Last updated: August 07 2024

New 30-Year Amortizations for Insured Mortgages

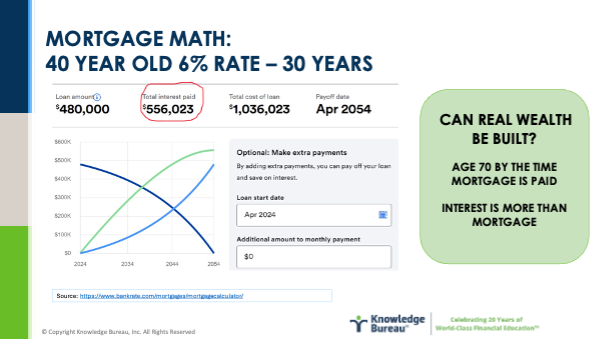

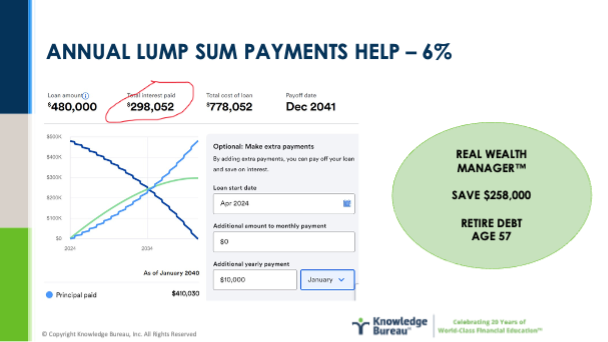

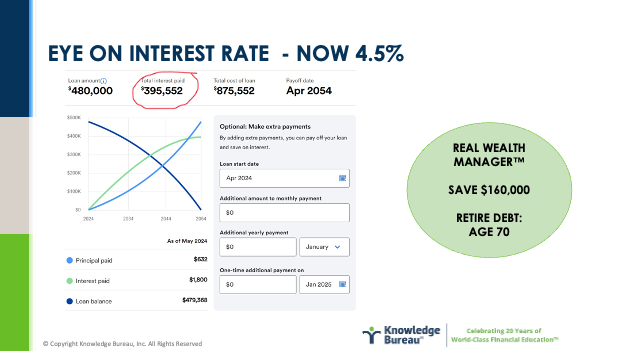

Effective August 1, 2024, the government will allow 30-year mortgage amortizations for first-time homeowners who purchase newly built homes. For existing mortgage holders who meet specific criteria, “permanent amortization relief” will be available to extend repayment periods for as long as they need to get to the number they can afford to pay monthly. It’s an extension from the 25-year mortgage amortizations previously allowed. However, this isn’t for everyone… there is a significant risk to lifetime wealth creation and must be managed with an eye to interest rates and payment terms to reduce the non-deductible interest costs.

A couple of details to note among the headlines: First, the new amortization periods will only affect first-time homebuyers who are purchasing new builds. Second, there is a second goal by the federal government: to incentivize the construction of more new homes.

Wealth Management Tip: Do the Mortgage Math! Is this right for your clients? Let’s take a look using a few examples are discussed below: