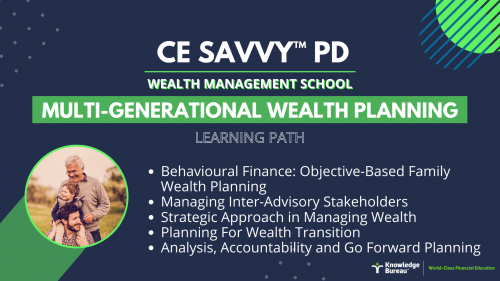

CE Savvy™ Collection – Multi-Generational Wealth Planning

Multi-generational wealth planning is fraught with potential failure because it’s so hard to get everyone on the same page – mom & dad, the kids and the grandkids! But it’s possible with a multi-stakeholder process you can easily learn with our new CE Savvy™ Collection of five micro-courses! You too can learn how the process of objective-based planning and joint decision making can really move a Real Wealth Management™ plan forward, and bring huge value to clients who are struggling with how to best plan for the future. The five micro-courses are entitled:

1. Behavioural Finance: Objective-Based Family Wealth Planning

2. Managing Inter-Advisory Stakeholders

3. Strategic Approach in Managing Wealth

4. Planning for Wealth Transition

5. Analysis, Accountability and Go-Forward Planning

Complete all 5 courses in 90 days. Pass them, get your certificate, then add them to your permanent Scholar’s Library. Here’s what you’ll learn:

Complete all 5 courses in 90 days. Pass them, get your certificate, then add them to your permanent Scholar’s Library. Here’s what you’ll learn:

- The issues that an affluent family needs to think about when anticipating wealth transition

- How to manage a team of inter-advisory stakeholders

- How to use the four elements in a Real Wealth Management™framework for strategic planning with clients

- How to create an “RWM Handbook©” to use consistently with clients as standard for practice in multi-advisory practices

Add value and save time: This CE Savvy™ Collection of micro-courses can also be gifted to your best clients, which is a great way to strengthen your relationship and also extend your “family relationship” to the next generation.

With the new CE Savvy™ Collections you’ll engage in a cool new format that allows for traditional, mobile and social learning, featuring gamification and personalized, data-driven results: keep track of your CE in your own learner dashboard. Plus, learn by collection (5 micro-courses at a time) or by annual subscription (the full professional library yours to select from any time 24/7).

Continue your academic pathway to professional development with exciting new micro-courses and start new conversations about issues and trends!