Last updated: October 25 2023

Year-End Planning: News for Disabled Persons

Evelyn Jacks

There are 6.2 million persons with disabilities in Canada, 23% of whom live in poverty. Soon there will be tax-assisted relief, but unfortunately not for at least a year. The Canada Disability Benefit (CDB) was passed into law under Bill C-22, June 22, 2023 to help. The payments are expected to start in December 2024 and delivered through the tax system. In the meantime, people living with disabilities and their caregivers can inform themselves of existing tax support for the 2023 tax year and the time to get ready is now. Here’s what you need to know:

Canada Disability Benefit (CDB) To be modelled after the GIS (Guaranteed Income Supplement, which is a refundable, income-tested tax benefit) the CDB will be paid to adults 18-64 years of age in 2024. The initial focus of the benefit will be on working people with disabilities. Also, it will be paid on top of other federal disability programs as well as other provincial programs such as provincial and territorial income assistance, CPP-D, Veteran’s Disability Benefits, Worker’s Compensation, private insurance and other disability support programs.

Some, like Professor Wayne Simpson of the University of Manitoba, question why the Disability Tax Credit shouldn’t simply be made refundable as a more direct line to success. He notes:

“For the same cost, the refundable credit would improve the incomes of the poorest families by an average of 20 per cent. It would also provide a framework for the provinces to convert their non-refundable disability tax credits to refundable tax credits, further increasing benefits for families most in need by about one-third.

A critical question is whether the Canada Disability Benefit will replace, complement or be integrated into the disability tax credit. The maximum impact of a refundable Canada Disability Benefit can only be achieved if the disability tax credit is eliminated.”

The elimination of the Disability Tax Credit would, however, ease burdens on doctors and nurse practitioners who now have to spend valuable time on the administration of this form as opposed to treating patients.

Claiming the Disability Tax Credit. The process for receiving the Disability Tax Credit has also changed. It’s now necessary to make a two part digital application (it is still possible however to use a paper process). This all begins with the patient’s identification, and the receipt of a reference number from CRA which must be used by the medical or nurse practitioner to complete the information for the claim. The application is reviewed within 8 weeks if all the information is available and then a Notice of Determination is issued by CRA. Only then can a disability tax credit be claimed for a particular tax year. CRA warns that if clients wait to file the disability amount on the tax return without following these procedures first it will delay the return and any potential refund.

Will income be low enough to qualify for the new Canada Disability Benefit next year? Making an RRSP contribution to reduce net income can help.

EI Compassionate care benefits for caregivers. Many in the Gen X and Gen Y generations are looking after vulnerable parents and grandparents, at the expense of accruing their own future benefits at work. Reduced paid sick leave or vacation leave are often the result. However, if caregivers must leave work to give care to a critically ill child, parent or to provide end-of-life care, the Employment Insurance (EI) program can provide some support. Specifically, there are three types of Family Caregiver/Compassionate Care programs for those who must take leave to help a critically ill person. It is possible to earn up to 55% of earnings to a maximum of $650 a week depending on who the care is given to:

- up to 35 weeks for critically ill minors

- up to 15 weeks for critically ill adults and

- up to 26 weeks for end of life care.

It is also possible to share these benefits with another caregiver and to take this time within 52 weeks following the date a person is certified by a medical doctor or nurse practitioner to need critical or end of life care.

Other Tax Assistance. Be sure to catch up with missed prior year tax returns to make sure Guaranteed Income Supplement (GIS), worker’s compensation, the refundable Canada Worker’s Benefit and certain provincial supports continue. Persons with disabilities who are working can also claim the Disability Supports Deduction, the Disability Tax Credit, medical expenses as well as the Refundable Medical Expense Supplement in many cases. It is also possible to tap into the CPP Disability Benefit.

Medical expenses are a great trigger for year end tax planning conversations. The total claim is reduced by 3% of the taxpayer's net income, it is often best to claim the amount for the best 12-month period ending in the tax year and on the return of the lower-income taxpayer, unless that taxpayer is not taxable. Common medical expenses paid to medical practitioners that seniors visit, aside from doctors, dentist and nurse practitioners include an optometrist, pharmacist, a psychologist, osteopath, chiropractor, naturopath, physiotherapist, an occupational therapist who is a member of the Canadian Association of Occupational Therapists, an acupuncturist, dietician or audiologist.

