Last updated: October 18 2016

Donating Public Shares with Accrued Gains

Budget 2016 eliminated the proposed change to exempt from capital gains tax, the gains made on the disposition of real estate or private corporation shares when the proceeds are donated to charity.

However, if you’re an investor in publicly traded securities, including mutual funds, you should look into transferring your winners for a tax-free gain and a handsome charitable donation slip before year end.

Here’s how it works:

Consider the following factors in estimating the potential tax savings from your donation:

- Province of residence (determines the size of the provincial credit)

- Whether the donor is a first-time donor (larger credit for first-time donors of cash until 2017)

- The size of the gift (no credit for donations in excess of 75% of the donor’s net income)

- Whether the donation includes publicly traded shares that have appreciated in value, and

- The taxpayer’s taxable income (if the donation includes publicly traded shares or exceeds $200,000)

To help you get quick answers to how much tax will be saved without hauling out the tax software, Knowledge Bureau has created the Donations Savings Calculator.

Example – First Time Donor

Charlie lives in Ontario and has a taxable income of $50,000. Damian has never claimed the donation tax credit. How much can Damian save by donating $2,000 to the local United Way in 2016? The calculator shows:

|

Because of the enhanced credit for the first $1,000 cash donated by a first-time donor, Charlie’s tax bill will be reduced by more than half of the donation: $1,012.98 leaving a net cost of $987.02 for donating $2,000.

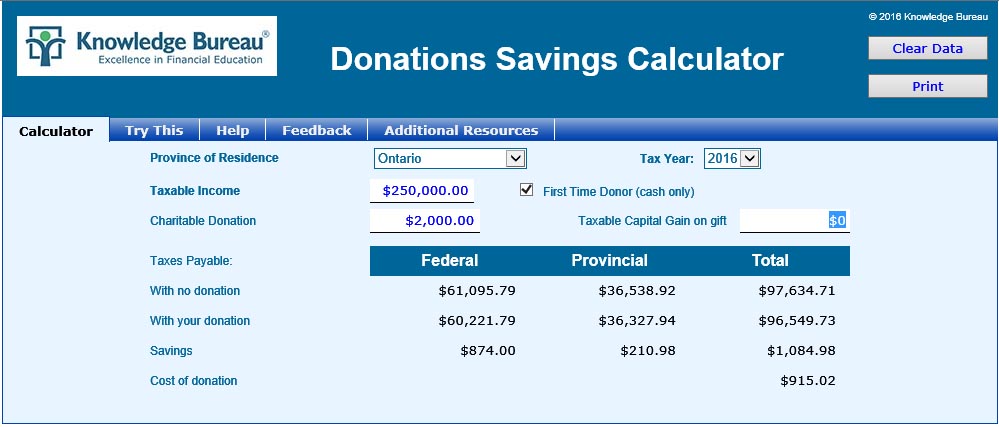

What would happen if Charlie’s taxable income was $250,000?

|

When the taxpayer’s taxable income exceeds $200,000 in 2016, their federal tax rate is 33% so donations over $200 are eligible for the 33% rate to the extent that the taxpayer’s income exceeds $200,000. For our first time donor’s $2,000 cash donation, the tax credit increases to $1,084.98 reducing the cost of the $2,000 donation to $915.02.

Example – Donation of Shares

Jenifer has 2,000 bank shares which are currently trading at $66.50 per share. They were passed to her as part of her husband’s estate. Her husband bought them in 2000 for $10.50 per share and transferred to her at cost. Eleanor lives in Halifax and her current taxable income is $45,000. How much taxes could she save by donating 200 of the shares to her local food bank?

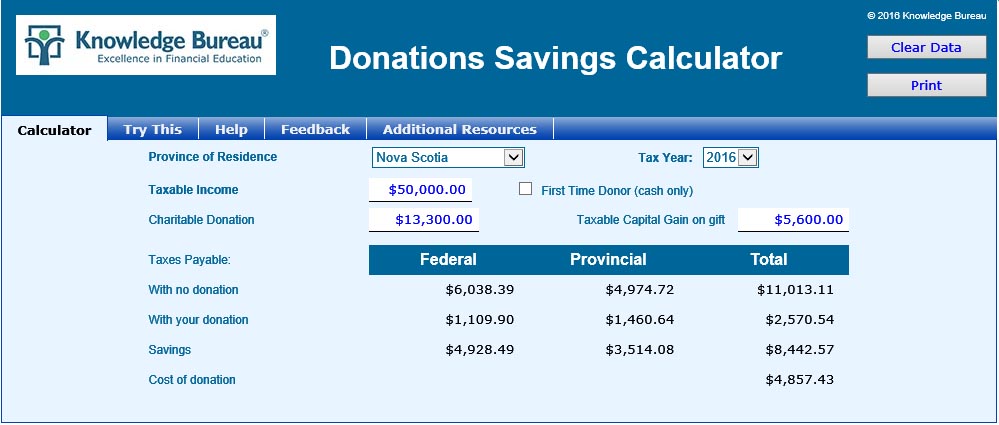

By disposing of the shares, Jenifer would normally have to include a taxable capital gain of $56/share x 200 x 50% shares = $5,600. The value of the donation is $66.50 x 200 = $13,300. Putting these figures into the calculator shows:

|

Jenifer’s tax bill is reduced to $2,570 by making the donation. If she retained the shares, her tax bill would have been $11,013 so the donation saved her $8,443 in current taxes plus the taxes on the capital gain that will eventually have to be paid when the donation is disposed of.

The Donation Savings Calculator is one of fourteen calculators available in the Knowledge Bureau Toolkit.

Next time: CLAIMING DONATIONS ON THE TERMINAL RETURN

©2016 Knowledge Bureau Inc. All Rights Reserved.