Last updated: February 26 2014

Evelyn Jacks: RRSP or TFSA?

Are you making choices between investing in a TFSA or an RRSP? Which should come first?

The correct answer is of course, it depends. We decided to do some numbers to come closer to the precise answer and what we found was interesting. The TFSA seems to be the winner over time, even in cases where income splitting is available in retirement. But there is a wild card: what tax bracket will you be in — at the time of RRSP contribution and at retirement?

Remember that the TFSA must be funded with after-tax dollars; the RRSP creates a tax refund on contribution and so is invested on a pre-tax basis. In both plans, earnings are tax sheltered while in the plan. On withdrawal all amounts are tax free from the TFSA; all amounts are taxed if they come from the RRSP.

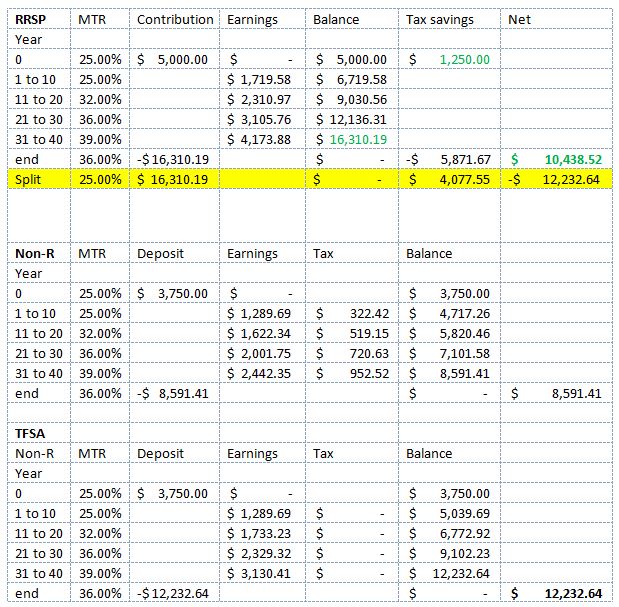

Consider the following example with a single $5,000 deposit when the tax bracket is 15%, earning 3% annually and brackets gradually increasing until the money is withdrawn 40 years later. We compare investments in an RRSP, a non-registered account and a TFSA.

RRSPs come out ahead of the TFSA, only when the current MTR is higher at the time of contribution than the retirement MTR. Both tax preferred investments beat the non-registered account.

Note that in the first chart, the RRSP contribution generates a $1,250 tax refund. This refund grows on a tax sheltered basis to $16,310 vs the $12,232 for the TFSA (which has to be funded with after-tax dollars). But, along with that RRSP deduction up front, comes an income tax liability at the end of the line of $5,871. The net gain is $10,438.52. The investor matches the TFSA returns when the RRSP benefits are split with a spouse.

It’s Your Money. Your Life. Take the time to do the numbers for a better handle on your investment options this month. Best case scenario: do both, contribute to your RRSP to get the tax savings and any refundable tax credits and social benefits available to your family; and then contribute to your TFSA for each adult in the family who is a resident of Canada.

Evelyn Jacks is president of Knowledge Bureau and author of 51 books on tax and personal wealth management. Her newest book Jacks on Tax: 2014 Edition is now available. She is also the founder and director of the Distinguished Advisor Conference (DAC). The theme of the 2014 three day think tank in Horseshoe Bay, Texas Nov 9-12 will be “Think BIG: Find the Sweet Spots in Wealth Management” Follow Evelyn on Twitter at @EvelynJacks.