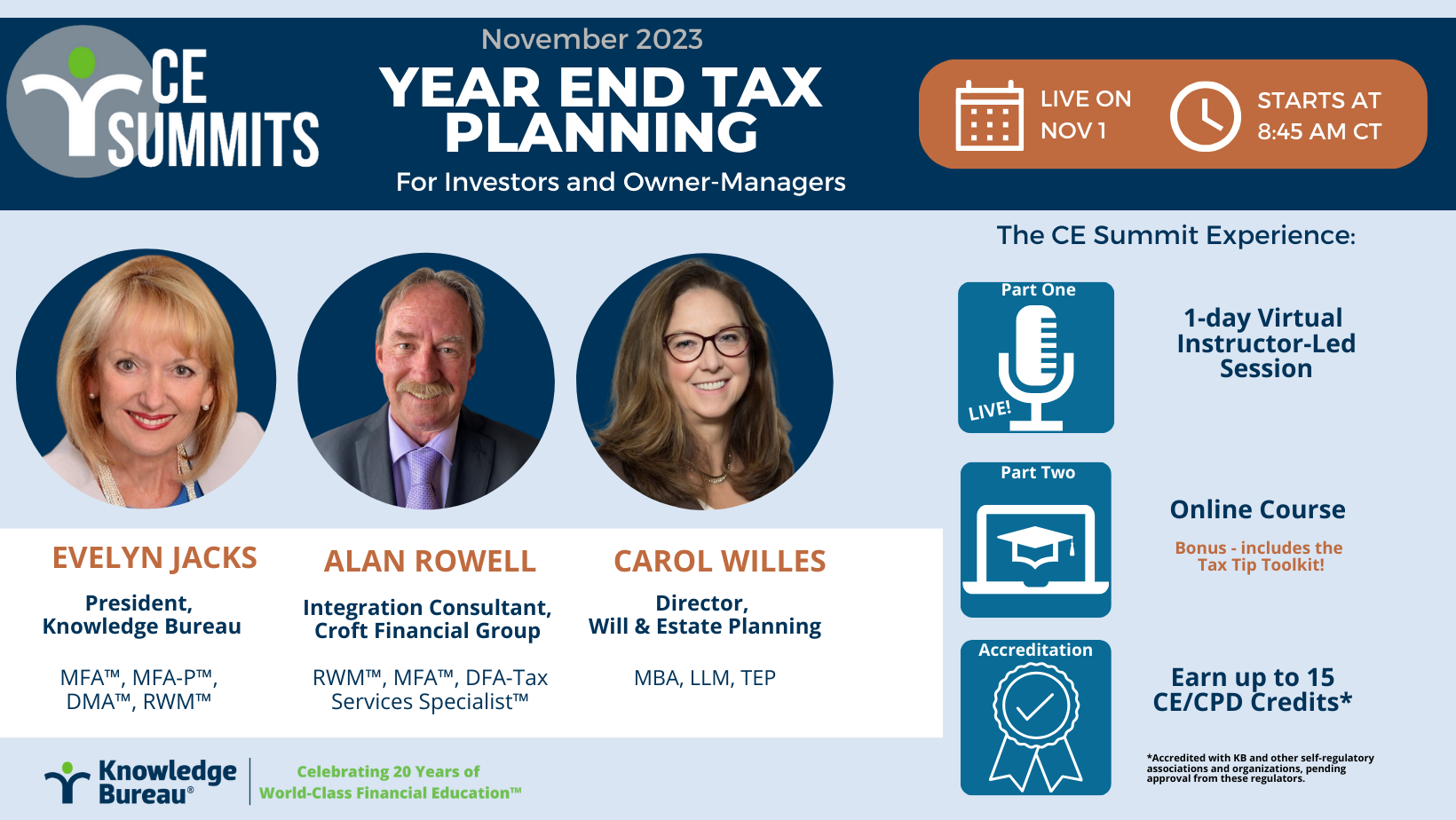

How to Make a Difference. People really appreciate advice about claiming the disability tax credit and medical expenses. It can make you a hero for a day if you have the right information at your fingertips! For more information see these Knowledge Bureau resources: Join us November 1 for the CE Summit on Year End Tax Planning or if you prefer an online education and great resources and instructor support try the DMA personal tax services specialist program.