Tax Expenditure Report Good Fodder for Next Federal Budget

What does the next federal budget, widely expected to be announced sometime this month, have in store for Canadian taxpayers?

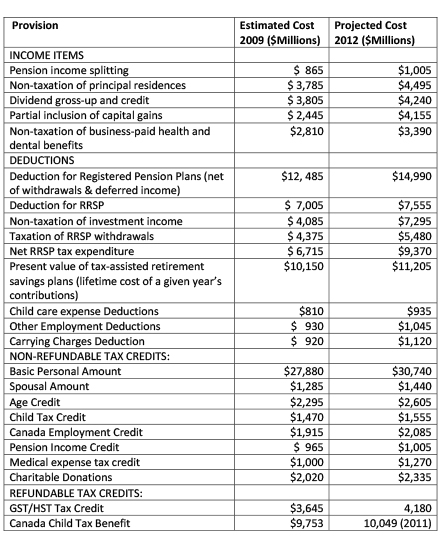

What exactly does it cost the government to give you a tax deduction or credit, or take it away? Those amounts are published annually, most recently in a report called Tax Expenditures and Evaluations 2012. This report would give any Finance Minister looking to cut or give tax breaks, a run-down of the most expensive provisions. It’s also a good heads up for taxpayers on what could be cut by governments short of cash.

Governments practice “tax choice architecture” in developing their budgets; the Income Tax Act (ITA) is not just a tax collecting statute, but also provides implicit subsidies that encourage economic behaviors or implement social goals in redistributing income. Following, from the tax expenditures report are some of the higher figures representing revenues lost through our progressive tax rate system and the myriad of deductions and credits attached to it:

The changes estimated to 2012 over the 2009 period reflect the introduction and enhancement of broad based non-refundable tax credits like the Basic Personal Amount in the case of personal tax provisions, reflected above. In the case of corporate taxes, the period say general tax rate reductions from 21% in 2007 to 15% in 2012 as well as the elimination of a 4% surtax. GST expenditures were affected by a drop in the GST rate from 6% to 5%.

For the full report including data tables click here.