Last updated: September 07 2022

Risk Management Reviews Important in Light of Higher Inflation

Ian Wood, CFP, CIM, MFA-A

With the recent spike in inflation, planners need to re-evaluate their financial plans. I’ve previously written about revisiting the long-term mortgage amortization projections with rising interest rates and the impact of rising costs to cash flow (With Mortgage Rates Rising, Revisit Financial Plans).

Advisors should also be reviewing the risk management plans of clients to determine if the level of coverage remains suitable. The basic insurance needs analysis process is broken down into four steps:

They are:

- The amount of coverage needed.

- How long the need will exist, and whether it will be an increasing, decreasing or consistent need over time.

- The suitability of riders and other options.

- Choosing the carrier that offers the product that best matches the client’s insurance needs.

Whether you are putting together an analysis for life, disability, or critical illness coverage, finding the right level of coverage is the obvious first step in the insurance needs analysis. Having too little coverage simply will not solve the problem that insurance is being used for, while having too much coverage means your client is allocating funds to a product they don’t need —instead of using that cash flow to support other goals.

Higher costs due to inflation affect the calculations used in step 1. Whether projecting th need for income replacement due to death or disability, the income needed has likely increased with higher prices. Likewise, the costs of treatments being covered by Critical Illness coverage have increased, and the coverage should therefore be reviewed.

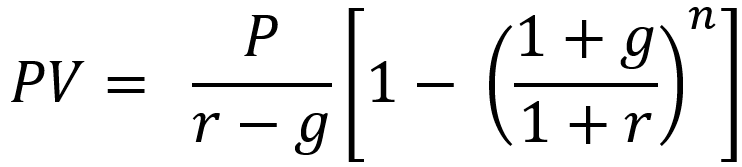

For example, in calculating replacement income needs for a life insurance policy, you use the present value formula for a growing annuity:

PV = Present Value, which is the amount of death benefit needed

P = Payment Desired in today’s dollars

r = Discount rate, which is the assumed rate of return for the lump sum proceeds

g = Growth rate, in this case that’s inflation

n = Number of years of income desired

This calculates the lump sum amount you need today to generate the desired income for the desired period of time.

The result is that an increase in the growth rate (inflation) will increase the calculated present value of the formula. Further, a higher payment may be desired to reflect the current increased costs compared to the original assessment, which will also result in a higher calculated insurance need.

Bottom line: The regular review of insurance product suitability is a best practice, regardless of the current inflation outlook; however, it is in times like these that the importance of these reviews becomes more evident and the value you can add to your clients becomes more impactful.

Ian Wood is Vice-President and Associate Portfolio Manager with Cardinal Capital Management in Winnipeg. As a financial planner, he works directly with clients across Canada and the US, specializing in the areas of business succession, retirement income planning, and estate planning.