn CE and use your exclusive VIP Designate tuition rates you can use to enrol yourself or train your team.

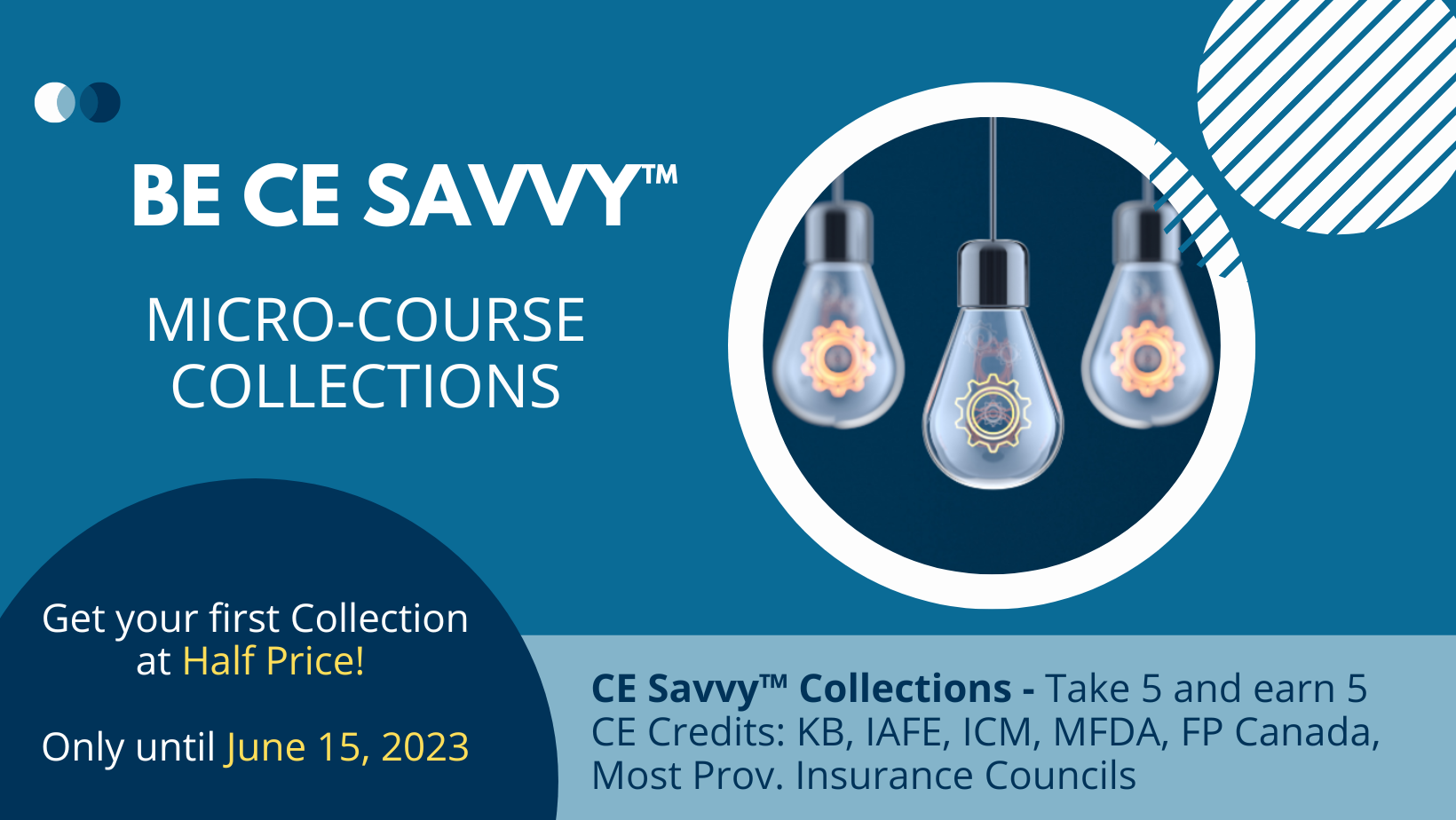

Micro-Course Collections

Looking for a new way to earn CE Credits? Check out the new micro-courses from Knowledge Bureau and build new relationships with new conversations with your clients! Earn 5 CE Credits for each collection with Knowledge Bureau and FPCanada, IAFE, ICM, AIC and MFDA. Now, save 50% on any collection of your choice until June 30!

With new CE Savvy Collections, you’ll engage in a cool new format that allows for traditional, mobile and social learning, featuring gamification and personalized, data-driven results: keep track of your CE in your own learners dashboard. Plus, learn by collection (5 micro-courses at a time) or by annual subscription (the full professional library yours to select from any time 24/7).

Check out what our brand new learning environment has to offer by watching this video!

Check Out the Collections:

Know Your Business Client Better!

Start new conversations with:

- Finding Financial Freedom

- Starting Your Business

- Building Your Business

- Understanding Tax

- Compensation Planning

- Investments: Diversify Your Risk

- Succession Planning

Drill Down Further on Special Skills to Excel and embrace new opportunities:

- Know Your Client

- Investor Profiles

- Asset Management

- Retirement Planning

- Tax Planning

- Wealth Planning

- Planning for Life’s Transitions

- Multi-Generational Wealth Planning

Line up your CE for the year with event passes for the CE Summits: take a quad or trio.

Join Knowledge Bureau President, Evelyn Jacks and Special Guest Instructors for hybrid live virtual events each featuring a comprehensive online course and after the event, the recorded presentations.

Join us to experience our newly designed a peer-to-peer virtual learning platform for your continuing education needs.

Now’s the time to start building your arsenal for next tax season! The new KB Tax Tip Toolkit gives you fast answers to your tax questions and you’ll earn up to 30 CE credits using it, too! Receive three great solutions at one great price: professional tax research library, powerful tax planning calculators, and CE accreditation.

CE Accreditation: Earn 30 non-verifiable CE Credits when you subscribe to the Tax Tip Toolkit for one year!

Only $495 until June 15. Designate savings applied automatically upon registration.

What’s in Your Tax Tip Toolkit:

EverGreen Explanatory Notes: Professional Tax Research Library

With over 800 topics with thousands of links to the Income Tax Act, CRA forms, publications, information circulars and interpretation bulletins. Featuring easy-to-understand definitions, tax facts, examples, tips and traps and interview checklists - questions to ask your clients.

All just a couple of mouse clicks away! Continually updated through our “EverGreening” process: when we get the news, you get the news!

RWM™ Discovery Calculators” Powerful Tax Planning Tools

Take your tax preparation service to the next level with 15 tax planning calculators that answer questions about decisions your clients need to make, including:

• Income Tax Estimator for 2023

• RWM™ Financial Discovery Calculator

• Take Home Pay Calculator

• RRSP Savings Calculator

• Tax Efficient Retirement Income Calculator

• Tax Efficient Assets Transfer Calculator

• Donations Savings Calculator

• CPP Calculator