Last updated: October 15 2019

How Accountants and Bookkeepers Can Help Small Business Owners Reclaim their Sundays

Small businesses are the backbone of the Canadian economy, accounting for *98% of businesses in the country. Accountants and bookkeepers are critical advisors to these small business owners, helping contribute to the company’s success. Managing business finances can be quite stressful for business owners, as handling the books on their own is often intimidating and quite a burden.

By: Andrew Turnbull, Senior Vice President, CIBC Business Banking

Accountants and bookkeepers go beyond helping managing books - they do what money can’t buy – give back valuable time. They help alleviate time-consuming tasks so business owners have more time for what’s important – running their business.

Business owners draw from their expertise to help make their work-life balance a bit simpler. They also offer advice on many operations of the business such as business structures, financial analysis of business plans, and provide recommendations on what accounting software best suits the company.

To help address and guide small business owners in their financial journey, it is vital to understand the pain points and common struggles they face. The CIBC SmartBanking™ for Business Survey, a poll of 1,005 small business owners across the country, was developed to uncover these insights.

The survey revealed one-in-four small business owners have too much manual data entry within their current platforms and they spend too much of their time on bookkeeping, accounting and  payroll. As well, 18% of these business owners stated they never stop working, making lack of time an ever-present concern.

payroll. As well, 18% of these business owners stated they never stop working, making lack of time an ever-present concern.

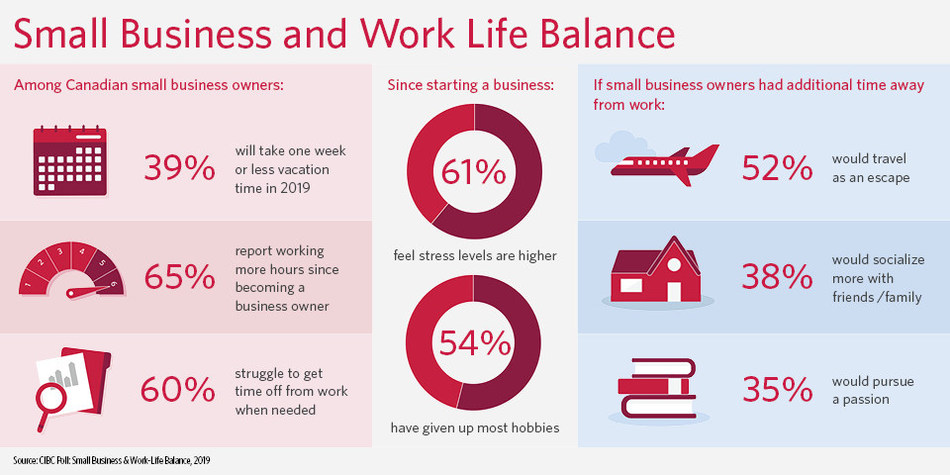

In addition to one-in-five always working, 17% of business owners say they work more than 60 hours per week and that if they were given any extra time in the week to be away from their desk, they would be spending time quite differently. Meanwhile, 52% said they would consider travelling, 38% would spend more time socializing with friends and family, 35% would pursue a passion and 28% would get more sleep.

In efforts to help Canadian business owners reclaim their Sundays, CIBC SmartBanking™ for Business has launched a new first-of-its-kind banking platform designed to assist small and medium-sized businesses run and grow their companies and manage their banking, accounting and payroll in one place. To accomplish this, CIBC integrates information from cloud accounting software companies QuickBooks Online and Xero, and payroll software company Ceridian.

CIBC SmartBanking for Business uses secure, two-way data integration between CIBC and cloud accounting platforms to reduce manual data entry, simplify reconciliation and improve accuracy. Through a single interface, business owners can get a view of their business finances including upcoming payroll details, pending invoices and receivables, as well as access their day-to-day banking to manage upcoming payments and optimize their cash flow.

It’s important to have a deep understanding of new software developments, technologies and updates, and make sure you have the right infrastructure in place to support your client’s continuous development.

CIBC is working to ensure that its software is easy, efficient and works seamlessly with other technology – to help provide small business owners the best client service possible.

Additional educational resources: CIBC presented SmartBanking™ for Business at Knowledge Bureau’s CE Summits in the spring. The next series of workshops is coming up this November in Winnipeg, Toronto, Calgary, and Vancouver. Enrol today!