Your Marginal Tax Rate

Your marginal tax rate is a measure of the rate of tax you’ll pay on the next dollar earned or, alternatively, the rate of savings on the next dollar deducted.

Since not all income types are taxed in the same way, you actually have four different marginal tax rates, one for each type of income: capital gains, eligible dividends, other than eligible dividends, and ordinary income.

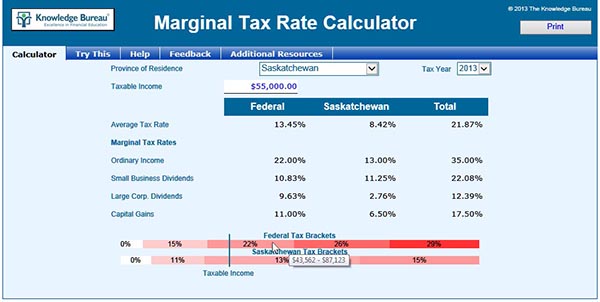

The Marginal Tax Rate Calculator quickly gives the marginal tax rates for each type of income based on only three parameters: Province of Residence, Tax Year, and Taxable Income. It also gives you a graphic representation of the federal and provincial brackets so you can quickly determine how far you are away from a bracket boundary (and thus rate change).

Example:

Aaron lives in Saskatchewan and has $55,000 taxable income in 2013.

The calculator shows that Aaron’s marginal tax rate on ordinary income (like salary, interest, or RRSP withdrawals) is 35%. That means if he earns $1,000 more of this type of income, he’ll pay $350 in income taxes on that income. On the other hand, if he earned that $1,000 from dividends from a small business corporation, he only pays $123.90 in taxes on the income. If Aaron were to qualify for a deduction of $1,000, for example by making a $1,000 RRSP contribution, he saves $350 in taxes as a result of the deduction.

The bars at the bottom of the calculator show graphically the federal and provincial tax brackets and their applicable rates. Aaron is in the 22% federal bracket and 13% Saskatchewan bracket (as marked by the vertical bar). With the cursor placed over the 22% bracket bar, the bracket range of $43,562 to $87,123 is shown. From this you can see that the 35% deduction rate applies until the deduction decreases his taxable income to $43,562 and the current marginal tax rates apply to additional income until his income level reaches $87,123.

The Marginal Tax Rate Calculator is one of fourteen calculators available in the Knowledge Bureau Toolkit.