Get Quick Answers on RRSP Contributions

The RRSP is the most versatile vehicle available for tax planning for most Canadians although it is often poorly utilized. The RRSP Savings Calculator provides quick answers about the potential tax savings that can be obtained through an RRSP contribution as well as the consequences of borrowing to make that contribution.

Example

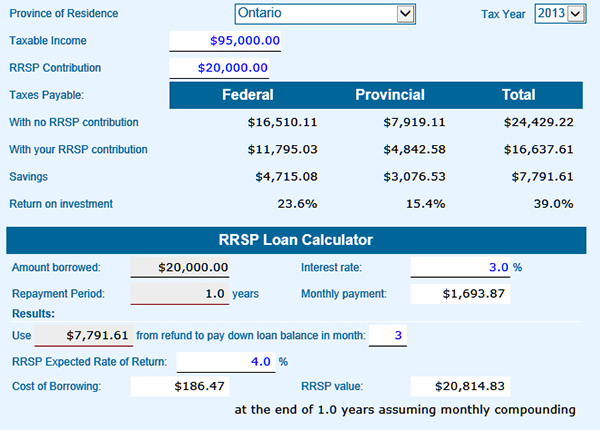

Jeremy lives in Ontario. For 2013 his taxable income will be $95,000. He has more than $50,000 of unused RRSP contribution room as he has not maximized his RRSP contributions in the past. How much tax would Jeremy save if he made a $20,000 RRSP contribution?

By making a few entries, the calculator shows that his estimated tax bill of $24,429 is reduced to $16,637 by making the contributions – a savings of $7,792. This represents a 39% return on his $20,000 investment.

The second section of the calculator shows that if Jeremy were to borrow the $20,000 at 3% for one year and use the additional refund generated to pay down the loan when it is received, the total cost of borrowing would be only $186.47. Monthly payments on the loan would be $1,694.

The RRSP Savings Calculator is one of 14 tools in the Knowledge Bureau Toolkit. Use it to quickly evaluate the saving available from RRSP contributions and the costs of borrowing to make such contributions.