Last updated: February 11 2014

Economic News: Taxes Grow Faster Than Economy, But Debt, Deficit Down

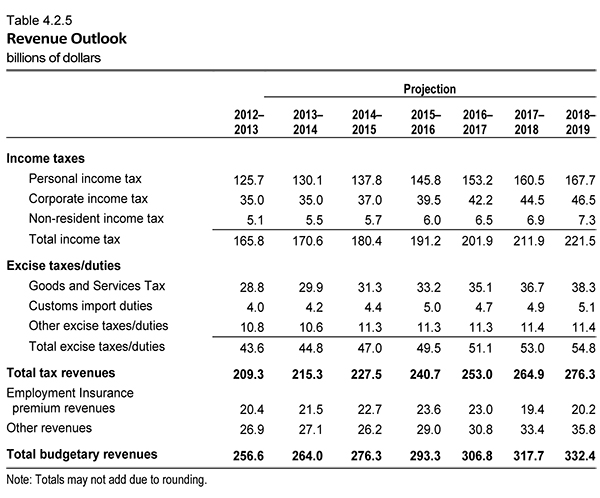

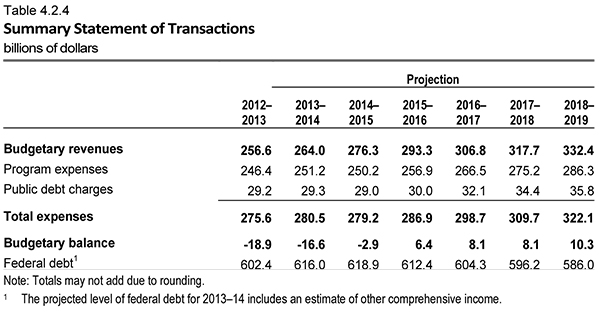

Revenues are expected to increase by 2.9 per cent in 2013–14 and then by an annual growth rate of 4.7 per cent over the forecast period ending in 2019. Some highlights appear below; followed by detailed tables from the Budget.

- Personal income tax revenues are the largest component of those revenes, and they are expected to increase by 3.5 per cent to $130 billion in 2013-2014 and then are projected to average 5.2 per cent in annual growth, faster than the projected growth in the economy, expected to range from 1.7 per cent in 2013 to 2.4 per cent by 2019.

- Corporate income tax revenues will be $35.0 billion in 2013–14 and then grow at an annual rate of 5.9 per cent largely due to recent tax changes and increased audit activities.

- Non-resident income tax revenues are made up most significantly of the reporting of dividends and interest payments, expected to increase by 7.6 per cent in 2013–14 and then at an average annual rate of 5.9 per cent.

- Goods and Services Tax (GST) revenues are projected to grow by 3.9 per cent in 2013–14 and by 5.1 per cent per year on average in the forecast period.

- Other excise taxes and duties will decline slightly in 2013–14, and then increase by 6.3 per cent, to $11.3 billion in 2014–15 as a result of the new excise duty rate for tobacco announced in this budget.

- Employment Insurance (EI) premium revenues will increase by 5.4 per cent in 2013–14. For 2015 and 2016, EI premium rates are assumed to be $1.88 and so from 2013–14 to 2015–16, the cumulative deficit in the EI Operating Account will be eliminated. By 2017, EI premium rates are expected to fall to $1.47. EI premium revenues are expected to grow again in 2018–19 as a result of a projected growth in wages and salaries.