Canada Training Credit: Learn Risk Free and with Tax Assistance

Investing time and money into new Specialized Credentials or continuing professional develop is an important undertaking and you want to make the most of both. That’s why you’ll want to learn more about the tuition fee amount and the Canada Training Credit (CTC) as potential tax assistance when you take a Knowledge Bureau course.

More good news: we offer risk free course trials for you to explore the right educational program for you.

Following is more detailed information:

Free Trial Courseware from Knowledge Bureau. Check out our Free Education options at https://learn.knowledgebureau.com/pages/free-trials. You can also take advantage of a free personal guided orientation of our virtual campuses by calling 1-866-953-4769 and our friendly educational consultants will help you make the best educational decisions to meet your objectives.

The Tuition Fee Amount. Knowledge Bureau certificate courses qualify for the tuition fee credit – it’s a non-refundable tax credit available when tuition fees exceed $100. You can check out your tax receipt in the Virtual Student Lounge.

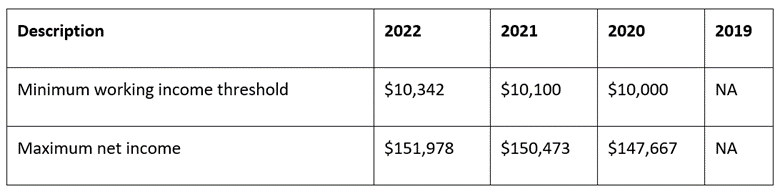

The Canada Training Credit. To qualify for this refundable tax credit, you must file a tax return and be between the ages of 26 and 65, a Canadian resident for the year, with a minimum total working income of at least $10,342 and a maximum net income of $151,978 in the prior year (indexed annually), a shown below. Net Income must not exceed the top threshold of the 3rd tax bracket for the preceding year. A history of the income-testing thresholds appears below

Canada Training Credit (CTC)

Qualifying income is from

- maternity and parental benefits, and

- working income (income from an office or employment, business income, the taxable part of scholarship income and research grants, the tax-exempt part of earnings of status Indians and emergency service volunteers, and income under the Wage Earner Protection Program Act).

Tuition or fees must be paid to an Eligible Educational Institution and for both the Canada Training Credit and the Tuition Tax Credit, the qualifying amount are the same. They include tuition fees, ancillary fees and charges (e.g., admission fees, exemption fees and charges for a certificate, diploma, or degree); and examination fees.

An Eligible Educational Institution for the purpose of calculating the CTC is either of the following:

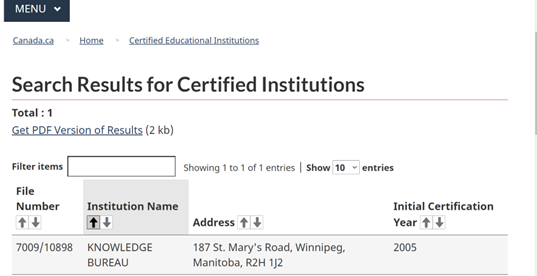

- a university, college or other educational institution in Canada providing courses at a post-secondary level

- an institution in Canada providing occupational skills courses, which is certified by the Minister of Employment and Social Development

Knowledge Bureau is recognized by the Minister of Employment and Social Development as an eligible educational institution. (See below)

Consult Your Notice of Assessment or Reassessment. Your Canada Training Credit Limit (CTCL) for the year is shown on your latest notice of assessment or reassessment. Every year you file an income tax and benefit return, since 2019, CRA will increase your CTC balance by $250 if you qualify, up to a maximum of $5,000 in a lifetime. Note the following:

- Even in years where you make a claim for the CTC, you can still accumulate $250 in your CTCL for the following tax year.

- You may claim the lesser of the CTC or 50% of eligible tuition paid in the year.

- Tuition paid in excess of the CTC may be claimed as the regular Tuition Tax Credit

Which Credit Should You Claim?

As a general rule, when the Canada Training Credit is available, it should be used for two reasons:

- The Tuition Credit is only 15% of the tuition paid (federally, plus a smaller provincial credit in most provinces), so the Canada Training Credit is more efficient.

- Taxpayers whose non-refundable credits exceed their taxable income cannot use the Tuition Credit in the year but must transfer it to a supporting individual or carry it forward to use in a future year when income increases. The Canada Training Credit can be used in any year and increases the claimant’s tax refund.

For more information: Consult with a Tax Services Specialist or go to CRA page: https://www.canada.ca/en/revenue-agency/services/child-family-benefits/canada-training-credit.html

©Knowledge Bureau, Inc. All rights Reserved