Quickly Estimate Your Tax Situation

The Income Tax Estimator is a simple calculator that helps determine total taxes paid for individuals and/or couples based on different combinations of income sources. See it in action with the following what-if-scenario and then try it for yourself, risk-free!

Scenario

Michael and Jessica are a married couple living in Ontario. Michael earns $48,000 salary and Jessica operates a small proprietorship with a net income of $23,000. They have two school-age children.

In 2005 Michael inherited a property when his father passed away. The fair market value of the property was $65,000 when he inherited it. Michael estimates that the property can be sold in 2013 for $125,000. He’d like to know how much his income tax bill will increase if he sells the property.

Solution

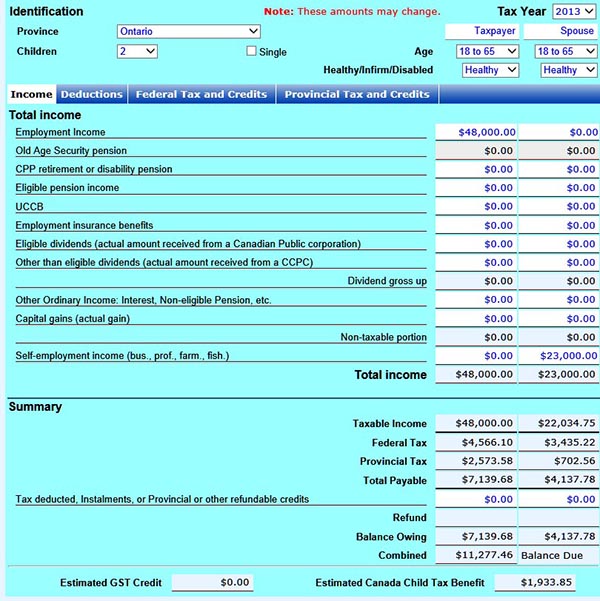

The first step is to determine the family’s current tax liability. Entering in the above information into the Knowledge Bureau’s Income Tax Estimator yields the following results:

The couple will have to pay $11,277.46 in taxes for 2013 and their estimated CCTB is $1,933.85. These calculations include non-refundable credits for the children, Canada Employment Amount for Michael, and CPP payable on self-employment earnings for Jessica.

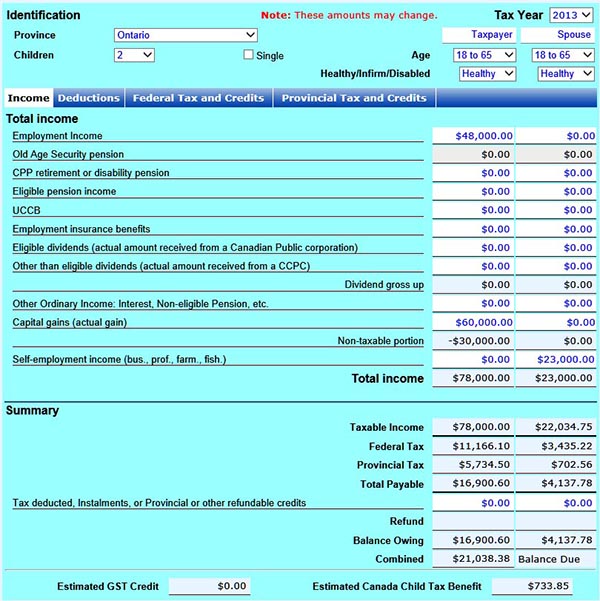

Now if the property is sold for $125,000, the result will be a capital gain or $125,000 – $65,000 = $60,000. Adding the gain to Michael’s income gives the following results:

The family’s tax bill increased to $21.038.38 (an increase of $21,038.38 - $11,277.46 = $9,760.92. In addition, their Child Tax Benefit decreased to $733.85 (a decrease of $1,933.85 - $733.85 = $1,200.00). The net tax cost of the sale would be $9,760.92 increase in taxes plus $1,200 decrease in Child Tax Benefit or $10,960.92.

The Income Tax Estimator, part of the Knowledge Bureau Toolkit, allows you to quickly estimate the tax situation for a single taxpayer or a couple for tax years 2003 to 2013 and to quickly look at several what-if scenarios.