Last updated: October 15 2014

Year End Donation Planning for Ontario Farmers

The new Ontario Community Food program Tax Credit is worth 25% of the fair market value of food donated to the community and it’s an innovative idea that may catch on with other provinces and the federal government.

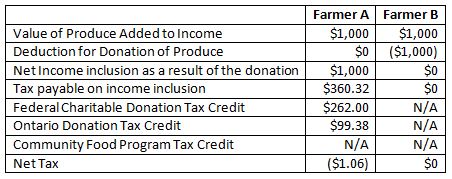

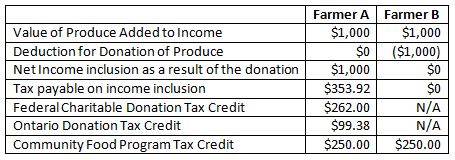

For now, here’s an example of how it would work for a proprietor and a corporation each donating $1,000 worth of produce in 2014. As a comparison, the first example shows the 2013 results.

Example: Farmer A (proprietor) donates food to the local food bank worth $1,000. Farmer A has taxable income of $85,000 before counting the donated produce. Farmer B (a corporation) also donates $1,000 worth of food.

2013

In neither case is there any incentive for the farmer to donate the food rather than wasting it. But here’s the real dollar value of the new credit:

2014

In this example the individual farmer gains slightly more from the food donation because he benefits from the normal donation credit as well as the new Community Food Program Tax Credit.

Reported by Walter Harder, DFA-Tax Services Specialist and DFA-Bookkeeping Services Specialist. Walter is based in Penticton, BC and provides support to students of a number of Knowledge Bureau tax courses including T1 Professional Tax Preparation – Basic. Walter also regularly updates EverGreen Explanatory Notes, an online research library of assistance to tax and financial professionals in working with their clients.