Last updated: February 16 2016

Max the RRSP Now to Maximize the New CTB

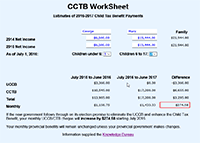

Families who wish to maximize the anticipated new Child Tax Benefit (CTB) for 2016/2017 have less than two weeks left to reduce 2015 net income using an RRSP contribution. The deadline is February 29. For these reasons, Knowledge Bureau has updated its Income Tax Estimator to assist with the calculations.

By way of background, the Liberal Government proposed in its election platforms that it will change the calculations of the current Canada Child Tax Benefit (CCTB) and introduce legislation to implement a new Child Tax Benefit (CTB), with payments starting in July 2016.

It is expected that the CTB will be based on 2015 family net income, which is affected by a number of specific deductions, including RRSP contributions. Following is an example using the proposed calculations:

For middle income families (income over $65,000) with more than two children, the CTB clawback rate for July 2016 to June 2017 is 24% of 2015 family net income — that means each $100 reduction in family net income will increase the Child Tax Benefit by $24. Likewise, a $100 increase in family net income will decrease CTB by $24. With a federal tax rate of 22% (2015) and provincial rates betwen 7% and 17%, the result of an RRSP contribution can be an increase in family wealth of between 53% and 63% of that contribution.

While incurring non-deductible debt, like borrowing to make an RRSP contribution, is not often recommended, taxpayers who can reap such returns should consider whether borrowing to make that RRSP contribution makes sense - just be sure that the contribution is not withdrawn when the taxpayer is in the same clawback zone.

As professionals review completed tax returns with a family, it's important to let them know what's in store starting in July. Financial advisors will also want to understand the extent of the changes in planning investment activities. Even for families who are not in such an onerous clawback zone, the elimination of the Universal Child Care Benefit and the new formula for the Child Tax Benefit may mean significant changes in monthly family income starting in July.

Unfortunately, tax software may not all implement the new CTB calculations until the new government introduces legislation — expected with the Federal Budget. In order to bridge the gap, Knowledge Bureau presents the CCTB WorkSheet. This calculator will give you the answer and is available on a trial basis.

For a printer-friendly version of this tool for use with your clients, click here. For a free trial of other calculators from Knowledge Bureau, including the Income Tax Estimator, click here.