Why Economic Growth is Job #1

Evelyn Jacks

It’s provincial budget season, with a federal election coming up soon. What should Finance Ministers in Canada be focusing on to try to meet the tariff winds head on and ensure the standards of living of Canadians going forward in a proactive way? The answer is to focus on economic growth. What is it, why is it important to consumers and voters and how do we measure that?

Consider the primer below and in our next episode of the Real Tax News podcast.

Definitions. Let’s start with the last question first. Economic growth is measured by a country’s provinces GDP or Gross Domestic Product. If we say our GDP is forecasted to be 2%, it means the economy is expected to grow by 2%.

Why is Economic Growth Important? When GDP grows, that’s good because it leads to more jobs, higher wages and for governments higher tax collections, which can pay debt and be redistributed through social benefits.

When GDP falls, our economy has stopped growing and when it falls for two consecutives quarters, we are said to be in a recession. There are consequences for that: job loss or wage cuts, lower consumption, business loss. And with that comes lower tax collections, which cuts the government’s ability to provide social safety nets. Today, on the federal side close to $70 Billion a year will be spent on interest on the debt alone.

What Can be Done? Borrowing is an option, but when governments borrow too much to do so at the risk of slowing down economic growth. According to a recent paper by the IMF,” using data from manufacturing industries since the 1980s, it shows that (i) government debt leads to a decline in growth, particularly in R&D-intensive industries; (ii) the differential effect of government debt on these industries is persistent; and (iii) more developed or open financial systems tend to mitigate this negative impact.”

They tend to cut interest rates and try to control inflation instead, which is tricky because lower interest rates could ramp up spending and then boost inflation. They also raise taxes.

Reducing taxes are another option to spur on growth. High taxes can potentially slow economic growth because they reduce incentives to work and invest money in the economy. They also reduce innovation. They also cause brain drain.

In fact, that is where economic growth and productivity often intersect. Productivity is a key requirement for economic development, and it’s driven by education, innovation and efficient outputs – higher quality goods, produced faster and at lower costs. Consumers win, businesses win, employees win and governments win, because higher profits and wages result in higher tax collections.

A Healthy Eco-system. Together, economic activity driven by innovation and productivity supported by low taxes, help economies grow. And that means high standards of living and choices in social programming.

So what comes first? The fastest way to reduce taxes for consumers is to raise the tax free zone. But the way to spur on investment and innovation for business is to reduce taxes on capital and investment, and the rewards for those risks.

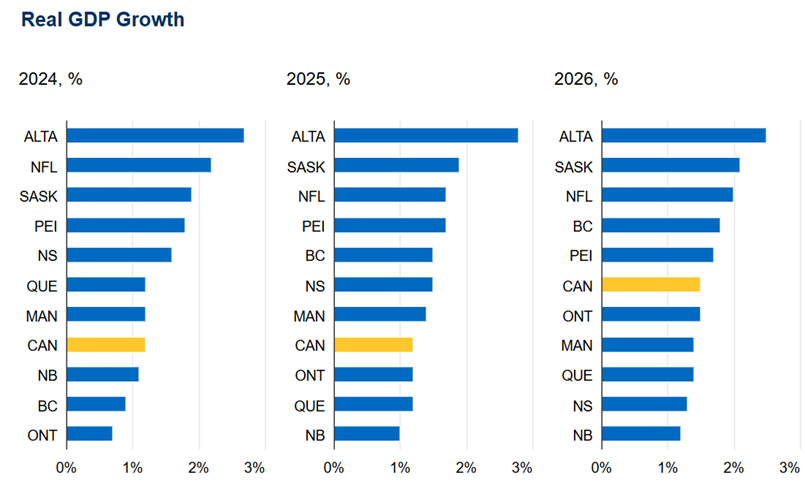

How do we say we are Open for Business? We focus on the factors that lead to growth. Some provinces are doing that better than others; and some are doing it much better than the federal government:

Source: https://thoughtleadership.rbc.com/canadas-growth-prospects-brighten-in-2025-but-not-without-challenges/#:~:text=ALBERTA%20%E2%80%93%20Energy%20sector%20powers%20growth,top%20provincial%20performer%20in%202025.

Bottom Line. Voters and their parliamentarians must have a better understanding of basic economic news to make informed decisions. Working with an astute advisory team can help.

Additional educational resources – the May 21 CE Savvy Summit. We’ll be discussing the budgets and the outcomes of a spring election, expected to be called before this. In addition, join us at the Acuity Conference for Distinguished Advisors November 23 - 26 when one of Canada's most distinguished and influential academics in public policy, Dr. Jack Mintz, will open your eyes to what a new Recovery Plan should look like.