Despite Inflation, No Raise for Seniors in Q2

Evelyn Jacks

Despite the fact that the cost of living seems to be increasing in the grocery story and when paying for transportation and costly medication, Old Age Security benefits will remain unchanged for the April to June 2025 quarter. While increases to OAS over the past year have been 2% from April 2024 to April 2025, the cost of living has increased more, as explained more fully below. You’ll also be interested in the prescribed interest rates applied to tax refunds and balances due, adjusted quarterly:

The Q2 Benefits Payable: Here are the summaries of benefit payments to expect from April 1 to June 30, whether you start at age 65, are age 75 or over (in which case you get a 10% bump or have deferred your OAS to start at age 70:

Footnote, as per Government of Canada

The Inflation. The Consumer Price Index (CPI) rose 2.6% year over year in February, 2025, according to Statistics Canada’s Consumer Price Index Portal.

The quarterly adjustment for all OAS benefits, including the Guaranteed Income Supplement (GIS), is based on the difference between the average CPI for 2 periods of 3 months each:

- the most recent 3-month period for which the CPI is available

- the last 3-month period where a CPI increase led to an increase in OAS benefit amounts

The Canada Pension Plan. Fortunately, the Canada Pension Plan benefits have been indexed by 2.6% for 2025. The maximum retirement benefit is $1,433 a month but the average monthly amount paid for a new retirement pension (at age 65) in October 2024 was $808.14, according to the government of Canada.

The Medical Costs. Meanwhile, the average cost to rent a seniors residence with minimal care (1.5 hours) is $3,075 per month. And Canadians are underestimating what it will cost to pay for out-of-pocket medical costs in retirement. According to a recent report by RBC, by age 65 health care expenditures will likely account for 15 percent of an individual’s overall spending.

In another study, out-of-pocket health care payments in Canada are projected to average just under $2000 per capital per year, reflecting trends in spending from 2010 to 2022.

Interest Rates if You Owe CRA. The prescribed interest rate for Q2 of 2025 is also unchanged. But it is still higher if you owe money to CRA than if they owe you; the rates below reflect rates that compound daily:

- 8% - that’s the interest rate charged on overdue taxes, Canada Pension Plan contributions, and employment insurance premiums

- 6% - that’s the interest rate CRA pays to individual taxpayers with tax refunds. However, there is a catch. CRA won’t pay until the latest of the following 3 dates:

- the 30th day after the balance due date for the tax year (April 30 or June 15 in the case of proprietorships)

- the 30th day after you file your return – that means if you don’t file to get refunds owing to you, you have given CRA an interest-free loan.

- the day you overpaid your taxes

- 4% - that’s the interest rate to be paid on corporate taxpayer overpayments

- 4% - this is also the rate used to calculate taxable benefits for employees and shareholders from interest free and low-interest loans or on interspousal loans.

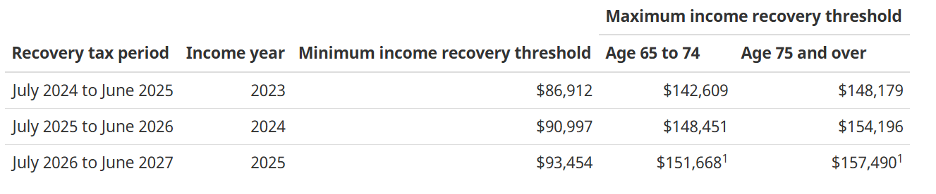

The OAS Recovery Tax. High income earners won’t receive any OAS if their net income exceeds certain thresholds; a reduced OAS will be received if net income exceeds a minimum threshold:

Bottom Line. Retirement income planning is important. To maximize your indexed CPP, earn active income from employment or self-employment to pay premiums at maximum levels for your occupation; then manage refunds, tax payments and clawbacks to keep the most in your pocket, after tax.