Last updated: January 03 2025

New! Tax & Accounting Specialized Credentials for Tax Season 2025

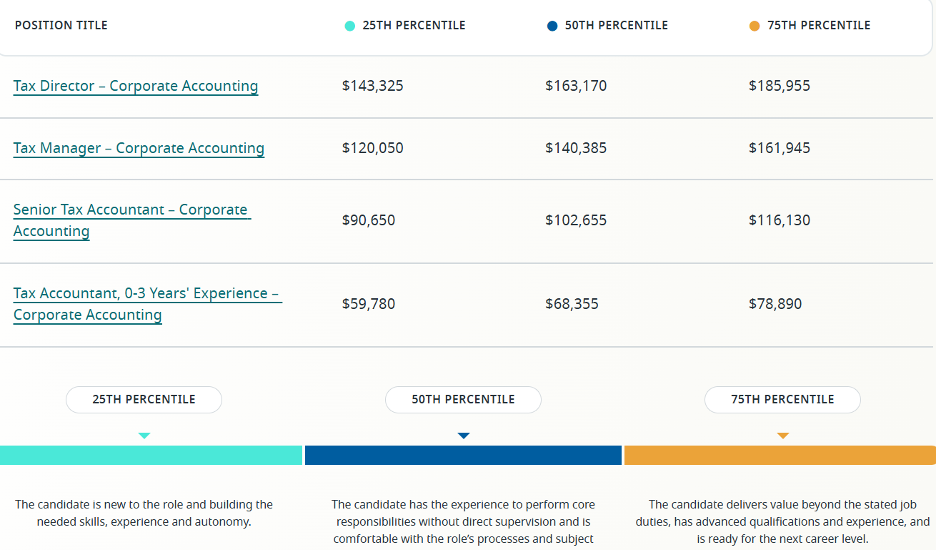

Taking a Knowledge Bureau Specialized Credential can really pay off. According to the 2025 Canada Salary Guide released by Robert Half, earnings are high in the tax accounting industry. Even those starting out in the field can expect to earn approximately $60,000 to $64,000, with significant upward mobility possible in the future (see details below). For these reasons, it’s a great time to specialize in this field and register now for our convenient online programming.

Salary comparisons. Here’s Winnipeg for example, where tax specialists earn about 2% less than the national average:

Employment Outlook. According to the Government of Canada Job Bank, the employment outlook will be good for Financial auditors and accountants (NOC 11100) in Manitoba for the 2024-2026 period. Here are some key facts about Financial auditors and accountants in Manitoba:

- Approximately 6,000 people work in this occupation.

- Financial auditors and accountants mainly work in the following sectors:

- Accounting, tax preparation, bookkeeping and payroll services (NAICS 5412): 34%

- Monetary Authorities - central bank and securities, commodity contracts and other intermediation and related activities (NAICS 521, 522, 523): 6%

- Federal government public administration (NAICS 911): 6%

- The distribution of full-time and part-time workers in this occupation is:

- Full-time workers: 94% compared to 81% for all occupations

- Part-time workers: 6% compared to 19% for all occupations

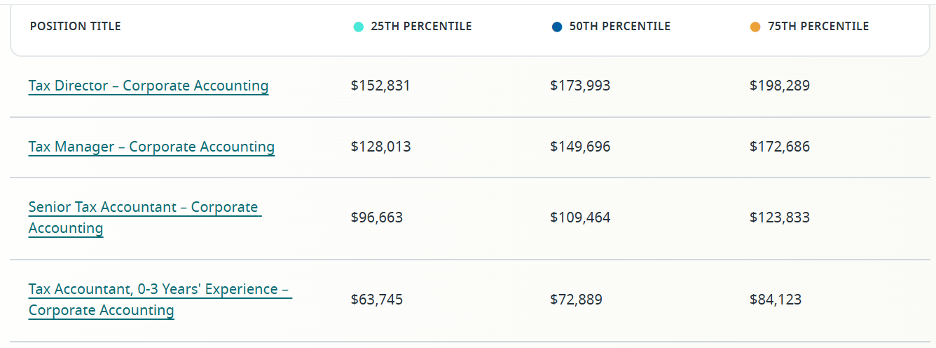

In Calgary, meanwhile, the same job pays 4.5% higher than the national average:

Competition is intense for skilled finance and accounting talent, and top candidates often receive multiple job offers. Some employers prefer to hold out for experienced professionals with in-demand skills, but that approach can result in overlooking high-potential candidates.

To overcome staffing gaps, managers are considering people who may need technical training but have polished soft skills. Knowledge Bureau’s programs and courses leading to specialized credentials can help prepare business owners in the field with technical training their new hires need in tax and accounting.

Our online certificate courses lead you down the educational pathway towards designation and new specialist skills. Ideal training for those new to the Canadian taxation system, or to give experienced professionals a refresher on the latest tax news and information.

“I am working on my second degree with the Knowledge Bureau, and I strongly recommend their courses for anyone in the financial services field. They have without a doubt, the most practical and effective approach to helping advisors serve their clients.”

Chris Valentine, DFA-Tax Services Specialist™ and MFA™-Retirement and Succession Services Specialist, RWM™