How Much is the New Canada Carbon Rebate?

Evelyn Jacks

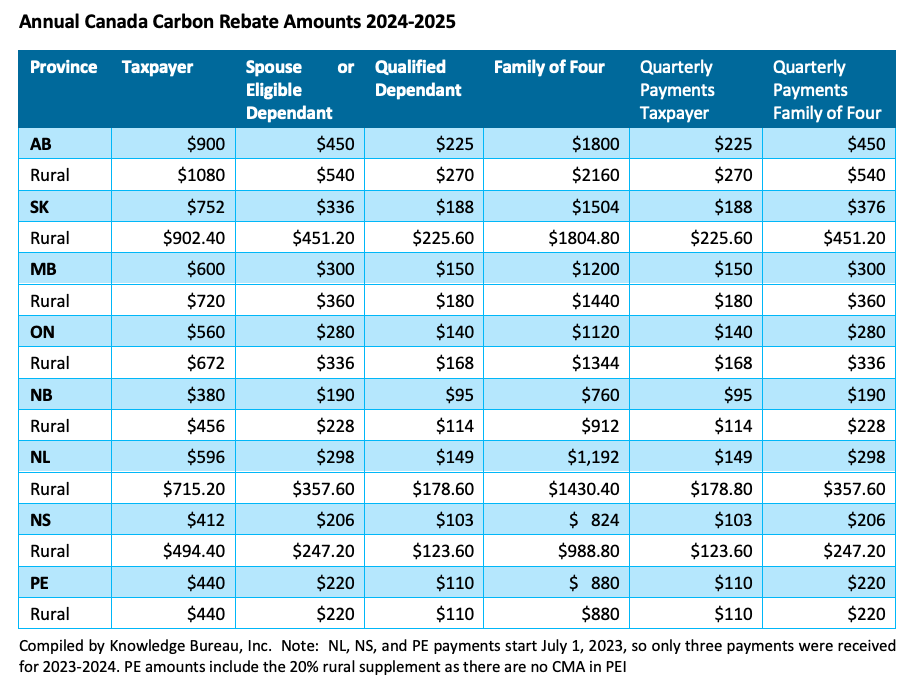

There’s lots to know about the new CCR – Canada Carbon Rebate. The first payment for 2024-25 under this new label has been increased in some provinces but decreased in others. The former Climate Action Incentive Payment (CAIP) is paid quarterly, and the new CCR will be too; but did you know that to receive the first payment on April 15, 2024 tax returns for both spouses must be filed by March 15? Here are the new amounts for April 2024 to January 2025 and some tax tips to observe too.

Yes, that’s right, early filing will be difficult for Canadians waiting for T3 slips, so those Canadians will be receiving their CCR with the July payment – not soon enough to help with home heating bills, unfortunately. Here are the new CCR payment amounts:

Also, if you live in New Brunswick there is a separate tax wrinkle: the CRA notes that the 2022 rural supplement question will be on the 2023 income tax and benefit return and a retroactive payment will then be issued for the 2022 base year.

Make a Difference. Tax specialists can help clients understand that to receive carbon tax relief from what is paid at the pumps and on home heating, they will have to file a tax return, indicate whether they qualify for the 20% rural supplement and recommend that they tell their spouses and family members they have received the new Canada Carbon Rebate (CCR) – if they can identify it, that is.

Always encourage clients who missed filing prior tax returns to catch up. Important benefits like the former Climate Action Incentive for 2018 to 2020 including Schedule 14, and the Climate Action Incentive Payments for 2021 to 2022, using the tick box on Page 2 for rural residents, can be recovered, too.